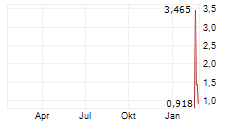

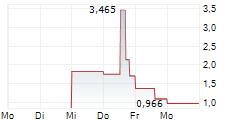

ATHENS, Greece, Feb. 10, 2026 (GLOBE NEWSWIRE) -- Rubico Inc. (Nasdaq: RUBI) (the "Company" or "Rubico"), a global provider of shipping transportation services specializing in the ownership of vessels, announced today that its board of directors (the "Board") has determined to effect a 1-for-seven-and-eight-tenths reverse stock split (the "Reverse Stock Split") of the Company's issued common shares, par value $0.01 (the "Common Shares"), effective at the opening of trading on February 12, 2026.

Reverse Stock Split

The Reverse Stock Split will be effective, and the Common Shares will begin trading on a split-adjusted basis on the Nasdaq Capital Market ("Nasdaq"), at the opening of trading on February 12, 2026, under the existing trading symbol "RUBI." The new CUSIP number for the Common Shares following the Reverse Stock Split will be Y1250N 115.

When the Reverse Stock Split becomes effective, every 7.8 issued and outstanding Common Shares will be automatically converted into 1 issued and outstanding Common Share without any change in (i) the par value per share or (ii) the total number of Common Shares the Company is authorized to issue.

Details

The Reverse Stock Split will not (i) affect any shareholder's ownership percentage of Common Shares (except as a result of the cancellation of fractional shares), (ii) have any direct impact on the market capitalization of the Company, or (iii) modify any voting rights or other terms of the Common Shares. As of February 10, 2026, the Company had 3,979,412 outstanding Common Shares, which will be reduced to approximately 510,180 Common Shares, to be adjusted for cancellation of any fractional shares.

No fractional shares will be created or issued in connection with the Reverse Stock Split. Shareholders who otherwise would be entitled to receive fractional shares because their pre-split holdings of Common Shares are not evenly divisible by the number of pre-split shares for which each post-split share is to be exchanged will receive a cash payment in lieu thereof at a price equal to that fraction of a share to which the shareholder would otherwise be entitled, multiplied by the closing price of the Common Shares on Nasdaq on February 11, 2026.

Shareholders with shares held in book-entry form or through a bank, broker, or other nominee are not required to take any action and will see the impact of the Reverse Stock Split reflected in their accounts on or after February 12, 2026. Such beneficial holders may contact their bank, broker, or nominee for more information.

The purpose of the reverse stock split is to increase the market price of the Company's common stock. The Company believes that the reverse stock split will increase the market price for its common stock and allow it to maintain compliance with Nasdaq's continued listing requirements.

About the Company

Rubico Inc. is a global provider of shipping transportation services specializing in the ownership of vessels. The Company is an international owner and operator of two modern, fuel efficient, eco 157,000 dwt Suezmax tankers.

The Company is incorporated under the laws of the Republic of the Marshall Islands and has executive offices in Athens, Greece. The Company's common shares trade on the Nasdaq Capital Market under the symbol "RUBI".

Please visit the Company's website at: https://rubicoinc.com/

For further information please contact:

Nikolaos Papastratis

Chief Financial Officer

Rubico Inc.

Tel: +30 210 812 8107

Email: npapastratis@rubicoinc.com

Forward-Looking Statements

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts, including with respect to the maintenance of the Company's Nasdaq listing.

The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words "believe," "anticipate," "intends," "estimate," "forecast," "project," "plan," "potential," "may," "should," "expect" "pending" and similar expressions identify forward-looking statements. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, our management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. Please see the Company's filings with the Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties. The information set forth herein speaks only as of the date hereof, and the Company disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication.