Posti Group Corporation Stock Exchange Release February 13, 2025, at 8.30 a.m. EET

Financial highlights in October-December 2025

- Net sales decreased by 3.3% to EUR 390.4 (403.6) million.

- Adjusted EBITDA increased to EUR 62.1 (54.2) million, or 15.9% (13.4%) of net sales.

- EBITDA increased to EUR 57.0 (52.8) million, or 14.6% (13.1%) of net sales.

- Adjusted operating result (adjusted EBIT) increased to EUR 30.0 (21.7) million, representing 7.7% (5.4%) of net sales.

- Operating result (EBIT) increased to EUR 24.8 (19.2) million, representing 6.4% (4.8%) of net sales. Operating result was negatively impacted by special items of EUR 5.2 (2.5) million including listing-related costs.

Financial highlights in January-December 2025

- Net sales decreased by 4.8% to EUR 1,447.6 (1,521.4) million.

- Adjusted EBITDA decreased to EUR 196.4 (207.6) million, or 13.6% (13.6%) of net sales.

- EBITDA decreased to EUR 180.4 (196.6) million, or 12.5% (12.9%) of net sales.

- Adjusted operating result (adjusted EBIT) decreased to EUR 69.3 (80.1) million, representing 4.8% (5.3%) of net sales.

- Operating result (EBIT) decreased to EUR 52.3 (68.0) million, representing 3.6% (4.5%) of net sales. Operating result was negatively impacted by special items of EUR 17.0 (12.2) million including listing related costs.

- Net debt to adjusted EBITDA was 2.6x (1.2x).

Operational highlights in October-December 2025

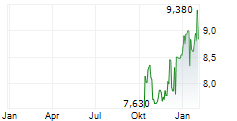

- Trading of Posti Group's shares commenced on Nasdaq Helsinki on October 14, 2025.

- Record-high Group's adjusted EBITDA margin and adjusted EBIT margin in ten years.

- Operationally successful peak season, during which Posti delivered 7.8 million parcels and 8.9 million Christmas greetings.

- Strong execution in delivery model, resource optimization and high-level sorting automatization in Postal Services increased the segment's profitability significantly. The adjusted EBITDA of Postal Services was 23.9% (20.5%) of net sales. Addressed letter volumes decreased by 19.8% (18.1%).

- Growth in Finland's consumer recommerce market boosted parcel volumes in the eCommerce and Delivery Services segment. Total parcel volumes in Finland and the Baltic countries increased by 11.1% (-2.0%). Change in product mix had a negative impact on the segment's net sales and profitability.

- Enhanced operational efficiency and higher demand in warehousing market drove growth in net sales and profitability for Fulfillment and Logistics Services.

Board of Director's proposal for dividend

Board of Director's proposes a dividend of EUR 34.0 million, or a dividend of EUR 0.84 per share for the 2025. Dividend to be distributed in two installments.

Guidance for 2026

Posti is expecting its net sales to be within the range of EUR 1,400-1,500 million, and adjusted EBIT to be within the range of EUR 63-79 million in 2026. In 2025, Posti's net sales were EUR 1,447.6 million and adjusted EBIT was EUR 69.3 million.

Posti is revising the way its full-year guidance is provided. Going forward, Posti will no longer include adjusted EBITDA in the guidance range. Posti will guide expected full-year net sales and adjusted EBIT.

Background for guidance for 2026

The operating environment in the logistics sector is expected to remain challenging. Growth in trade and industry continues to be constrained by uncertainty, while consumer confidence remain subdued.

As Posti serves a broad customer base, both GDP growth and confidence indicators have a direct impact on the sector's performance. GDP growth forecasts in Finland for 2026 are moderate, while in Sweden and the Baltics growth is expected to continue. Tightening trade policies, geopolitical tensions, financial market volatility, and potential additional fiscal adjustment measures may further slow Finland's economic recovery.

Growth in ecommerce, both domestically and internationally, continues to support the expansion of the parcel market. This growth is driven by increased recommerce trade and the rising number of smaller parcels. Competition in the parcel market in both Finland and the Baltics is expected to remain intense.

