Thor is taking on District-scale exploration!

ESTES PARK, CO / ACCESS Newswire / February 17, 2026 / Taranis Resources Inc. ("Taranis" or the "Company") [TSX.V:TRO][OTCQB:TNREF] is providing an update on its planned 2026 exploration activities at the Thor project. Recent airborne electromagnetic ("EM") surveying has identified a series of conductive anomalies immediately east and downslope of the Thor deposit, including the newly defined Borr Zone. These anomalies are interpreted to represent the down-dip continuation of mineralization beyond a lamprophyre dyke that bisects the known Thor epithermal system and form the basis for targeted drilling planned in 2026. There are notably few historical workings nor is there any recorded prior drilling in the area of the Borr zone, meaning that further discoveries in this area could drastically reshape the existing mineral resource.

The Mineralized Trend at Thor

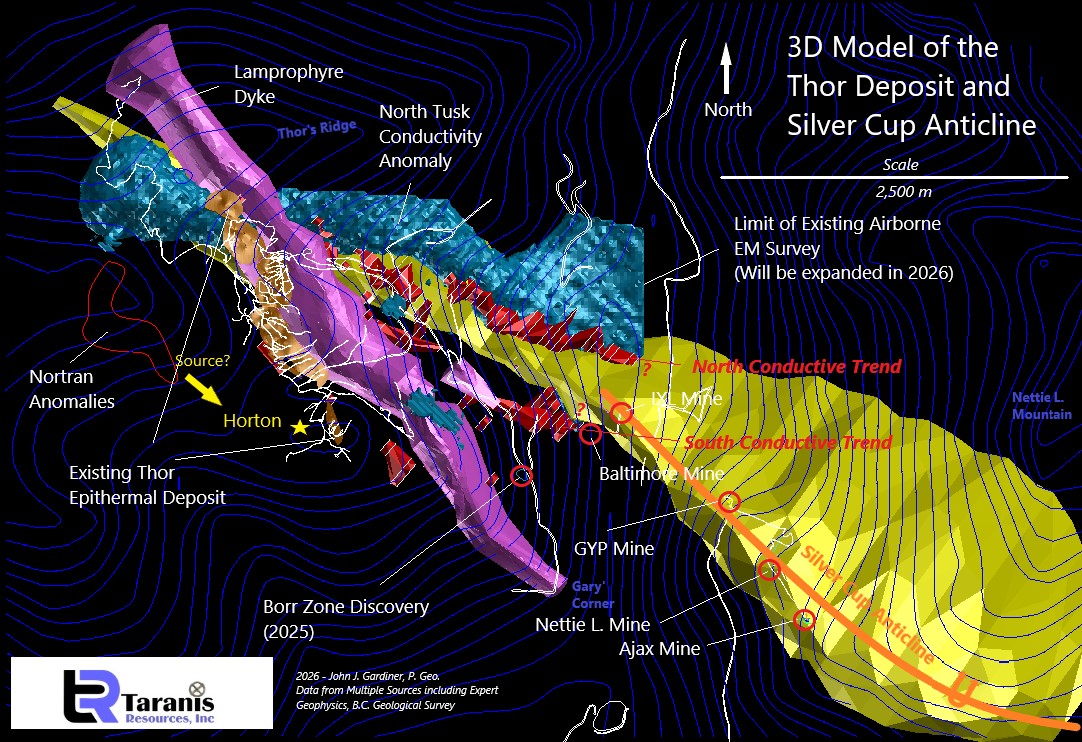

Thor lies within a 5-kilometer, northwest-trending mineralized corridor that includes the Ajax, Nettie L., GYP, IXL, Baltimore, and True Fissure Mines. This trend is spatially related to the overturned Silver Cup Anticline, which plunges 35 degrees to the northwest. Silver, gold, and base-metal mineralization occur in proximity to the Silver Cup Anticline in epithermal veins.

The Silver Cup Anticline plunges Northwesterly under the Thor epithermal Deposit. The Silver Cup Anticline is overturned to the northeast, and on the east side of Ferguson Creek the IXL, GYP, Nettie L., and Ajax Mines occur directly along apex of this anticline. 3D modeling of geological and airborne MT data shows that there are two parallel bands of EM conductors lying on the limbs of the tightly folded anticline. The source of these anomalies extends to great depth, but they link the sulfide-rich mineralization at Thor to the tightly folded edges of the Silver Cup Anticline. This is consistent with historic information that Taranis has been able to acquire and incorporate into the 3D modeling that shows the Nettie. L. Mine is a funnel shaped feature along the crest of the Silver Cup Anticline.

On the west side of Ferguson Creek, Taranis discovered the Borr Zone in 2025. Intercepts of the Borr zone included 5.25m of 26.2 g/t Ag, 0.766 g/t Au and 3.55% combined Pb+Zn. (see Taranis News Release dated 10/27/2025). This area is of major importance because it lies 1.3km southeast of the known Thor deposit, and it geologically connects to the historic mines on the east side of Ferguson Creek based on the distribution of EM conductors. High-grade zinc showings, such as the Baltimore Mine, have been noted in this area between the Borr Zone and the IXL Mine. In 2025, Taranis also drilled another shallow drill hole that intersected mineralization in close vicinity to Thor-256 and the results are shown below.

