Well positioned with low leverage and acquisition and organic growth drivers;

Advancing digital transformation with Navegate platform; and

Launch of Company's first AI Agent, "Ray", to streamline international operations

RENTON, Wash., Feb. 9, 2026 /PRNewswire/ -- Radiant Logistics, Inc. (NYSE American: RLGT), a technology-enabled global transportation and value-added logistics services company, today reported financial results for the three and six months ended December 31, 2025.

Financial Highlights - Three Months Ended December 31, 2025

- Revenues of $232.1 million for the second fiscal quarter ended December 31, 2025, down $32.4 million or 12.2%, compared to revenues of $264.5 million for the comparable prior year period. The comparable year ago period included $64.8 million in revenues for air charters to bring approximately 8 million units of IV fluid to the U.S. as a result of the national shortages resulting from Hurricane Milton (the "Milton Project"). Excluding this $64.8 million in revenues from the Milton Project in the comparable year ago period, revenues for the second fiscal quarter ended December 31, 2025, were up $32.4 million or 16.2%, compared to revenues of $199.7 million for the second fiscal quarter ended December 31, 2024.

- Gross profit of $61.0 million for the second fiscal quarter ended December 31, 2025, up $1.4 million or 2.3%, compared to gross profit of $59.6 million for the comparable prior year period. Excluding $7.0 million in gross profit from the Milton Project in the comparable year ago period, gross profit for the second fiscal quarter ended December 31, 2025, was up $8.4 million or 16.0%, compared to gross profit of $52.6 million for the second fiscal quarter ended December 31, 2024.

- Adjusted gross profit, a non-GAAP financial measure, of $63.5 million for the second fiscal quarter ended December 31, 2025, up $0.2 million or 0.3%, compared to adjusted gross profit of $63.3 million for the comparable prior year period. Excluding $7.0 million in adjusted gross profit from the Milton Project in the comparable prior year period, adjusted gross profit for the second fiscal quarter ended December 31, 2025, was up $7.2 million or 12.8%, compared to adjusted gross profit of $56.3 million for the second fiscal quarter ended December 31, 2024.

- Net income attributable to Radiant Logistics, Inc. of $5.3 million, or $0.11 per basic and fully diluted share for the second fiscal quarter ended December 31, 2025, compared to $6.5 million, or $0.14 per basic and $0.13 per fully diluted share for the comparable prior year period.

- Adjusted net income, a non-GAAP financial measure, of $8.1 million, or $0.17 per basic and fully diluted share for the second fiscal quarter ended December 31, 2025, down $2.6 million or 24.3%, compared to adjusted net income of $10.7 million, or $0.23 per basic and $0.22 per fully diluted share for the comparable prior year period. Excluding $4.5 million in adjusted net income from the Milton Project in the comparable year ago period, adjusted net income for the second fiscal quarter ended December 31, 2025, was up $1.9 million or 30.6%, compared to adjusted net income of $6.2 million for the second fiscal quarter ended December 31, 2024. Adjusted net income is calculated by applying a normalized tax rate of 24.5% and excludes costs unrelated to our core operations.

- Adjusted EBITDA, a non-GAAP financial measure, of $11.8 million for the second fiscal quarter ended December 31, 2025, down $0.2 million or 1.7%, compared to adjusted EBITDA of $12.0 million for the comparable prior year period. Excluding $5.9 million in adjusted EBITDA from the Milton Project in the comparable year ago period, adjusted EBITDA for the second fiscal quarter ended December 31, 2025, was up $5.7 million or 93.4%, compared to adjusted EBITDA of $6.1 million for the second fiscal quarter ended December 31, 2024.

- Adjusted EBITDA margin (adjusted EBITDA expressed as a percentage of adjusted gross profit), a non-GAAP financial measure, of 18.6% or 40 basis points, for the second fiscal quarter ended December 31, 2025, compared to adjusted EBITDA margin of 19.0% for the comparable prior year period. Excluding $5.9 million in adjusted EBITDA from the Milton Project in the comparable year ago period, adjusted EBITDA margin for the second fiscal quarter ended December 31, 2025 of 18.6% up 780 basis points when compared to the 10.8% adjusted EBITDA margin for the second fiscal quarter ended December 31, 2024.

