NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESSWIRE / October 3, 2023 / Zimtu Capital Corp. (TSXV:ZC)(FSE:ZCT1) (the "Company" or "Zimtu") announces that it has entered into an agreement with Todd River Resources (ASX:TRT) ("Todd River") to sell thirty-seven (37) mineral claims located approximately 250 kms northeast of Yellowknife, Northwest Territories (NWT) collectively known as the Munn Lake properties (the "Halo-Yuri Lithium Project"). Zimtu will receive a cash payment of $80,000 in addition to 32,240,000 shares of Todd River Resources for the transaction. Zimtu will retain a 1% net smelter returns royalty (NSR) on all metals and minerals and a 1% gross overriding royalty (GOR) on Lithium and/or Diamond production from 33 of the 37 mineral claims, which constitute the Halo Property.

Halo-Yuri Lithium Project

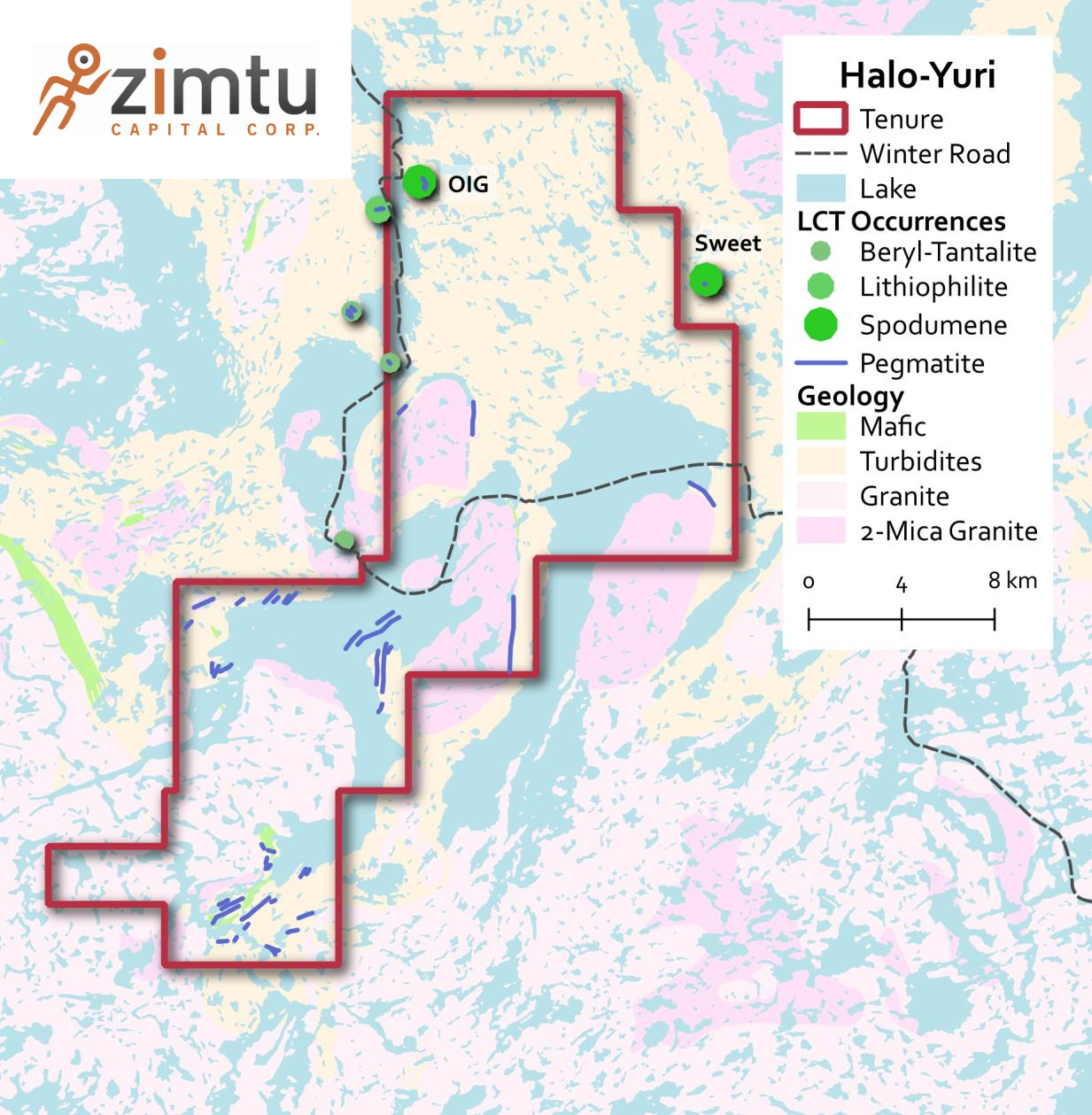

The Halo-Yuri Lithium Project covers approximately 450 square kilometers and comprises 37 contiguous claims. It is located approximately 250 kms northeast of Yellowknife on the Gahcho Kue annual winter road which provides access for exploration programs and is within a few hundred meters of the 'OIG' spodumene occurrence. Historically, exploration on the project has focused on diamonds with little or no previous work on lithium bearing pegmatites albeit there is documented spodumene (Li bearing mineral) bearing pegmatites with numerous unexplored targets (Figure 4).

