At the end of the year, Grupo Nutresa's consolidated sales of COP 20.6 trillion, a growth of 10.7% compared to 2024.

International revenues reached COP 8.3 trillion, reflecting a growth of 11.9%. In dollars, they amounted to USD 2.2 trillion, reflecting a 31.3% increase.

Sales in Colombia reached COP 12.3 trillion, registering a 9.9% growth.

The company continues to advance in its transformation efforts toward a more flexible, competitive, and global operation. As a result, Grupo Nutresa's annual EBITDA adjusted for non-recurring expenses, reached COP 3.45 trillion. During the fourth quarter, adjusted EBITDA was COP 1.02 trillion with a margin of 19.3%.

Net income, excluding non-recurring expenses, was COP 1.7 trillion, a 126.6% increase.

Accounting profit, including non-recurring restructuring expenses, was COP 1.2 trillion.

MEDELLÍN, CO / ACCESS Newswire / February 19, 2026 / Grupo Nutresa S.A. (BVC:NUTRESA) reports the accumulated financial results of year 2025.

Solid growth across all operating regions and categories, coupled with steady improvements in profitability and efficiency, defined the results for the period.

This performance reflects the results of the organizational transformation strategy initiated in early 2025, which focuses on efficiency, profitable investment, and a commitment to creating social, environmental, and economic value.

