Defence Holdings Plc - Launches Sovereign Software Capability Accelerator and Provides Operational Update

PR Newswire

LONDON, United Kingdom, February 17

FOR IMMEDIATE RELEASE

17 February 2026

London, UK

Defence Holdings PLC

("Defence Holdings" or the "Company")

Defence Holdings Launches Sovereign Software Capability Accelerator and Provides Operational Update

Defence Holdings PLC (LSE: ALRT), the UK's listed software-led defence technology company, today announces the launch of the Defence Holdings Accelerator, a structured programme designed to identify, harden and deploy early-stage sovereign software capabilities into UK and allied defence environments.

The Accelerator builds on Defence Holdings' existing delivery model under Defence Technologies and expands the Company's ability to engage earlier with high-potential software and AI technologies aligned to live operational demand.

In parallel, the Company provides an operational update on Project Ixian.

Highlights

· Launch of a structured Accelerator programme focused on sovereign software, AI and data capability

· Designed to progress mission-aligned technologies from prototype to Defence-ready deployment

· Provides SMEs with access to senior Defence stakeholders, validated problem statements and integration pathways

· Enables disciplined capital deployment into technologies with clear operational demand

· Builds on Defence Holdings' PLC structure, hyperscale partnerships and senior Defence relationships

· Directly aligned with the Strategic Defence Review's emphasis on faster capability translation and software-defined defence

Strategic Significance

The pace of software innovation now materially exceeds the tempo of traditional defence procurement. Many high-impact capabilities originate in SMEs and founder-led ventures that move at speed but lack structured access to senior defence stakeholders, secure architecture support, or credible routes to adoption.

The Defence Holdings Accelerator has been established to address this gap. It provides a repeatable mechanism for:

·

Identifying technologies aligned to validated operational requirements

·

Embedding them within secure sovereign architectures from inception

·

Providing structured evaluation pathways into defence environments

·

Deploying capital selectively where operational demand and delivery feasibility are demonstrated

The programme is a capability-first accelerator focused exclusively on sovereign software and AI aligned to live defence priorities.

By operating as a London-listed vehicle with established hyperscale relationships and senior defence engagement, Defence Holdings is uniquely positioned to:

·

Provide governance, compliance and credibility that early-stage SMEs cannot achieve alone

·

Connect emerging capability directly to end-user networks

·

Retain UK-sovereign control of data, intellectual property and export pathways

·

Align capital deployment with validated operational pull rather than speculative innovation

In doing so, the Accelerator positions Defence Holdings as a structured conduit between sovereign innovation and operational deployment, engaging high-potential capability earlier in the innovation cycle and translating it into deployable outcomes at pace.

This model reflects the increasing reality that advances in software, data and AI originate outside traditional procurement pathways and require secure, credible routes to operational adoption.

By focusing on capability outcomes rather than corporate structures, the Accelerator reduces delivery risk and shortens the path from innovation to operational relevance.

Crucially, the Accelerator is designed to build directly alongside end users within Defence environments, not developing capability in isolation and handing it over at the point of delivery, but co-creating solutions with operators from the outset. This approach ensures relevance, accelerates validation, and materially reduces the gap between concept and operational deployment

Alignment with UK Defence and National Security Priorities

The launch of the Accelerator reflects a structural shift in defence delivery. The Strategic Defence Review and allied initiatives have emphasised the need for:

· Faster translation of software capability into operational effect

· Greater engagement with SMEs

· Reduced dependency on slow, hardware-led procurement cycles

· Increased sovereign control over digital infrastructure and IP

At the same time, Defence Holdings is experiencing growing inbound engagement from defence stakeholders seeking earlier visibility of emerging software capability.

The Accelerator formalises this pull, and allows Defence Holdings to move upstream in the innovation cycle, identifying and shaping capability before it enters rigid procurement pathways, while maintaining discipline, sovereign architecture and commercial clarity.

This timing positions the Company to capture early-stage innovation precisely as defence systems move toward software-defined operating models.

Defence Technologies remains the Company's primary sovereign software delivery platform, progressing classified programmes and hyperscale integrations. The Accelerator expands the pipeline feeding that platform.

Capabilities matured through the Accelerator may:

· Integrate into Defence Technologies' sovereign software stack

· Progress as standalone deployments under Defence Holdings

· Be scaled through joint ventures or structured commercial partnerships

This layered model increases optionality while preserving capital discipline and sovereign control.

Andy McCartney, Chief Technology Officer of Defence Holdings, commented:

"The Accelerator model is rooted in lived experience. Our leadership team has taken frontier technologies from early-stage concept through to institutional deployment in some of the most demanding environments. We understand the discipline required to scale, commercially and operationally. This model combines venture-speed execution with the delivery standards expected in sovereign Defence contexts, ensuring innovation translates into real capability."

Project Ixian Update

Project Ixian continues to progress in line with Company expectations. Activity is advancing through established UK Defence technical, security and commercial protocols consistent with delivery within classified operational environments.

The Company will provide a further update at the earliest point at which disclosure is permitted under applicable Defence and regulatory constraints.

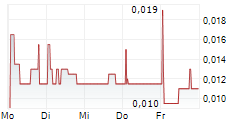

Exercise of Warrants and Update on ATM Facility

The Company has received notices from a warrant holder to exercise warrants over a total of 46,693,028 ordinary shares of £0.001 each in the Company ("Ordinary Shares"). Accordingly, the Company will issue 46,693,028 new Ordinary Shares to the warrant holder.

Admission and Total Voting Rights

Application will be made for the 46,693,028 Warrant Shares, which will rank pari passu with the existing Ordinary Shares in issue, to be admitted to trading on the London Stock Exchange Main Market ("Admission"). Dealings are expected to commence on or around 20 February 2026.

Following Admission, the Company's total issued and voting share capital will consist of 2,473,485,974 Ordinary Shares. The Company does not hold any ordinary shares in treasury.

Therefore, the above figure may be used by shareholders in the Company as the denominator for the calculation by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the FCA's Disclosure Guidance and Transparency Rules.

Update on ATM facility

Further to the announcement dated 05 February 2026, Fortified Securities has successfully raised additional gross proceeds of £41,450.00 (the "ATM Proceeds") for the period ending 06 February 2026. Settlement of the ATM Proceeds has now been completed.

Following these ATM-related sales, Fortified Securities' shareholding has decreased from 111,500,000 shares (4.59% of the issued share capital) to 109,000,000 shares (4.49% of the issued share capital).

Taking into account the ATM Proceeds announced on 31 October 2025, 14 November 2025, 18 December 2025, 5 February 2026 and those announced today, the Company has now raised total gross proceeds of £754,567.49 under the ATM facility.