Thor-257 | |||||||||||

From (m) | To (m) | Width (m) | Ag (g/t) | Cd (ppm) | S (%) | Sb (ppm) | Sn (ppm) | Au (ppb) | Pb (%) | Zn (%) | Combined Pb+Zn (%) |

27.00 | 27.74 | 0.74 | 15.4 | 43.9 | 0.3 | 13.4 | 48.3 | 16 | 0.85 | 0.72 | 1.56 |

27.74 | 28.14 | 0.40 | 43.7 | 89.7 | 0.9 | 31.6 | 23.9 | 19 | 1.90 | 1.53 | 3.43 |

28.14 | 28.70 | 0.56 | 14.3 | 402 | 3.3 | 7.7 | 14.9 | 132 | 0.30 | 6.75 | 7.05 |

Average |

| 1.70 | 21.7 | 173 | 1.4 | 15.8 | 31.6 | 55 | 0.91 | 2.89 | 3.81 |

Little is understood about the Borr Zone as it is not exposed at surface, but it is clearly the down-dip continuation of the main Thor epithermal deposit and warrants further drilling.

Historic Evidence for a Larger, Truncated Deposit

With a more comprehensive understanding of the local geology, it has been identified that a relatively young lamprophyre dyke intersects the Thor epithermal deposit. The discovery of the Borr Zone on the east side of the dyke (Thor-256 & 257) shows that mineralization extends east beyond the dyke boundary, supporting the potential for significant down-dip expansion of the Thor epithermal deposit.

The Morgan Tunnel, the last major historical underground exploration effort at Thor in the early 1900's, inadvertently intersected the lamprophyre dyke rather than the projected down-dip continuation of the existing Thor deposit. This explains why the Thor epithermal system appears unusually long (2.3 km strike), but has a minimal dip extent. Taranis believes the original deposit was more equidimensional and the lower part of the Thor deposit was discovered with holes Thor-256 and Thor-257.

"Nortran" EM Anomalies at Horton

Compilation work by Taranis has also identified a cluster of 19 EM anomalies that occur directly north of the area of high-grade float mineralization discovered by Taranis at Horton. These anomalies were identified in 1987 by Nortran Resources, and were never explored. The helicopter survey was conducted by Apex Airborne Surveys in conjunction with Questor Surveys using three frequencies (380, 920 and 4,020 Hz). Taranis was also able to identify an anomalous areas of conductivity in a ground EM-37 survey completed in 2007, and the Nortran anomalies were also duplicated in the Expert Geophysics survey completed in 2022. This cluster of EM anomalies are now considered high-priority given numerous high-grade boulders found at Horton (See Taranis News Release dated 03/25/2025).

Comments

The Silver Cup Mining District is large, extending for approximately 52km in a northwesterly direction. Many old mines have not been explored with modern geophysical methods, despite being mined over a century ago. Recently, Taranis has initiated exploration outside of the known Thor deposit and this has yielded promising results in addition to the recent discovery of a lamprophyre dyke system. Modern geophysical surveying and 3D computer models that incorporate district-scale geological features such as the Silver Cup Anticline have outlined an existing mineralized system that is dotted with old mines and prospects at surface. Accurate 3D models reaching up to 2km underground help relate surface prospects to their broader deposit sources. Taranis's goal is to link all of these together into a singular cluster of deposits in the subsurface that extends upwards of 7km.

Qualified Person

Exploration activities at Thor were overseen by John Gardiner (P. Geo.), President and CEO of Taranis Resources Inc., and a Qualified Person under Canadian National Instrument 43-101. Mr. Gardiner is the principal of John J. Gardiner & Associates, LLC, operating in British Columbia under Firm Permit Number 1002256. Mr. Gardiner has reviewed and approved the comments contained within this News Release.

Quality Control and Laboratory Methods

All samples for the Thor project were securely delivered to Actlabs in Kamloops, British Columbia. Analytical work was completed both at the Kamloops, and Ancaster, Ontario locations. Actlabs is ISO 17025 accredited.

Visibly (or potentially mineralized sections of core) were systematically sampled after sawing the core in-half onsite. Samples were analyzed for 42 elements by 4-Acid Digestion / Inductively Coupled Plasma - Mass Spectrometry ("ICP-MS") and for gold by 30g Fire Assay / Atomic Absorption Spectrophotometry ("AAS")

Where overlimit values were encountered in the analysis of these samples, 'ore-grade' determinations were made using subsequent ICP analysis and gravimetric methods. As a Quality Control ("QC") measure, Taranis also submitted analytical standards into the sample stream every tenth sample in addition to the laboratory's own quality control methods.

Taranis currently has 102,421,487 shares issued and outstanding (119,972,613 shares on a fully-diluted basis).

TARANIS RESOURCES INC.

Per: John J. Gardiner (P. Geo.), President and CEO

For further information contact:

John J. Gardiner

681 Conifer Lane

Estes Park, Colorado 80517

Cell: (720) 209-3049

johnjgardiner@earthlink.net

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

This News Release may contain forward-looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of factors beyond its control, and actual results may differ materially from expected results.

SOURCE: Taranis Resources, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/taranis-identifies-borr-zone-using-em-prepares-for-drilling-on-east-side-of-lampr-1138090