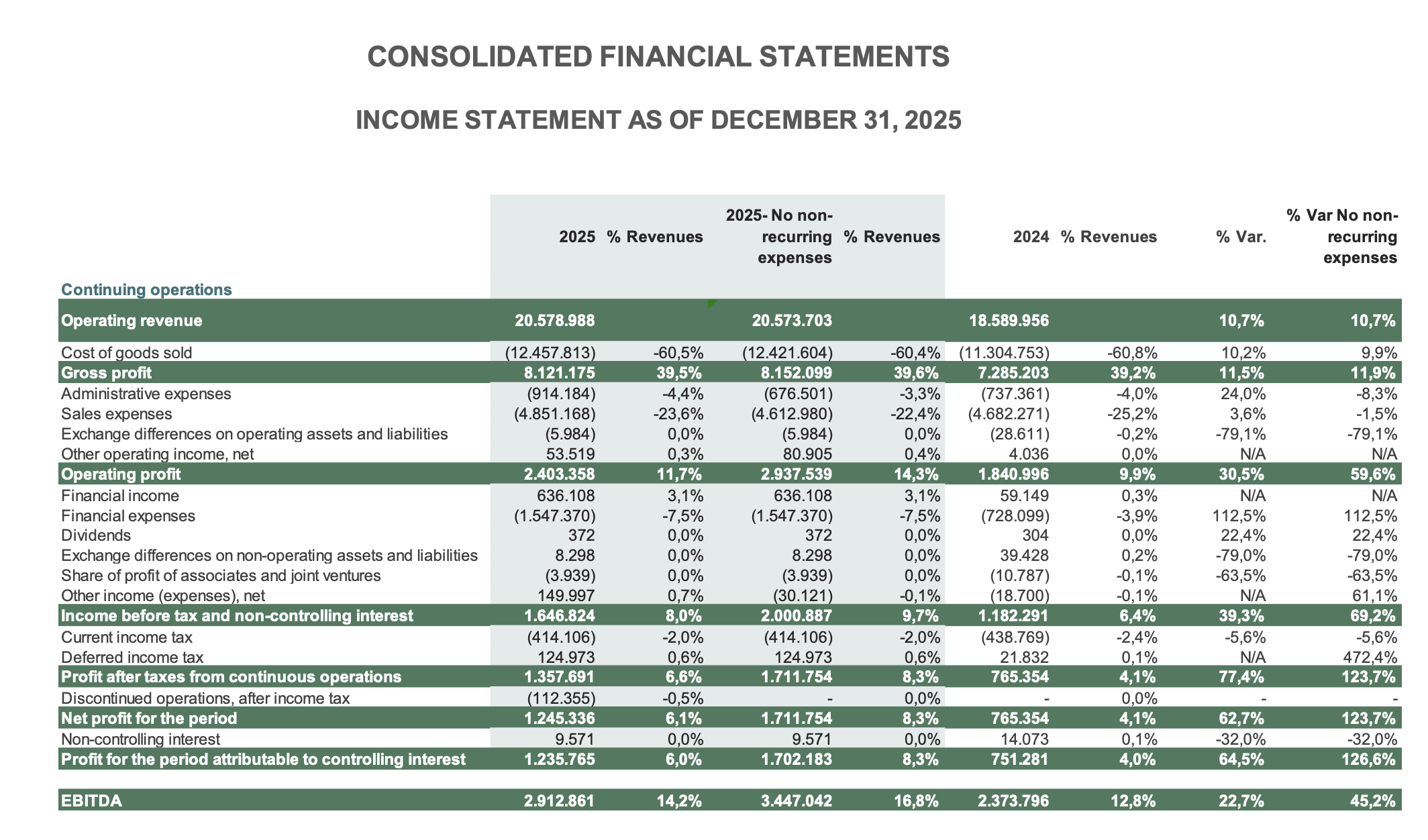

Consolidated Financial Results as of December 31, 2025

During 2025, Grupo Nutresa reported sales of COP 20.6 trillion, 10.7% higher than those reported in 2024. Key factors contributing to this growth include: (i) regional geographic diversification, (ii) the strength of its brands and leading market positions, and (iii) the service provided by its distribution network.

The strength of these results was supported by positive sales growth both in Colombia and internationally.

Sales by Geography and Business Units

International Performance

Sales from international platforms totaled COP 8.3 trillion, which marks an 11.9% rise and constitutes 40.4% of the total sales. When measured in US dollars, this revenue saw a significant 31.3% jump, reaching USD 2.2 trillion.

International expansion was robust across all major operating regions, driven by the performance of the Coffee (+56.6%), Chocolate (+50.1%), and Biscuits (+25.2%) businesses.

Local Performance

Colombian sales reached COP 12.3 trillion, marking a 9.9% increase compared to the previous year and contributing 59.6% to the Group's total sales. This result was driven by consistent growth across all eight of the Group's main business units. The Coffee business unit achieved the highest growth at +29%, followed by Ice Cream (+12%), Biscuits (+9.3%), and Chocolates (+9.2%).

Profitability and Net Income

The strong business performance during 2025, coupled with the cost and expense optimization strategy implemented throughout the year, resulted in a considerable expansion of the Group's margins.

In terms of profitability, EBITDA adjusted for non-recurring expenses reached COP 3.45 trillion, with a margin of 16.8%. During Q4, EBITDA adjusted for non-recurring expenses was COP 1.02 trillion, with a margin of 19.3%.

During the transformation process carried out in 2025, Grupo Nutresa incurred COP 534 billion in non-recurring restructuring expenses. Reported EBITDA, including these expenses, was COP 2.9 trillion.

To summarize the financial results, the Group's adjusted net income, after all the aforementioned elements, increased by 126.6% to COP 1.7 trillion. After including non-recurring expenses, the net income was at COP 1.2 trillion.

According to Jaime Gilinski, President of Grupo Nutresa, the Company's 2025 financial results highlight the strength of its corporate capabilities and the successful execution of its sustainable profitability strategy. This strategy involves transforming the business model to be more efficient, agile, and relevant to consumers.

Looking ahead to 2026, the Company remains committed to profitable growth, expanding its market presence, and intensifying its efforts to optimize costs and expenses, all aimed at generating sustainable long-term value.