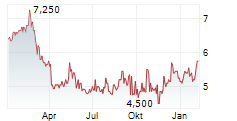

Stock Buy-Back

We purchased 445,058 shares of our common stock at an average cost of $5.97 per share for an aggregate cost of $2.7 million during the three months ended December 31, 2025.

As of December 31, 2025, the Company had 46,826,544 shares outstanding.

CEO Bohn Crain Comments on Results

"With the benefit of our diversified service offering we delivered another quarter of solid financial results generating $11.8 million in adjusted EBITDA for our second fiscal quarter ended December 31, 2025," said Bohn Crain, Founder and CEO of Radiant Logistics. "The comparable year ago period included $64.8 million in revenues for air charters to bring approximately 8 million units of IV fluid to the U.S. as a result of the national shortages resulting from Hurricane Milton (the "Milton Project"). When excluding $5.9 million in adjusted EBITDA from the Milton Project in the year ago period, adjusted EBITDA increased by $5.7 million or 93.4%, compared to $6.1 million for the second fiscal quarter ended December 31, 2024. This growth breaks down as follows: Same-Store Growth of $3.6 million in our U.S. Operations, $1.4 million in our Canadian Operations, and Acquisition Growth of $0.7 million. Without the lower margin of Milton Project in the current period, our adjusted gross profit margin returned to more normalized levels, improving 340 basis points to 27.3% compared to 23.9% in the year ago period, demonstrating our ability to maintain solid margins even as we navigate a challenging freight market. Importantly, when excluding the impact of Project Milton in the comparable year ago period, our adjusted EBITDA margin expanded by 780 basis points to 18.6%, reflecting our continued focus on operational efficiency and disciplined cost management.

And while still very early in our journey, we continue to be encouraged about the prospects of Navegate, our proprietary global trade management and collaboration platform. Navegate represents a meaningful differentiator for us in the marketplace and supports both domestic and international shipments by aggregating and organizing supply-chain data to deliver enhanced visibility, automation and faster decision making. With streamlined deployment measured in weeks - not months or years - our customers can quickly reduce costs, optimize routing and improve buying and routing decisions. We believe this speed to market and ease of deployment represent a clear competitive advantage and that Navegate will serve as a meaningful catalyst for organic growth as we introduce the technology to our current and prospective customers in coming quarters.

We are also pleased to announce the launch of 'Ray', our first AI-powered agent, which is initially focused on streamlining the administration of quote requests from our international agents around the world. Ray represents an important step in our ongoing digital transformation journey and complements our Navegate platform by further automating and accelerating key workflows. By leveraging artificial intelligence to handle routine quote administration tasks, we expect Ray to improve response times for our global network of agents, enhance service quality for our customers, and drive additional operational efficiencies across our organization. We look forward to expanding Ray's capabilities and introducing additional AI-powered solutions in the coming quarters."

Mr. Crain continued, "As previously discussed, we believe our durable business model, diverse service offering, disciplined approach to capital allocation and low leverage continues to serve us well. We remain virtually debt free (no net debt of as of December 31, 2025) relative to our $200.0 million credit facility and on track with our continued efforts to deliver profitable growth through a combination of organic and acquisition initiatives, while thoughtfully re-levering our balance sheet through a combination of strategic operating partner conversions, synergistic tuck-in acquisitions, and stock buy-backs.. With respect to our stock buy-back program, we acquired another $2.7 million of our stock through the three months ended December 31, 2025. Looking ahead, we expect to stay the course with our balanced approach to capital allocation through a combination of agent station conversions, synergistic tuck-in acquisitions, and stock buy-backs while at the same time looking to invest in incremental sales resources with attention given to our deployment of the Navegate technology."

