2025 was a stable year for Catena. Profit from property management increased to SEK 1,613 million, rental income increased by 21 percent and the occupancy rate remained high. Catena ended the year by announcing a portfolio acquisition, enabling Catena to enter Finland and further strengthen its positions in Sweden and Denmark.

20 February 2025, 8.00 a.m. CET

- Rental income increased by 21 percent to SEK 2,651 million (2,193).

- Net operating surplus increased by 23 percent to SEK 2,198 million (1,789).

- Profit from property management increased by 28 percent to SEK 1,613 million (1,261).

- Earnings per share from property management increased by 18 percent to SEK 26.72 (22.59).

- EPRA Earnings per share totalled SEK 25.62 (21.33).

- The change in the value of properties amounted to SEK 482 million (131).

- Profit for the year increased to SEK 1,644 million (1,080), corresponding to earnings per share of SEK 27.24 (19.36).

- EPRA NRV Long-term net asset value per share increased to SEK 445.89 (424.92).

- A total of 73 percent of lettable area, corresponding to 2,303 thousand m², is environmentally certified.

- The Board of Directors proposes a dividend of SEK 9.50 (9.00) per share, corresponding to an increase of 5.6 percent, be paid out in two instalments, with SEK 4.75 per share being paid on each occasion.

occasion.

Catena's CEO Jörgen Eriksson comments on the year-end report:

"The letter of intent regarding the acquisition of a Nordic property portfolio, which was announced in December 2025, has, after the end of the period, resulted in Catena's largest acquisition to date. The transaction not only entails the addition of modern, high-quality properties to our portfolio, but also enables us to welcome a number of reputable customers operating their businesses within these facilities. Catena is also making its entry into Finland and further strengthening its position in the Nordic logistics property market."

"I am proud of the perseverance and commitment shown by Catena's employees. With clear objectives and a long-term perspective, we have laid a solid foundation which equips us well and motivates us for the opportunities that 2026 will bring."

At 10.00 a.m. on February 20, a presentation will commence for the year-end report for January-December 2025. The presentation will be broadcasted live and participants may access the event via live audiocast and teleconference through the following link: https://investorcaller.com/events/catena/catena-q4-report-2025

To participate in the event, attendees are required to register. To join the Q&A session, participants must dial in to the teleconference. After registering, they will receive a dial-in number, a conference ID, and a personal user ID to access the conference. Questions can be submitted either verbally via the teleconference line or in writing through the audiocast.

For further information, please contact

Jörgen Eriksson, CEO, Tel. + 46 730-70 22 42, jorgen.eriksson@catena.se

Magnus Thagg, CFO, Tel. + 46 70-425 90 33 magnus.thagg@catena.se

Follow us: catena.se / LinkedIn

This information is such that Catena AB (publ) is obliged to publish under the EU Market Abuse Regulation (EU nr 596/2014) and the Swedish Securities Markets Act (2007:528). The information was provided by the contact persons mentioned in this press release, for publication at the time stated above.

About Catena

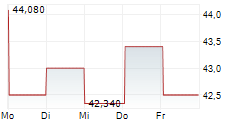

Catena is a listed property company that sustainably and through collaboration develops and durably manages efficient logistics facilities. Its strategically located properties supply the Scandinavian metropolitan areas and are adapted for both current and future goods flows. The overarching objective is to generate strong cash flow from operating activities to enable sustainable growth and stable returns. As of 31 December 2025, the properties had a total value of SEK 44,473 million. Catena's shares are traded on NASDAQ Stockholm, Large Cap.