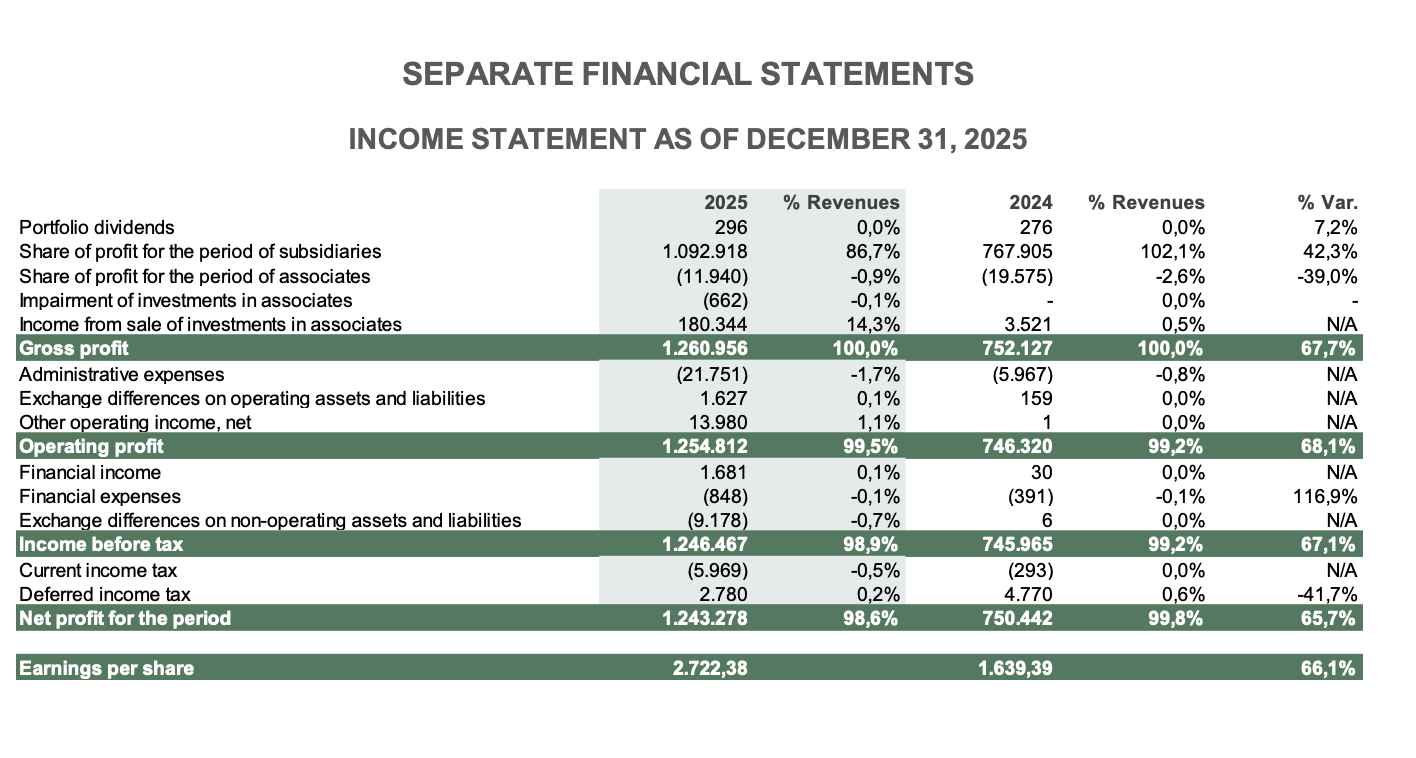

Separate Financial Statements

The separate financial statements of Grupo Nutresa S.A. report net operating income of COP 1,260.956 billion, of which COP 1,080.316 billion corresponds to profit from the equity method of investments in food companies; COP 296 million to dividends from the investment portfolio; and COP 180.344 million to income from the sale of investments. Net income is COP 1,243.278 billion.