Second Fiscal Quarter Ended December 31, 2025 - Financial Results

For the three months ended December 31, 2025, Radiant reported net income attributable to Radiant Logistics, Inc. of $5.3 million on $232.1 million of revenues, or $0.11 per basic and fully diluted share. For the three months ended December 31, 2024, Radiant reported net income attributable to Radiant Logistics, Inc. of $6.5 million on $264.5 million of revenues, or $0.14 per basic and $0.13 per fully diluted share.

For the three months ended December 31, 2025, Radiant reported adjusted net income, a non-GAAP financial measure, of $8.1 million, or $0.17 per basic and fully diluted share. For the three months ended December 31, 2024, Radiant reported adjusted net income of $10.7 million, or $0.23 per basic and $0.22 per fully diluted share.

For the three months ended December 31, 2025, Radiant reported adjusted EBITDA, a non-GAAP financial measure, of $11.8 million, compared to $12.0 million for the comparable prior year period.

Six Months Ended December 31, 2025 - Financial Results

For the six months ended December 31, 2025, the Company reported net income attributable to Radiant Logistics, Inc. of $6.6 million on $458.8 million of revenues, or $0.14 per basic and fully diluted share. For the six months ended December 31, 2024, the Company reported net income attributable to Radiant Logistics, Inc. of $9.8 million on $468.1 million of revenues, or $0.21 per basic and $0.20 per fully diluted share.

For the Six Months Ended December 31, 2025, the Company reported adjusted net income, a non-GAAP financial measure, of $12.5 million, or $0.27 per basic and $0.26 per fully diluted share. For the six months ended December 31, 2024, the Company reported adjusted net income of $18.6 million, or $0.40 per basic and $0.38 per fully diluted share. Normalizing these results to exclude the $1.3 million First Brands adjustment, adjusted net income would have been $13.5 million for the six months ended December 31, 2025.

For the six months ended December 31, 2025, the Company reported adjusted EBITDA, a non-GAAP financial measure, of $18.6 million, compared to $21.5 million for the comparable prior year period. Normalizing these results to exclude the $1.3 million First Brands adjustment, adjusted EBITDA would have been $19.9 million for the six months ended December 31, 2025.

Earnings Call and Webcast Access Information

Radiant Logistics, Inc. will host a conference call on Monday, February 9, 2026 at 4:30 PM Eastern to discuss the contents of this release. The conference call is open to all interested parties, including individual investors and press. Bohn Crain, Founder and CEO will host the call.

Conference Call Details

DATE/TIME: | Monday, February 9, 2026 at 4:30 PM Eastern |

DIAL-IN | US (888) 506-0062; Intl. (973) 528-0011 (Participant Access Code: 209811) |

REPLAY | February 10, 2026 at 9:30 AM Eastern to February 23, 2026 at 4:30 PM Eastern, US (877) 481-4010; Intl. (919) 882-2331 (Replay ID number: 53602) |

Webcast Details

This call is also being webcast and may be accessed via Radiant's web site at www.radiantdelivers.com or at https://www.webcaster5.com/Webcast/Page/2191/53602

About Radiant Logistics (NYSE American: RLGT)

Radiant Logistics, Inc. (www.radiantdelivers.com) operates as a third-party logistics company, providing technology-enabled global transportation and value-added logistics services primarily to customers in the United States, Canada, and Mexico. Through its comprehensive service offerings, Radiant provides domestic and international freight forwarding and freight brokerage services to a diversified account base including manufacturers, distributors and retailers, which it supports from an extensive network of company and agent-owned offices throughout North America and other key markets around the world. Radiant's value-added logistics services include warehouse and distribution, customs brokerage, order fulfillment, inventory management and technology services.

