As global trade continues to experience structural shifts, an increasing number of small and medium-sized enterprises (SMEs) across Asia are under pressure to expand beyond their domestic markets in order to sustain growth. Yet for many businesses, cross-border trade remains challenging due to risks related to partners, payments, and operational execution.

NEW FARM, AU / ACCESS Newswire / February 9, 2026 / Recently, 7CENTER, a global trade platform designed for SMEs, announced the expansion of its presence into several strategic markets, including Australia, Dubai, Thailand, and Vietnam. The move marks a strategic step in the company's efforts to build a comprehensive ecosystem that enables small businesses to participate in international trade more sustainably.

Expansion Driven by Systems, Not Just Opportunities

According to industry experts, access to international markets is no longer the primary barrier for SMEs. Digital platforms and online channels have made it easier than ever for businesses to identify potential partners and explore new opportunities abroad.

The greater challenge, however, lies in execution. Businesses must conduct transactions safely, ensure transparency, and sustain long-term partnerships in a cross-border environment where risks are often amplified. Against this backdrop, 7CENTER's decision to establish offices in major trade and logistics hubs is seen as a move to address real operational needs, rather than functioning solely as an online connection platform.

From a Transaction Platform to a Trade Ecosystem

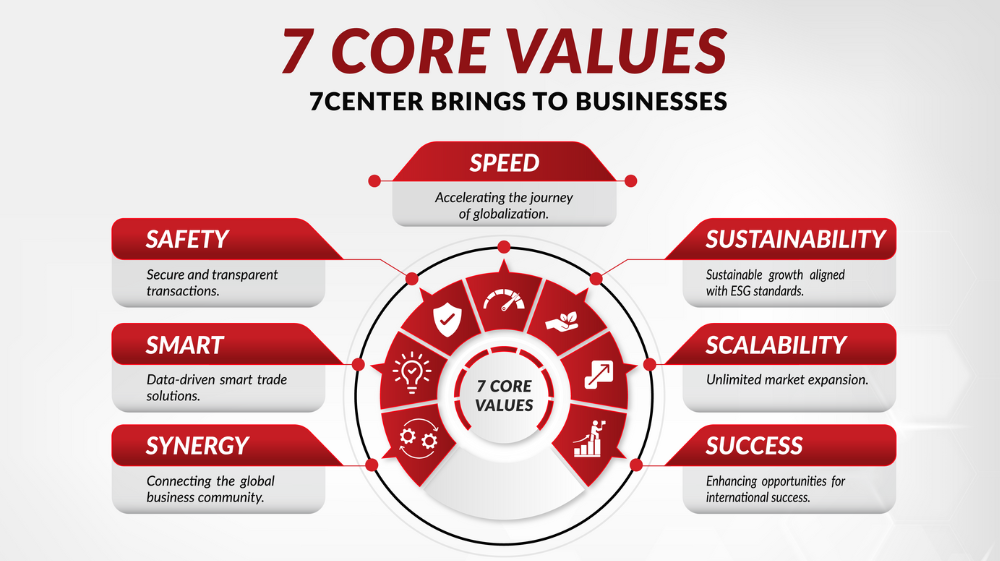

Founded in Australia-a market known for its high standards of transparency and compliance-7CENTER deliberately chose not to adopt the traditional B2B marketplace model. Instead, the company positions itself as a global trade ecosystem, integrating core elements of cross-border commerce into a unified structure.

According to representatives from 7CENTER, many SMEs struggle internationally not because of product limitations or lack of ambition, but because they lack a reliable system to manage risks and execute transactions effectively. In response, the platform focuses on foundational elements such as business verification, information transparency, payment support, and logistics connectivity.

Trust as the Anchor of B2B Trade

One of the defining features of 7CENTER's model is its emphasis on trust and corporate credibility. Through structured business profiles and partner verification mechanisms, the platform aims to mitigate risks at the connection stage-an area that often discourages SMEs from engaging in international trade.

Beyond facilitating introductions, 7CENTER seeks to support businesses through the completion of real transactions, enabling them to gradually build trade histories and reputational capital in global markets. Observers note that as cross-border B2B trade becomes more complex, trust is increasingly emerging as one of the most significant "invisible costs" for SMEs.

Local Presence to Navigate Market-Specific Rules

Establishing offices in Australia, Dubai, Thailand, and Vietnam also reflects 7CENTER's strategy to gain deeper insight into local business ecosystems. Each market presents unique regulatory frameworks, cultural norms, and trade practices that require on-the-ground understanding rather than a purely digital approach.

Alongside its platform operations, 7CENTER participates in and organizes business matching activities, trade forums, and investment promotion events, creating additional touchpoints between SMEs and stakeholders across the global value chain.

The Rise of Ecosystem-Based Support for SMEs

As global trade becomes increasingly fragmented, experts suggest that SMEs will require more than standalone connection platforms. Ecosystem-based models-combining technology, local presence, and operational support-are expected to play a critical role in enhancing the competitiveness of small businesses internationally.

In this context, 7CENTER's expansion is viewed as part of a broader trend toward building "soft infrastructure" for global trade-where trust, transparency, and execution capability are treated as essential foundations rather than afterthoughts.

Media Contact:

Organization: 7CENTER

Contact Person: Ivanka Do

Website: www.7center.com

Email: admin@7center.com

SOURCE: 7CENTER

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/7center-expands-into-key-markets-to-build-a-global-trade-ecosyst-1134792