Proposed sale provides certainty and immediate returns for IHS Towers shareholders

KEY HIGHLIGHTS

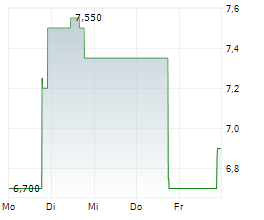

- IHS Towers shareholders will receive $8.50 per share in cash, representing:

- Approximately 239% premium over IHS Towers' share price at the announcement of the Company's strategic review on March 12, 2024

- Approximately 36% premium to the 52-week Volume-Weighted Average Price (VWAP)

- Approximately 3% premium over IHS Towers unaffected closing share price of $8.23 on February 4, 2026

- Transaction values IHS Towers at an enterprise value of approximately $6.2 billion

- Transaction enables IHS Towers' shareholders to crystallize the significant value created during the company's strategic review process

- MTN has agreed to vote all of its IHS shares in favor of the transaction, and long-term IHS Towers' shareholder, Wendel, has also provided a letter of support to vote in favor of the transaction.

IHS Holding Limited, (NYSE: IHS) ("IHS Towers" or the "Company"), one of the largest independent owners, operators and developers of shared communications infrastructure in the world by tower count, has today announced that it has entered into a merger agreement (the "Agreement") to be acquired by MTN Group Limited ("MTN"), a pan-African mobile operator, for $8.50 per ordinary share, in an all-cash transaction that values IHS Towers at an enterprise value of approximately $6.2 billion.

Under the terms of the Agreement, IHS Towers shareholders will receive $8.50 per ordinary share in cash, representing a premium of approximately 239% premium over IHS Towers' share price at the announcement of the Company's strategic review on March 12, 2024. It also represents a premium of approximately 36% to the 52-week volume-weighted average price as of February 4, 2026, and a premium of approximately 3% over IHS Towers' unaffected closing share price of $8.23 on February 4, 2026, when public reports indicated that negotiations with MTN were ongoing. The transaction provides shareholders with an immediate and certain opportunity to realize the value generated since the announcement of the Company's strategic review on March 12, 2024, which was initiated during a period of sustained geopolitical and macroeconomic volatility in key operating markets.

IHS Towers' Board of Directors, has unanimously approved the Agreement and the transaction, and resolved to recommend approval of the Agreement and the transaction by IHS Towers' shareholders.

MTN has agreed to vote all of its IHS shares in favor of the transaction, and long-term IHS Towers' shareholder, Wendel, has also provided a letter of support to vote in favor of the transaction. With these two shareholders combined, more than 40% shareholder agreement or support has been secured for this proposed transaction to conclude. Upon completion of the transaction, IHS Towers' ordinary shares will no longer be publicly listed, and IHS Towers will become a wholly owned subsidiary of MTN.

Sam Darwish, Chairman CEO, IHS Towers, commented, "Today's announcement creates a compelling opportunity that provides certainty and immediate returns for our shareholders, enabling them to crystallize the significant value generated during our strategic review. The proposed transaction deepens our long-standing partnership with MTN, as it combines Africa's largest mobile network operator with one of its largest digital infrastructure platforms, and underscores the strong connection between IHS Towers and the African continent.

I would like to take this opportunity to thank our colleagues, customers and partners for their support over the past 25 years, as IHS Towers has grown from a single tower in one market to an eleven-country portfolio of approximately 40,000 towers at its peak."

Ralph Mupita, Group President and CEO, MTN, commented, "This proposed transaction is a pivotal step in further strengthening MTN Group's strategic and financial position for a future where digital infrastructure will become ever more essential to Africa's growth and development. This transaction gives us a unique opportunity to buy back our towers and strengthen our ability to be partners for progress to the nation states in which we operate."

"For IHS customers and partners across the continent, we commit to continuing high standards of service and the right governance of what is the largest standalone and integrated tower company in Africa, enabled by the excellent people within IHS."

The transaction is expected to close in 2026, and is subject to certain closing conditions, including shareholder and regulatory approvals. The transaction will be funded through the rollover of MTN's existing approximately 24% fully diluted stake in IHS Towers, together with approximately $1.1 billion of cash from MTN, approximately $1.1 billion of cash from IHS Towers' balance sheet, and the rollover of no more than the existing IHS Towers debt. The Company will also be required to have minimum cash of $355 million on balance sheet at closing. The Company's ability to satisfy some of these requirements is dependent upon the successful completion of the sales of both its Latin American tower and fiber operations, announced on February 17, 2026, and February 11, 2026, respectively.

The foregoing description of the Agreement and the transactions contemplated thereby is subject to, and is qualified in its entirety by reference to, the full terms of the Agreement, which IHS Towers will be filing on Form 6-K.

Advisors

J.P. Morgan is acting as financial advisor to IHS Towers, and Latham Watkins LLP and Walkers (Cayman) LLP are acting as legal counsel to IHS Towers.

BofA Securities and Citigroup Global Markets Limited are acting as financial advisors to MTN; Cravath, Swaine Moore LLP are acting as legal advisors.

---ENDS---

About IHS Towers: IHS Towers is one of the largest independent owners, operators and developers of shared communications infrastructure in the world by tower count and is solely focused on the emerging markets. The Company has over 37,000 towers across its seven markets, including Brazil, Cameroon, Colombia, Côte d'Ivoire, Nigeria, South Africa and Zambia. For more information, please email: communications@ihstowers.com or visit: www.ihstowers.com

About MTN Group: Launched in 1994, the MTN Group is a leading digital operator with a clear vision to lead the delivery of a bold new digital world to our customers. We are inspired by our belief that everyone deserves the benefits of a modern connected life. The MTN Group is listed on the JSE Securities Exchange in South Africa under the share code 'MTN'. Our purpose is Leading digital solutions for Africa's progress

Cautionary Language Regarding Forward-Looking Statements

This document contains forward-looking statements, including regarding the closing of future transactions. We intend such forward-looking statements to be covered by relevant safe harbor provisions for forward-looking statements (or their equivalent) of any applicable jurisdiction, including those contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this document may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expects," "plans," "anticipates," "could," "intends," "targets," "commits," "projects," "contemplates," "believes," "estimates," "forecast," "predicts," "potential" or "continue" or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. You should read this press release and the documents that we reference in this press release with the understanding that our actual future results, performance and achievements may be materially different from what we expect. Further information on such assumptions, risks and uncertainties is available in our filings with the US Securities and Exchange Commission, including our Annual Report on Form 20-F for the fiscal year ended December 31, 2024. We qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this press release. Except as required by applicable law, we do not assume, and expressly disclaim, any obligation to publicly update or revise any forward-looking statements contained in this press release, whether as a result of any new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260217889873/en/

Contacts:

Enquiry: Investor

Contact Info:

IHS Africa (UK) Limited

1 Cathedral Piazza

123 Victoria Street

London, SW1E 5BP

United Kingdom

investorrelations@ihstowers.com

Enquiry: Other

Contact Info:

IHS Africa (UK) Limited

1 Cathedral Piazza

123 Victoria Street

London, SW1E 5BP

United Kingdom

+442081061600

communications@ihstowers.com