This press release contains "forward-looking statements" within the meaning set forth in United States securities laws and regulations - that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business, financial performance and financial condition, and often contain words such as "anticipate," "believe," "estimates," "expect," "future," "intend," "may," "plan," "see," "seek," "strategy," or "will" or the negative thereof or any variation thereon or similar terminology or expressions. These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. We have developed our forward-looking statements based on management's beliefs and assumptions, which in turn rely upon information available to them at the time such statements were made. Such forward-looking statements reflect our current perspectives on our business, future performance, existing trends and information as of the date of this report. These include, but are not limited to, our beliefs about future revenue and expense levels, growth rates, prospects related to our strategic initiatives and business strategies, along with express or implied assumptions about, among other things: our continued relationships with our strategic operating partners; the performance of our historic business, as well as the businesses we have recently acquired, at levels consistent with recent trends and reflective of the synergies we believe will be available to us as a result of such acquisitions; our ability to successfully integrate our recently acquired businesses; our ability to locate suitable acquisition opportunities and secure the financing necessary to complete such acquisitions; transportation costs remaining in line with recent levels and expected trends; our ability to mitigate, to the best extent possible, our dependence on current management and certain larger strategic operating partners; our compliance with financial and other covenants under our indebtedness; the absence of any adverse laws or governmental regulations affecting the transportation industry in general, and our operations in particular; our ability to continue to respond to macroeconomic factors that have recently had a negative effect on worldwide freight markets; the impact of any health pandemic or environmental event on our operations and financial results; continued disruptions in the global supply chain; higher inflationary pressures particularly surrounding the costs of fuel, labor, and other components of our operations; potential adverse legal, reputational and financial effects on the Company resulting from prior or future cyber incidents and the effectiveness of the Company's business continuity plans in response to cyber incidents; the commercial, reputational and regulatory risks to our business that may arise as a consequence of our prior inability to remediate a material weakness in our internal control over financial reporting, and the further risks that may arise should we be unable to maintain an effective system of disclosure controls and internal control over financial reporting in the future; and such other factors that may be identified from time to time in our U.S Securities and Exchange Commission ("SEC") filings and other public announcements including those set forth under the caption "Risk Factors" in Part 1 Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 2025. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Readers are cautioned not to place undue reliance on our forward-looking statements, as they speak only as of the date made. We disclaim any obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

RADIANT LOGISTICS, INC. Consolidated Balance Sheets (unaudited) | ||||||

December 31, | June 30, | |||||

(In thousands, except share and per share data) | 2025 | 2025 | ||||

(unaudited) | ||||||

ASSETS | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | 31,884 | $ | 22,942 | ||

Accounts receivable, net of allowance of $3,454 and $2,128, respectively | 139,947 | 134,911 | ||||

Contract assets | 6,477 | 6,904 | ||||

Income tax receivable | 1,887 | 2,194 | ||||

Prepaid expenses and other current assets | 11,196 | 12,299 | ||||

Total current assets | 191,391 | 179,250 | ||||

Property, technology, and equipment, net | 21,944 | 23,489 | ||||

Goodwill | 121,146 | 117,637 | ||||

Intangible assets, net | 48,290 | 49,123 | ||||

Operating lease right-of-use assets | 54,669 | 55,066 | ||||

Deposits and other assets | 2,007 | 2,209 | ||||

Total other long-term assets | 226,112 | 224,035 | ||||

Total assets | $ | 439,447 | $ | 426,774 | ||

LIABILITIES AND EQUITY | ||||||

Current liabilities: | ||||||

Accounts payable | $ | 74,124 | $ | 74,411 | ||

Operating partner commissions payable | 10,469 | 10,541 | ||||

Accrued expenses | 11,959 | 10,637 | ||||

Current portion of operating lease liabilities | 13,445 | 12,741 | ||||

Current portion of finance lease liabilities | 263 | 282 | ||||

Current portion of contingent consideration | 9,170 | 6,050 | ||||

Other current liabilities | 806 | 483 | ||||

Total current liabilities | 120,236 | 115,145 | ||||

Notes payable | 30,000 | 20,000 | ||||

Operating lease liabilities, net of current portion | 47,568 | 49,245 | ||||

Finance lease liabilities, net of current portion | 846 | 969 | ||||

Contingent consideration, net of current portion | 7,130 | 13,300 | ||||

Deferred tax liabilities | 2,400 | 1,782 | ||||

Other long-term liabilities | 10 | 248 | ||||

Total long-term liabilities | 87,954 | 85,544 | ||||

Total liabilities | 208,190 | 200,689 | ||||

Redeemable noncontrolling interest | 1,321 | - | ||||

Equity: | ||||||

Common stock, $0.001 par value, 100,000,000 shares authorized; 52,592,617 and | 34 | 34 | ||||

