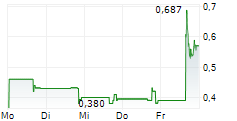

BUKIT MERTAJAM, MALAYSIA, Feb. 10, 2026 (GLOBE NEWSWIRE) -- CCH Holdings Ltd (the "Company"), today announced that it received a notification letter, dated February 3, 2026 (the "Notification Letter"), from the Listing Qualifications Department of The Nasdaq Stock Market Inc. (the "Nasdaq"), notifying the Company that it is not in compliance with the requirement to maintain a minimum closing bid price of $1.00 per share, because the closing bid price of the Company's ordinary shares was below $1.00 per share for 30 consecutive business days.

The letters are only a notification of deficiency, not of imminent delisting, and have no current effect on the listing or trading of the Company's securities on Nasdaq.

The Company would like to clarify that the Notification Letters has no current effect on the listing or trading of the Company's securities on Nasdaq. In accordance with Nasdaq Listing Rule 5810(c)(3), the Company has a period of 180 calendar days from the Notification Date, until August 3, 2026, to regain compliance with the minimum bid price requirement. During this period, the Company's ordinary shares will continue to trade on the Nasdaq Capital Market. If at any time before August 3, 2026, the bid price of the Company's ordinary shares closes at or above $1.00 per share for a minimum of ten consecutive trading days, Nasdaq will provide the Company a written confirmation of compliance and the matter will be closed.

The Company intends to monitor the closing bid price of its ordinary shares, between now and August 3, 2026, and is intending to take all reasonable measures to regain compliance under the Nasdaq Listing Rule. The Company is currently in compliance with all other Nasdaq continued listing standards. The Notification Letter does not affect the Company's business operations, its U.S. Securities and Exchange Commission reporting requirements or contractual obligations.

About CCH Holdings Ltd

CCH Holdings Ltd commenced operations in 2015 with roots in George Town, Penang, Malaysia. The Company is one of the leading specialty hotpot restaurant chains in Malaysia, specializing in chicken hotpot and fish head hotpot. The Company offer catering services in Malaysia and outside Malaysia mainly under two brands, namely Chicken Claypot House for our fish head hotpot restaurants through a combination of company-owned restaurant outlets and franchised restaurant outlets.

For more information, please visit the Company's website: https://ir.chickenclaypothouse.com.my

Cautionary Note Regarding Forward-Looking Statements

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "confident" and similar statements. Among other things, the description of the proposed offering in this announcement contain forward-looking statements. The Company may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: (i) the Company's goals and strategies; (ii) the Company's future business development, financial condition, and results of operations; (iii) general economic and business conditions in Malaysia; and (iv) the outlook of specialty hotpot market in Malaysia, Southeast Asia, Hong Kong, Taiwan, and the U.S., including competition, government policies and regulations. Further information regarding these and other risks is included in the Company's filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company undertakes no obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

CCH Holdings Ltd

Investor Relations

Email: cch_ir@cchasia.com.my