SF-based Company Delivers $34-45M in Annual Value for Refineries Through Advanced AI That Combines Data, Engineering Analysis, and Organizational Knowledge

SAN FRANCISCO, CA / ACCESS Newswire / February 12, 2026 / Archimetis, the AI-powered operational reasoning system for energy, chemical, and industrial plants, today announced it has raised $11.5M in funding led by Inspired Capital, with participation from Homebrew, MCJ, Borusan Ventures, Incite, and leading operators including Jeff Dean, Matt Rogers, John Giannandrea, Alfred Spector, and Diane Tang.

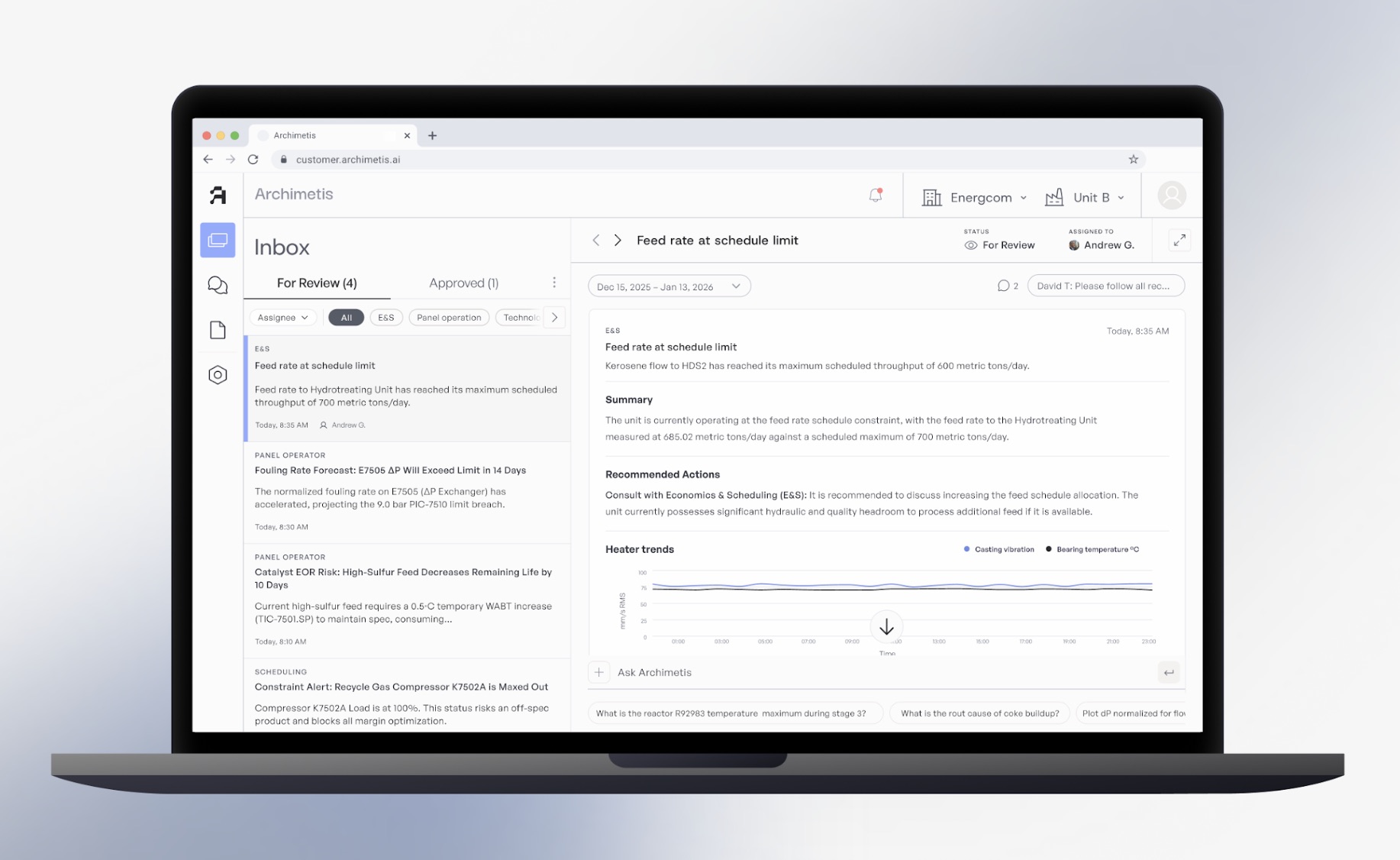

Founded in 2023, Archimetis is revolutionizing how refineries and heavy industrial plants operate by solving a problem that has plagued the industry for decades: teams working under immense pressure with inadequate support systems. When production lines shut down unexpectedly, operations teams face overwhelming, noisy data that isn't consistently collected or organized, forcing them to spend days gathering information from sensors, tickets, PDFs, emails, and the institutional knowledge locked in their most experienced team members' minds. Multiplying by the hundreds of smaller daily issues faced by these operators, millions of dollars optimization opportunities go uncaptured every year.

Archimetis builds on breakthrough AI technology from Google DeepMind's AlphaCode to act as an operational reasoning system. The platform combines data from disparate sources, continuously monitors systems for issues and opportunities, performs complex engineering analysis, and packages insights for immediate decision-making. Early results are notable: a 120,000 barrel-per-day refinery demonstrated $34-45 million in bottom line impact through margin improvement, cost savings, and enhanced process safety.

"For years, industrial operations teams have been asked to manage ever-increasing operational complexity with tools that haven't kept pace," said Paul Manwell, Co-Founder and CEO of Archimetis. "Recent breakthroughs in AI reasoning have finally made it possible to solve this problem for any sized plant. We can now give every operations and engineering team member the judgments and instincts of the very best, while unlocking organizational knowledge so best practices are used every shift. This is the right technology at the right time to help engineering and operations teams transform their industry, which has been underserved for far too long."

Elevating Industrial Operations Through AI Reasoning