Additional paid-in capital | 111,388 | 110,588 | ||||

Treasury stock, at cost, 5,766,073 and 5,181,023 shares, respectively | (35,457) | (31,964) | ||||

Retained earnings | 157,167 | 150,569 | ||||

Accumulated other comprehensive loss | (3,304) | (3,211) | ||||

Total Radiant Logistics, Inc. stockholders' equity | 229,828 | 226,016 | ||||

Noncontrolling interest | 108 | 69 | ||||

Total equity | 229,936 | 226,085 | ||||

Total liabilities and equity | $ | 439,447 | $ | 426,774 | ||

RADIANT LOGISTICS, INC. Consolidated Statements of Comprehensive Income (unaudited) | ||||||||||||||

Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||||

(In thousands, except share and per share data) | 2025 | 2024 | 2025 | 2024 | ||||||||||

Revenues | $ | 232,130 | $ | 264,544 | $ | 458,785 | $ | 468,109 | ||||||

Operating expenses: | ||||||||||||||

Cost of transportation and other services | 168,669 | 201,239 | 335,871 | 347,250 | ||||||||||

Operating partner commissions | 20,307 | 19,291 | 40,303 | 38,092 | ||||||||||

Personnel costs | 22,589 | 19,554 | 44,160 | 39,177 | ||||||||||

Selling, general and administrative expenses | 9,609 | 12,000 | 21,683 | 22,321 | ||||||||||

Depreciation and amortization | 3,566 | 5,038 | 7,092 | 9,843 | ||||||||||

Change in fair value of contingent consideration | (90) | (1,300) | 110 | (1,100) | ||||||||||

Total operating expenses | 224,650 | 255,822 | 449,219 | 455,583 | ||||||||||

Income from operations | 7,480 | 8,722 | 9,566 | 12,526 | ||||||||||

Other income (expense): | ||||||||||||||

Interest income | 36 | 367 | 80 | 832 | ||||||||||

Interest expense | (625) | (311) | (1,230) | (548) | ||||||||||

Foreign currency transaction gain (loss) | (120) | 181 | (116) | 119 | ||||||||||

Change in fair value of interest rate swap contracts | - | (301) | - | (741) | ||||||||||

Other | 174 | 14 | 259 | 1,053 | ||||||||||

Total other income (expense) | (535) | (50) | (1,007) | 715 | ||||||||||

Income before income taxes | 6,945 | 8,672 | 8,559 | 13,241 | ||||||||||

Income tax expense | (1,725) | (2,163) | (2,064) | (3,308) | ||||||||||

Net income | 5,220 | 6,509 | 6,495 | 9,933 | ||||||||||

Net loss (income) attributable to noncontrolling interest | 85 | (42) | 103 | (90) | ||||||||||

Net income attributable to Radiant Logistics, Inc. | $ | 5,305 | $ | 6,467 | $ | 6,598 | $ | 9,843 | ||||||

Other Comprehensive income attributable to Radiant Logistics, Inc.: | ||||||||||||||

Foreign currency translation gain (loss) | 869 | (2,911) | (93) | (2,271) | ||||||||||

Comprehensive loss attributable to noncontrolling interest | 40 | - | 53 | - | ||||||||||

Comprehensive income attributable to Radiant Logistics, Inc. | $ | 6,129 | $ | 3,598 | $ | 6,455 | $ | 7,662 | ||||||

Income per share: | ||||||||||||||

Basic | $ | 0.11 | $ | 0.14 | $ | 0.14 | $ | 0.21 | ||||||

Diluted | $ | 0.11 | $ | 0.13 | $ | 0.14 | $ | 0.20 | ||||||

Weighted average common shares outstanding: | ||||||||||||||

Basic | 46,912,966 | 46,942,639 | 47,039,566 | 46,831,938 | ||||||||||

Diluted | 48,665,202 | 48,983,153 | 48,701,899 | 48,784,482 | ||||||||||

Reconciliation of Non-GAAP Measures

RADIANT LOGISTICS, INC.

