- Strong Q4 with 76.0 MSEK in revenue, up 135% from Q4 2024.

- Submission of Biologics License Application (BLA) for imlifidase for highly sensitized patients awaiting kidney transplantation.

- Successfully completed a directed share issue raising 671.5 MSEK (~ $71.3M).

LUND, Sweden, Feb. 11, 2026 /PRNewswire/ -- Hansa Biopharma AB, "Hansa" (Nasdaq Stockholm: HNSA), today announced its Q4 2025 and full-year financial results.

Renée Aguiar-Lucander, CEO, Hansa Biopharma, said, "Q4 capped a strong year for Hansa Biopharma. Filing our BLA with the FDA just three months after announcing Phase 3 results highlights the strength of our team and execution focus. We delivered solid growth in Europe, advanced market access efforts, and made the strategic decision to progress our next-generation enzyme HNSA-5487 in Guillain-Barré syndrome, with FDA interactions planned for the first half of 2026. As we enter 2026, our focus is clear: secure FDA approval, ensure a successful U.S. launch of imlifidase, and progress commercial adoption across Europe."

Financial Performance

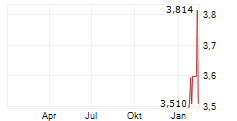

Fourth-quarter IDEFIRIX product sales reached 61.1 MSEK, a 139% increase from 25.6 MSEK in Q4 2024. Revenue totalled 76.0 MSEK, representing a 135% increase compared to 32.3 MSEK in Q4 2024.

Full-year 2025 IDEFIRIX product sales amounted to 204.7 MSEK for the full year, a 46% increase from 140.1 MSEK in the previous year. Revenue totalled 222.3 MSEK, representing a 30% increase compared to 171.3 MSEK in 2024. This growth reflects continued adoption across major European markets and underscores both the clinical value of IDEFIRIX, and the momentum Hansa is building in the treatment of highly sensitized patients undergoing kidney transplantation

Pipeline Progress

Imlifidase in Kidney transplantation: In December, Hansa submitted a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for imlifidase in the desensitization of highly sensitized adult patients undergoing deceased kidney donor transplantation. The FDA is currently reviewing the BLA for acceptability and evaluating Hansa's request for Priority Review, which-if granted-would result in a PDUFA target date in August 2026.

Imlifidase in Gene therapy: Initial data from the first patient in the GNT-018-IDES trial, presented at the European Society of Gene and Cell Therapy, showed that imlifidase rapidly and effectively removed AAV antibodies and can potentially serve as a pre-treatment to enable gene therapy in patients with Crigler-Najjar syndrome who have pre-formed antibodies to the AAV vector. No severe side effects were reported.

HNSA-5487: Hansa is advancing the next-generation enzyme, HNSA-5487, in Guillain-Barré syndrome (GBS). The company is planning for FDA interactions in the first half of 2026, to reach agreement on the clinical development program.

Financial Summary

Amounts in MSEK, unless otherwise stated | Q4 2025 | Q4 2024 | 12M 2025 | 12M 2024 |

Revenue | 76.0 | 32.3 | 222.3 | 171.3 |

- Including: Product sales | 61.1 | 25.6 | 204.7 | 140.1 |

SG&A expenses | (101.6) | (89.0) | (356.6) | (344.3) |

R&D expenses | (74.4) | (101.4) | (304.7) | (375.7) |

Loss from operations | (124.9) | (174.2) | (520.7) | (637.9) |

Loss for the period | (165.0) | (276.9) | (529.3) | (807.2) |

Net cash used in operations | (177.5) | (147.8) | (549.2) | (674.9) |

Cash and short-term investments | 701.1 | 405.3 | 701.1 | 405.3 |

EPS before and after dilution (SEK) | (1.62) | (4.08) | (6.52) | (12.85) |

Number of outstanding shares | 101,763,222 | 67,814,241 | 101,763,222 | 67,814,241 |

Weighted average number of shares before and after dilution | 101,763,222 | 67,814,241 | 81,200,543 | 62,834,848 |

Number of employees at period end | 125 | 135 | 125 | 135 |

Conference Call Details

Hansa Biopharma will host a telephone conference today Wednesday, 11 February 2026, at 14:00 CET / 8:00 am EST.

The event will be hosted by Renée Aguiar-Lucander, CEO, Richard Philipson, CMO, Evan Ballantyne, CFO, and Maria Törnsén COO and President U.S. The call will be held in English.

Slides used in the presentation will be live on the company website during the call under Financial reports | Hansa Biopharma and will also be made available online after the call.

To participate in the telephone conference, please use the dial-in details provided below:

Participant Dial In (Toll Free): 1-833-821-3542

Participant International Dial In: 1-412-652-1248

*Please ask to be joined into the Hansa Biopharma call

Join the webcast here: Webcast | Hansa Biopharma Fourth Quarter 2025 Earnings

Contacts for more information:

Evan Ballantyne, Chief Financial Officer

[email protected]

Kerstin Falck, VP Global Corporate Affairs

[email protected]

Notes to editors

About Hansa Biopharma

Hansa Biopharma AB is a pioneering commercial-stage biopharmaceutical company developing and commercializing novel immunomodulatory therapies to transform care for patients with acute or complex immune disorders. Hansa's proprietary IgG-cleaving enzyme technology platform to address serious unmet medical needs in transplantation, gene therapy and autoimmune diseases. The company's portfolio includes imlifidase, a first-in-class immunoglobulin G (IgG) antibody-cleaving enzyme therapy, which has been shown to enable kidney transplantation in highly sensitized patients, and HNSA-5487, a next-generation IgG-cleaving molecule that will be developed for Guillain-Barré Syndrome (GBS). Hansa Biopharma is based in Lund, Sweden, and has operations in Europe and the U.S. The company is listed on Nasdaq Stockholm under the ticker HNSA. Find out more at www.hansabiopharma.com and follow us on LinkedIn.

©2026 Hansa Biopharma AB. Hansa Biopharma, the beacon logo, IDEFIRIX, and IDEFIRIX flower logo are trademarks of Hansa Biopharma AB, Lund, Sweden. All rights reserved.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/hansa-biopharma-ab/r/hansa-biopharma-reports-fourth-quarter-and-full-year-2025-financial-results,c4305662

The following files are available for download:

https://mb.cision.com/Main/1219/4305662/3928047.pdf | HNSA - Q4 2025 ENG Final |