Relais Group Plc

Stock Exchange Release 13 February 2026, 9:10 am EET

Relais Group Oyj ("Relais Group") today announces that it is transitioning from a geographically organised management structure to a business area-based operating and management structure. Going forward, the Group will manage and monitor its operations through three distinct business areas, enabling clearer strategic steering, improved transparency, and a more disciplined capital allocation across the Group.

The new structure supports Relais Group's continued development as a leading consolidator and operator in the mobility aftermarket. It is designed to enhance both organic and acquisitive growth, improve comparability across the group and better leverage the Group's scale and expertise.

"The new structure provides a clearer operating model with stronger accountability and better visibility into the value creation across the Group. It strengthens our ability to allocate capital, scale our platforms and consistently build long-term shareholder value" says Christian Gebauer, President & CEO of Relais Group.

Three business areas

Going forward, Relais Group's operations are organised into three business areas:

- Commercial Vehicle Services, consisting of companies that are leading suppliers of repair, maintenance, and service solutions for commercial vehicles and industrial equipment. These companies create value through a strong focus on availability, safety, and total cost of ownership, where reliability and uptime are mission critical.

- Products and Solutions, consisting of companies with scalable branded products and solutions for vehicle users across international markets. The companies create value through innovation, strong market positioning, and international scalability.

- Technical Wholesale, bringing together leading distributors of spare parts, vehicle equipment, and technical solutions primarily for commercial vehicles and professional mobility. These companies create value through scale, strong local market leadership, and disciplined execution in resilient aftermarket segments with recurring demand where uptime, safety, and availability are critical.

New leadership roles

As part of the new management model, certain members of the Group Management Team, who have previously held business-specific development responsibilities alongside their existing roles, are now appointed as heads of their respective business areas.

Relais Group has made the following appointments:

- Jan Popov is appointed Head of Business Area Commercial Vehicle Services.

- Johan Carlos is appointed Head of Business Area Products and Solutions.

- Juan Garcia is appointed Head of Business Area Technical Wholesale.

Through these new appointments, the business area heads are given clear responsibility for operational performance, strategic development, and value creation within their respective areas.

Changes in segment reporting

Following the change in the Group's operating and management structure, Relais Group will update its financial reporting to align with the new business area model. The three business areas will constitute the Company's reportable segments going forward.

The updated segment reporting structure will be applied in the Relais Group's external financial reporting starting from the Interim Report for the first quarter of 2026. Comparative segment information will be provided at the latest in end of April 2026.

Group Management Team

As a result of the new appointments, the Group Management Team will comprise the following members as of 13 February 2026:

Christian Gebauer, President & CEO

Thomas Ekström, CFO

Jan Popov, Head of Business Area Commercial Vehicle Services

Johan Carlos, Head of Business Area Products and Solutions

Juan Garcia, Head of Business Area Technical Wholesale

Sebastian Seppänen, Director M&A and Business Development

Juri Viitaniemi, Director Compliance, Legal and HR

Further information:

Christian Gebauer

President & CEO, Relais Group Oyj

Telephone: 358 10 5085 800

Email: christian.gebauer@relais.fi

www.relais.fi

Relais Group

Relais Group is a leading compounder and acquisition platform on the commercial vehicle aftermarket in Northern Europe. We have a sector focus in vehicle life cycle enhancement and related services. We also serve as a growth platform for the companies we own.

We are a profitable company seeking strong growth. We carry out targeted acquisitions in line with our growth strategy and want to be an active player in the consolidation of the aftermarket in our area of operation. Our acquisitions are targeted at companies having a good strategic fit with our group companies.

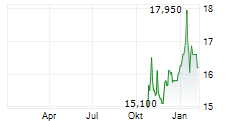

Our net sales in 2025 were EUR 383.4 (2024: 322.6) million. In 2025 we made seven acquisitions. We employ approximately 1,700 professionals in eight different countries. The Relais Group share is listed on the Main Market of Nasdaq Helsinki with the stock symbol RELAIS.

www.relais.fi