Reconciliation of Gross Profit to Adjusted Gross Profit, Net Income Attributable to Radiant Logistics, Inc.

to Adjusted Net Income, EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

(unaudited)

As used in this report adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin are not measures of financial performance or liquidity under United States Generally Accepted Accounting Principles ("GAAP"). Adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin are presented herein because they are important metrics used by management to evaluate and understand the performance of the ongoing operations of Radiant's business. For adjusted net income, management uses a 24.5% tax rate to calculate the provision for income taxes to normalize Radiant's tax rate to that of its competitors and to compare Radiant's reporting periods with different effective tax rates. In addition, in arriving at adjusted net income, the Company adjusts for certain non-cash charges and significant items that are not part of regular operating activities. These adjustments include income taxes, depreciation and amortization, costs unrelated to our core operations, and other non-cash charges.

We commonly refer to the term "adjusted gross profit" when commenting about our Company and the results of operations. Adjusted gross profit is a non-GAAP measure calculated as revenues less directly related operations and expenses attributed to the Company's services. Adjusted gross profit is calculated as GAAP gross profit exclusive of depreciation and amortization, which are reported separately. We believe adjusted gross profit is a better measurement than are total revenues when analyzing and discussing the effectiveness of our business and is used as a portion of a key metric the Company uses to discuss its progress.

EBITDA is a non-GAAP financial measure of income and does not include the effects of interest, income taxes, and the "non-cash" effects of depreciation and amortization on long-term assets. Companies have some discretion as to which elements of depreciation and amortization are excluded in the EBITDA calculation. We exclude all depreciation charges related to property, technology, and equipment and all amortization charges (including amortization of leasehold improvements). We then further adjust EBITDA to exclude share-based compensation, costs unrelated to our core operations (primarily acquisition and litigation costs), allocation of earnings attributable to noncontrolling interests in subsidiaries, and other non-cash charges. While management considers EBITDA and adjusted EBITDA useful in analyzing our results, it is not intended to replace any presentation included in our consolidated financial statements.

We believe that these non-GAAP financial measures, as presented, represent a useful method of assessing the performance of our operating activities, as they reflect our earnings trends without the impact of certain non-cash charges and other non-recurring charges. These non-GAAP financial measures are intended to supplement the GAAP financial information by providing additional insight regarding results of operations to allow a comparison to other companies, many of whom use similar non-GAAP financial measures to supplement their GAAP results. However, these non-GAAP financial measures will not be defined in the same manner by all companies and may not be comparable to other companies. Adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin should not be considered in isolation or as a substitute for any of the consolidated statements of comprehensive income prepared in accordance with GAAP, or as an indication of Radiant's operating performance or liquidity.

(In thousands) | Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||||

Reconciliation of adjusted gross profit to GAAP gross profit | 2025 | 2024 | 2025 | 2024 | |||||||||||

Revenues | $ | 232,130 | $ | 264,544 | $ | 458,785 | $ | 468,109 | |||||||

Cost of transportation and other services (exclusive of | (168,669) | (201,239) | (335,871) | (347,250) | |||||||||||

Depreciation and amortization | (2,445) | (3,707) | (4,784) | (7,195) | |||||||||||

GAAP gross profit | $ | 61,016 | $ | 59,598 | $ | 118,130 | $ | 113,664 | |||||||