Postal volumes are expected to continue declining due to digitalization. Posti has continued to develop its delivery models for paper mail and offers digital mail solutions to support customers in their transition to digital services. In 2026, legislation introducing the digital priority of official Government letter mail will come into effect, further negatively impacting addressed letter volumes.

Posti remains committed to customer centricity and continuously develops its services in response to evolving customer needs. The Group's key priorities are commercial growth, stronger network synergies, and improved operational efficiency.

The Group's business is characterized by seasonality, and net sales and adjusted EBIT are not accrued evenly throughout the year. The fourth quarter is typically the strongest quarter. Accelerating digitalization is expected to impact negatively letter volumes especially in the first quarter.

Mid-term financial targets

The Board of Directors of Posti Group has set the following mid-term financial targets 2026 onwards:

- Average organic net sales growth (3-5-year period) of at least 2% at Group level and at least 5% outside Postal Services compared to 2025

- Baseline for 2025 at Group level of EUR 1,447.6 million

- Baseline for 2025 outside Postal Services of EUR 917.1 million

- Average adjusted operating result (adjusted EBIT) growth (3-5-year period) over 5% compared to 2025

- Net debt/adjusted EBITDA less than 2.5x

Posti Group's target is to pay continuously increasing ordinary dividends, and a payout ratio of at least 60 percent of net income based on Board of Directors approved dividend policy.

Key Figures of Posti Group

| 10-12 | 10-12 | 1-12 | 1-12 | |

| EUR million | 2025 | 2024 | 2025 | 2024 |

| Financial development and profitability | ||||

| Net sales, EUR million | 390.4 | 403.6 | 1,447.6 | 1,521.4 |

| Change in net sales, % | -3.3% | -6.1% | -4.8% | -4.1% |

| Adjusted EBITDA, EUR million | 62.1 | 54.2 | 196.4 | 207.6 |

| Adjusted EBITDA margin, % | 15.9% | 13.4% | 13.6% | 13.6% |

| EBITDA, EUR million | 57.0 | 52.8 | 180.4 | 196.6 |

| EBITDA margin, % | 14.6% | 13.1% | 12.5% | 12.9% |

| Adjusted operating result (adjusted EBIT), EUR million | 30.0 | 21.7 | 69.3 | 80.1 |

| Adjusted operating result (adjusted EBIT) margin, % | 7.7% | 5.4% | 4.8% | 5.3% |

| Operating result (EBIT), EUR million | 24.8 | 19.2 | 52.3 | 68.0 |

| Operating result margin (EBIT), % | 6.4% | 4.8% | 3.6% | 4.5% |

| Result for the period, EUR million | 14.7 | 12.4 | 23.5 | 43.8 |

| Financial position | ||||

| Equity ratio, % | 24.6% | 25.2% | ||

| Return on capital employed (12 months), % | 7.8% | 11.2% | ||

| Net debt, EUR million | 517.0 | 257.5 | ||

| Net debt / adjusted EBITDA | 2.6x | 1.2x | ||

| Financial net debt / adjusted EBITDA | 1.1x | -0.1x | ||

| Other key figures | ||||

| Operative free cash flow, EUR million | -37.0 | -2.9 | ||

| Investments, EUR million | 175.1 | 183.5 | ||

| Personnel, end of period | 13,751 | 14,764 | ||

| Personnel on average, FTE | 11,638 | 12,777 | 11,845 | 13,095 |

| Earnings per share, basic and diluted, EUR | 0.37 | 0.31 | 0.59 | 1.10 |

| Dividend per share, EUR | 0.84* | 0.83 | ||

| Dividend, EUR million | 34.0* | 33.0 |

*Board of Directors' proposal to the Annual General Meeting

Calculation, use and reconciliations of Key figures are presented in section Key Figures

Antti Jääskeläinen, President and CEO

In the fourth quarter we delivered a successful peak season with high service quality and resource efficiency. Our operations ran smoothly and efficiently, reflecting Posti's strengths in planning, customer service and continuous improvement.

In the fourth quarter, the Group's net sales decreased by 3.3%. Net sales were negatively impacted by the 19.8% decline in addressed letter volumes in Postal Services; however, parcel volumes increased by 11.1%. Adjusted EBITDA and adjusted EBIT both increased clearly from the previous year, driven by strong operational execution. In fact, our relative profitability - the adjusted EBITDA and adjusted EBIT margins - reached their highest level in over ten years in the fourth quarter. I am pleased to note the clear sequential improvement in the Group's overall profitability throughout the year. Full year net result was negatively impacted by higher financial items and listing related costs.