In refineries and industrial plants, the challenge isn't just about having data; it's about making sense of it under pressure. Data is fragmented across sensors, maintenance systems, manufacturer documentation, and institutional knowledge. Traditional approaches rely on offline modeling, with Excel serving as the primary analysis tool.

Archimetis's operational reasoning system bridges this gap by deploying a modern AI stack that integrates leading language models and analytics tools in a secure, private cloud environment. The system regularly monitors operations for issues and opportunities, combines structured and unstructured data from multiple sources, applies global and company-specific best practices, and performs the kind of complex engineering analysis that previously required days of manual work.

"The Archimetis team represents exactly the kind of technical depth and operational excellence we look for," said Charlotte Ross, Partner at Inspired Capital. "Paul and Aaron spent years building the data infrastructure and AI systems that power Google-Paul as Chief of Staff to Sundar Pichai and founder of Google's cross-company data warehouse, and Aaron leading Google's internal developer infrastructure. They deeply understand how to build systems that work at scale under pressure. We believe Archimetis is positioned to become the operational intelligence layer for the global industrial sector."

The team is currently targeting Energy, Chemicals, and Metals customers, and has already built global operations, working with industry leaders in refining and industrials including Borusan. The funding will be used to continue scaling these teams and to build on the team's differentiated technology to address a broader range of use cases.

About Archimetis

Archimetis is an AI-powered operational reasoning system that transforms the performance of energy, chemical, and industrial plants. By combining data from disparate sources, performing complex engineering analysis, and applying organizational best practices, Archimetis elevates every operations and engineering team member with the judgments and instincts of the very best. Founded in 2023 and headquartered in San Francisco, CA, Archimetis is backed by Inspired Capital, Homebrew, and leading angel investors. To learn more, visit https://www.archimetis.ai/.

For Media Inquiries: press@archimetis.ai

SOURCE: Archimetis

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/industrial-and-manufacturing/archimetis-raises-11.5m-to-transform-industrial-operations-with-ai-pow-1136001