Depreciation and amortization | 2,445 | 3,707 | 4,784 | 7,195 | |||||||||||

Adjusted gross profit | $ | 63,461 | $ | 63,305 | $ | 122,914 | $ | 120,859 | |||||||

GAAP gross profit percentage | 26.3 | % | 22.5 | % | 25.7 | % | 24.3 | % | |||||||

Adjusted gross profit percentage | 27.3 | % | 23.9 | % | 26.8 | % | 25.8 | % | |||||||

Reconciliation of GAAP net income to adjusted EBITDA | 2025 | 2024 | 2025 | 2024 | |||||||||||

Net income attributable to Radiant Logistics, Inc. | $ | 5,305 | $ | 6,467 | $ | 6,598 | $ | 9,843 | |||||||

Income tax expense | 1,725 | 2,163 | 2,064 | 3,308 | |||||||||||

Depreciation and amortization (1) | 3,566 | 5,038 | 7,092 | 9,957 | |||||||||||

Net interest expense | 589 | (56) | 1,150 | (284) | |||||||||||

Share-based compensation | 508 | (1,813) | 932 | (1,650) | |||||||||||

Change in fair value of contingent consideration | (90) | (1,300) | 110 | (1,100) | |||||||||||

Lease termination costs | 54 | 1,166 | 162 | 1,166 | |||||||||||

Change in fair value of interest rate swap contracts | - | 301 | - | 741 | |||||||||||

Other (2) | 117 | 50 | 463 | (513) | |||||||||||

Adjusted EBITDA | 11,774 | 12,016 | 18,571 | 21,468 | |||||||||||

Adjusted EBITDA as a % of adjusted gross profit (3) | 18.6 | % | 19.0 | % | 15.1 | % | 17.8 | % | |||||||

(1) | Depreciation and amortization for the purposes of calculating adjusted EBITDA, a non-GAAP financial measure, includes depreciation expenses recognized on certain computer software as a service. |

(2) | Other includes costs unrelated to our core operations (primarily acquisition and litigation costs), and other non-cash charges. |

(3) | Adjusted gross profit is revenues less the cost of transportation and other services. |

(In thousands, except share and per share data) | Three Months Ended December 31, | Six Months Ended December 31, | ||||||||||||

Reconciliation of GAAP net income to adjusted net income | 2025 | 2024 | 2025 | 2024 | ||||||||||

GAAP net income attributable to Radiant Logistics, Inc. | $ | 5,305 | $ | 6,467 | $ | 6,598 | $ | 9,843 | ||||||

Adjustments to net income: | ||||||||||||||

Income tax expense | 1,725 | 2,163 | 2,064 | 3,308 | ||||||||||

Depreciation and amortization | 3,566 | 5,038 | 7,092 | 9,843 | ||||||||||

Change in fair value of contingent consideration | (90) | (1,300) | 110 | (1,100) | ||||||||||

Lease termination costs | 54 | 1,166 | 162 | 1,166 | ||||||||||

Change in fair value of interest rate swap contracts | - | 301 | - | 741 | ||||||||||

Other | 137 | 332 | 587 | 806 | ||||||||||

Adjusted net income before income taxes | 10,697 | 14,167 | 16,613 | 24,607 | ||||||||||

Provision for income taxes at 24.5% | (2,621) | (3,471) | (4,070) | (6,029) | ||||||||||

Adjusted net income | $ | 8,076 | $ | 10,696 | $ | 12,543 | $ | 18,578 | ||||||

Adjusted net income per common share: | ||||||||||||||

Basic | $ | 0.17 | $ | 0.23 | $ | 0.27 | $ | 0.40 | ||||||

Diluted | $ | 0.17 | $ | 0.22 | $ | 0.26 | $ | 0.38 | ||||||

Weighted average common shares outstanding: | ||||||||||||||

Basic | 46,912,966 | 46,942,639 | 47,039,566 | 46,831,938 | ||||||||||

Diluted | 48,665,202 | 48,983,153 | 48,701,899 | 48,784,482 | ||||||||||

SOURCE Radiant Logistics, Inc.