Looking at the fourth quarter, on the segment level. Sustained increase in consumer parcel volumes in eCommerce and Delivery Services continued, driven by recommerce. This was consistent with the previous quarters. The B2B parcel market was weaker. As a result of product mix developments, the net sales in eCommerce and Delivery Services increased slightly, whereas adjusted EBITDA decreased. Fulfillment and Logistics Services achieved growth in net sales, driven by increased customer demand in warehousing. This positive momentum and improved operational efficiency contributed to the increase of the segment's adjusted EBITDA. In addition, Postal Services recorded a significant improvement in adjusted EBITDA, despite continuously lower addressed letter volumes and our earlier decision to discontinue unaddressed mail services. Strong execution in delivery model changes, resource optimization, and high sorting automation rate increased the segment's profitability significantly. This underscores the team's ability to adapt to changing market conditions and deliver good results.

The operating environment remained challenging during 2025, with heightened competition. Market transformation continues. Ongoing digitalization across both public and private sectors has led to a clear reduction in letter volumes, a structural shift that is expected to continue. Also, general economic conditions, particularly in Finland, were softer than anticipated. In response, we continued our customer centric commercial actions, network optimization and improved efficiency. We see further synergy potential in our network operations and will continue to pursue these initiatives going forward.

As consumer and market behaviors evolve it is crucial that the Postal Act in Finland adapts accordingly to support a sustainable universal service model. We continue to work with and inform the relevant stakeholders and regulators of market development. We operate in full compliance with current legislation.

The fourth quarter was historic for Posti Group as our shares began trading on Nasdaq Helsinki. The successful listing was an intensive project for many Posti employees. The whole Posti organization made it possible through several years of hard work when developing Posti to where we are today.

Thanks to our strong operational resilience and reflecting our dividend policy to provide a continuously increasing ordinary dividend, the Posti Group's Board of Director's proposes a dividend of EUR 0.84 per share for the 2025 financial year. The dividend will be distributed in two installments.

I am also proud to note that in our first CDP Climate Change Assessment as a publicly listed company, Posti received a B rating, placing us in the second highest category. This achievement reflects our progress and systematic approach to managing climate risks. I am also satisfied that the employee satisfaction scores in our recent employee survey continued an upward trend despite persistently changing market conditions.

Looking ahead, accelerated digitalization continues. This will further drive the decline in postal volumes, and it has had a clear impact already in the first quarter compared to previous years. We remain committed to customer centricity and continuously develop our services as customer needs evolve. Our key priorities are growth and commercial excellence, stronger network synergies, and improved operational efficiency. My sincere thanks to all employees for their exceptional work during 2025, and to our customers for their continued trust and partnership.

Audiocast for investors, analysts and media

An English-language audiocast for investors, analysts and media will be held on February 13, 2025, at 11.00 a.m. EET. Link for the audiocast will be available on www.posti.com/en/investors.

In the audiocast Posti Group's President and CEO Antti Jääskeläinen and CFO Timo Karppinen will go through Posti's Q4 and full year 2025 financial results.

A recording of the event will be available on www.posti.com/en/investors later on the same day.

Further information

Antti Jääskeläinen, President and CEO

Timo Karppinen, CFO

Tel. +358 20 452 3366 (MediaDesk)

Distribution

Key media

www.posti.com/en/investors

Images and logos

https://www.posti.com/en/corporate/media

Posti Group Corporation in brief

Posti is one of the leading delivery and fulfillment companies in Finland, Sweden, and the Baltics. We make our customers' everyday lives smoother with a wide range of services, which include parcels, freight, and postal services as well as warehouse, fulfillment, and logistics services. Our goal is to transport completely fossil-free throughout the value chain by 2030 and zero our own emissions by 2040. Our net sales in 2025 amounted to EUR 1,447.6 million and we have approximately 13,700 employees. Posti Group's shares are listed on the Nasdaq Helsinki official list in Finland. www.posti.com.