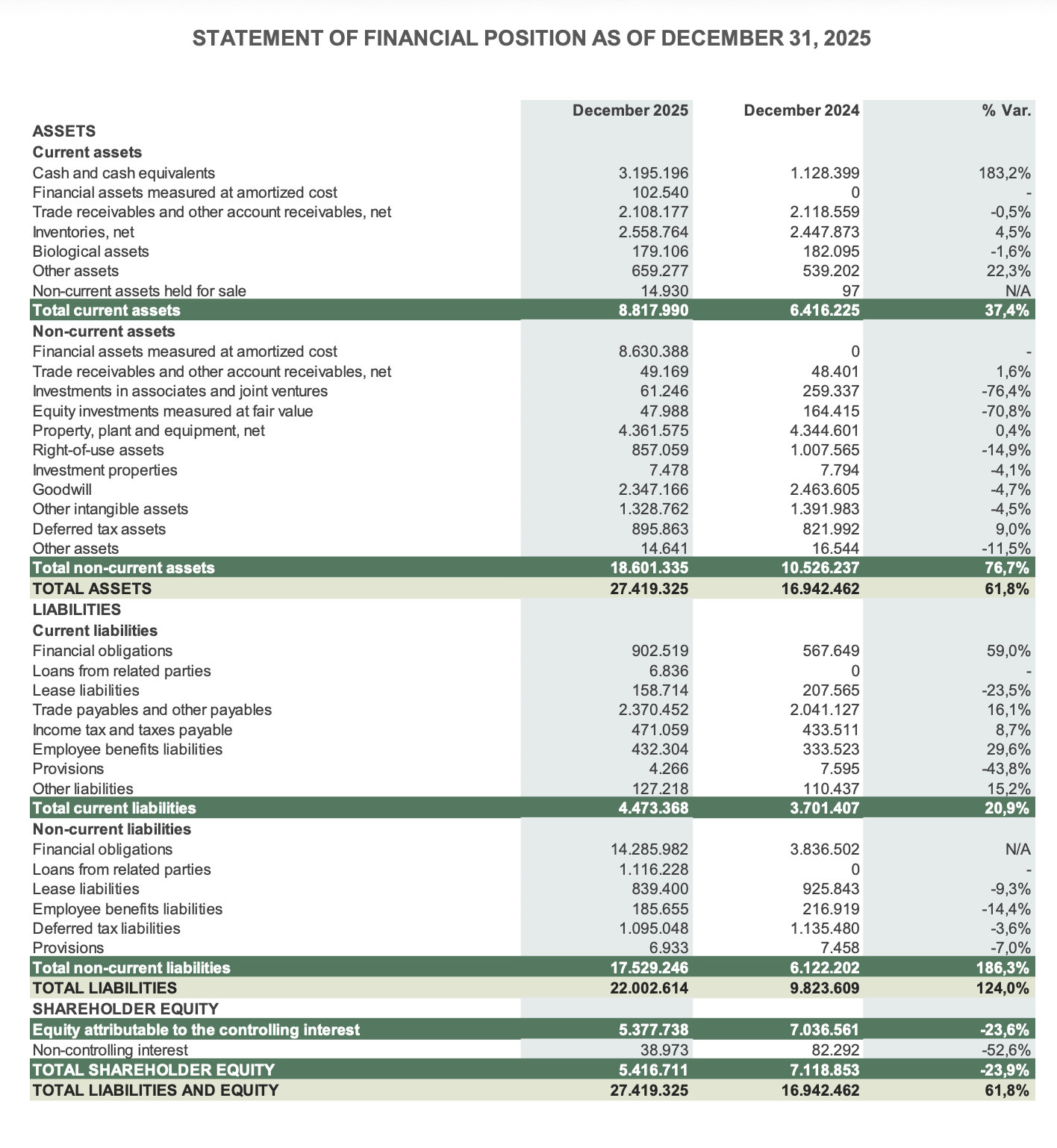

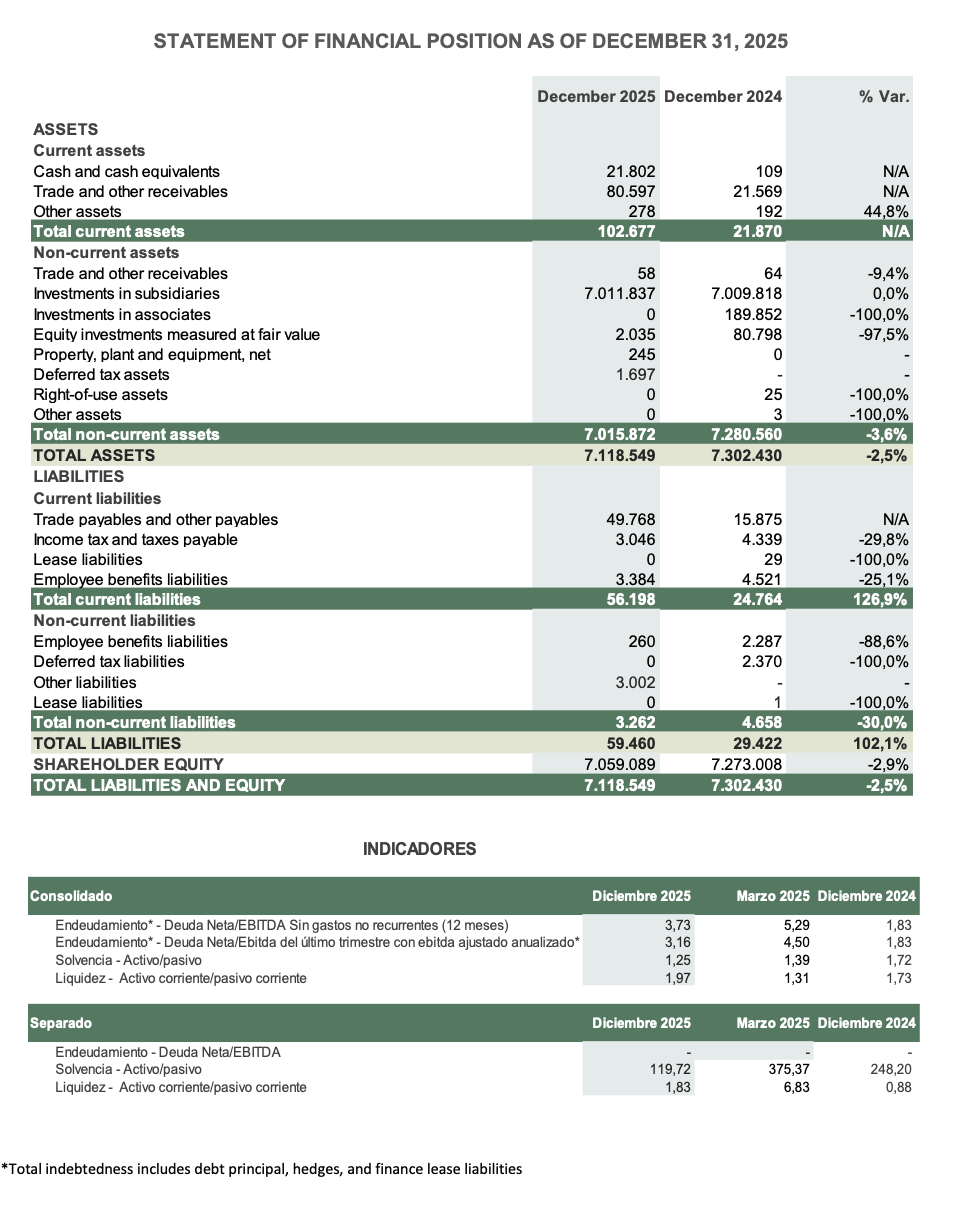

The consolidated and separate financial statements, the statement of financial position as of December 31, 2025, and related financial indicators form an integral part of this press release.

CONTACT:

CAMILA REY

Directora de Cuentas

camila.rey@publicisgroupe.com

SOURCE: Grupo Nutresa SA

Related Documents:

- Grupo Nutresa - Comunicado 4Q25

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/food-and-beverage-products/during-2025-grupo-nutresa-recorded-sales-of-cop-20.6-trillion-and-an-adj-1139405