Approximately 40 kilometers to the northeast of the Halo-Yuri Lithium Project is the Alymer Lake pegmatite field that contains both the Big Bird Lithium Pegmatite (1,280m in strike with 34m @ 1.24% Li2O in drilling) and the Curlew Lithium Pegmatite (400m strike length and 14.8m @ 1.72% Li2O in drilling). No assurances can be given that a similar or any mineral resource estimate will be determined at the Halo-Yuri Lithium Project.

Historical work across the project by Southern Era noted that most outcrop occurrences on the property consisted of various types of granitoids, metasediments and pegmatites with large NW-SE trending pegmatites of the MacKenzie Dyke Swarm crosscutting the property.

Spodumene is mapped at the 'OIG' pegmatites in the northwest of the project, and at the 'Sweet' pegmatite which is located a few hundred meters to the east of the project. The OIG pegmatites are described in a 1991 Master's thesis by Paul Tomascak submitted to the University of Manitoba which states "The four dikes of this series all contain spodumene and little K-feldspar, although OIG-4 is largely aplitic and the spodumene is not as coarse as it is in all other dikes of the series. Despite the presence of extensive spodumene, dikes are poorly zoned. Dikes are elongated, in general striking north south. Contact relations are incomplete, but most dikes appear concordant with metasediment schistosity. Lengths of dikes range from 6 to 18 m. Texturally and mineralogically these dikes appear to belong to Cerny's (1982) albite-spodumene type, bearing similarities to the King's Mountain pegmatites of North Carolina, U.S.A. (Kesler, 1976)."

Furthermore, Tomascak goes on to say "OIG-1, 2, 3: These dikes are spodumene-rich and poorly zoned. They consist of a random assemblage of 0.5-4.0 cm spodumene + quartz + plagioclase (usually cleavelandite) ±muscovite ±K-feldspar (some megacrysts up to 5 cm). Randomly distributed pods of blocky spodumene + K-feldspar ±cleavelandite also are present in these dikes. Aside from spodumene they remarkably lack other rare-element minerals.

OIG-4: This dike is much smaller than the others and appears extensively metasomatized. It contains a near-homogeneous and relatively fine-grained assemblage of cleavelandite + spodumene +muscovite+ quartz."

High resolution satellite-based targeting and mapping will be utilized to filter out high priority areas prior to undertaking detailed field work. A field program is proposed to start in fall of 2023.

Private Placement Update

The Company announces that it does not intend to proceed at this time with the third tranche of its non-brokered private placement (the "Offering") as previously announced in its News Releases of March 14, 2023, May 2, 2023, May 16, 2023, June 16, 2023 and July 17, 2023, for the issuance of up to 18,750,000 units (each, a "Unit") at a price of $0.08 per Unit for gross proceeds of up to $1,500,000.

On May 2, 2023, the Company closed the first tranche of the Offering pursuant to which it sold an aggregate of 13,759,042 Units for gross proceeds of $1,100,723.36. On July 17, 2023, the Company closed a second tranche of the Offering pursuant to which it sold an aggregate of 2,312,500 Units for gross proceeds of $185,000. Each Unit consists of one common share in the capital of the Company (each, a "Share") and one non-transferable share purchase warrant (each, a "Warrant"). Each Warrant is exercisable into one additional Share (a "Warrant Share") at a price of $0.10 per Warrant Share for a period of three years from the closing date.

National Instrument 43-101 Disclosure

Nicholas Rodway, P.Geo, (License #46541) (Permit to Practice# 100359) is a qualified person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects. Mr. Rodway has reviewed and approved the technical content in this release.

About Todd River Resources

Todd River Resources (ASX:TRT) is an Australian-based resources company that is focused on critical minerals that are essential for the future. The Company is in the process of acquiring several lithium focused projects in Canada and continues to own a base metal resource at its Mt. Hardy Project in the Northern Territory as well as several exciting Ni-Cu-PGE and base metal projects in Western Australia.

With a strong management team and strong financial position, Todd River is well placed to pursue additional critical mineral opportunities across Canada and Australia.

About Zimtu Capital

Zimtu Capital Corp. is a public investment issuer that aspires to achieve long-term capital appreciation for its shareholders. Zimtu Capital companies may operate in the fields of mineral exploration, mining, technology, life sciences or investment. The Company trades on the TSX Venture Exchange under the symbol "ZC" and Frankfurt under symbol "ZCT1". For more information visit: www.zimtu.com.

On Behalf of the Board of Directors

ZIMTU CAPITAL CORP.

"Sean Charland"

Sean Charland

President & Director

Tel: 604.681.1568

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Zimtu Capital Corp.

View source version on accesswire.com:https://www.accesswire.com/789691/zimtu-capital-announces-property-transaction