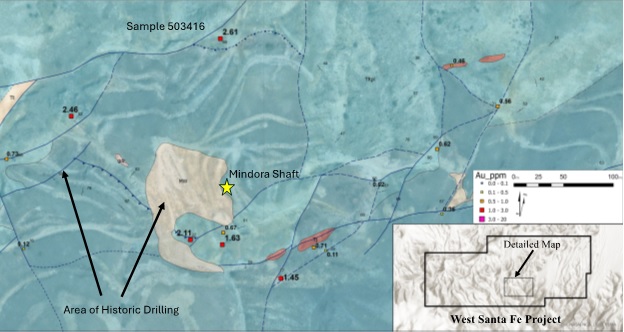

TORONTO, ON / ACCESSWIRE / February 20, 2024 / Lahontan Gold Corp (TSXV:LG),(OTCQB:LGCXF) (the "Company" or "Lahontan"), is pleased to announce the results from rock-chip sampling and geologic mapping at its 19.7 km2 West Santa Fe project ("West Santa Fe"). West Santa Fe is located only 13 km from the Company's flagship Santa Fe Mine project in mining friendly Nevada's Walker Lane. New geologic mapping and sampling have identified high-grade gold and silver mineralization in area north of the historic Mindora shaft with individual samples containing up to 2.61 g/t gold and 899 g/t silver (14.60 g/t Au Eq, please see Table, Map and Photo below). Samples range in value from 0.02 to 2.61 g/t gold and 0.7 to 899 g/t silver, and average 1.97 g/t Au Eq.

Eleven surficial rock chip samples were collected in an area proximal to the historic Mindora shaft area in order to further expand potential drill targets and better understand distribution of epithermal gold and silver mineralization at the surface. Previous drilling in this area defined a large oxide gold and silver system that remains open along strike and at depth. The highest grades, 2.61 g/t gold and 899 g/t silver in sample 503416, come from a gossan rich fault gouge where a major northeast striking high-angle fault intersects an older low-angle thrust fault (please see map above and photo below). These intersections of multiple fault sets and the intersection of faults with fold axes are proving to be crucial controls on gold and silver mineralization at West Santa Fe.

Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: "The work by our geologic team at West Santa Fe has proven vital in understanding the controls to gold and silver mineralization at West Santa Fe. High grade gold and silver seem to be associated with fault intersections and provide excellent drill targets for expanding the footprint of this already very large hydrothermal system. We will use this data to design Lahontan's Phase One drill program with the goal of defining a maiden Mineral Resource Estimate for West Santa Fe in 2024".

Sample ID | Au (g/t) | Ag (g/t) | Au Eq (g/t) | Description |

503407 | 0.56 | 9.8 | 0.69 | Silicified breccia |

503408 | 0.71 | 22.0 | 1.00 | Gossan fault gouge |

503409 | 0.02 | 0.7 | 0.03 | Gossan fault gouge |

503410 | 0.62 | 36.9 | 1.11 | Clay fault breccia |

503411 | 0.36 | 85.1 | 1.49 | Clay fault gouge |

503412 | 0.73 | 35.1 | 1.20 | Gossan fault gouge |

503413 | 0.14 | 10.1 | 0.27 | Gossan fault gouge |

503414 | 0.11 | 2.0 | 0.14 | Silicified breccia |

503415 | 1.45 | 44.9 | 2.05 | Fault gouge, vein quartz |

503416 | 2.61 | 899.0 | 14.60 | Silicified breccia, gossan |

503417 | 0.12 | 8.1 | 0.23 | Clay fault gouge |

503418 | 0.45 | 24.9 | 0.78 | Red jasperoid |

Average: | 0.66 | 98.2 | 1.97 |

Results from rock-chip sampling at the West Santa Fe Project. Au Eq equals (Au g/t) + ((Ag g/t)/75). Metallurgical recovery has not been factored as insufficient test-work is available to determine potential Ag recoveries.

Sampling protocols and QA/QC

Lahontan geologists collect grab samples based upon mappable geologic features. Samples are approximately 1-2 kilograms in weight. After collection, the samples are sealed, labeled and stored in a secure area prior to shipment to a certified assay laboratory. Analyses conducted include Au analysis using 30-gram fire assay with ICP finish, along with a 37-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Blanks and standards are inserted by the laboratory approximately every 15 samples, and duplicate samples are created and analyzed approximately every 10 samples.

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 26.4 km2 Santa Fe Mine, had past production of 345,000 ounces of gold and 711,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Bureau of Mines and Geology, 1995). The Santa Fe Mine has Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,112,000 oz Au Eq (grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 544,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). The Company will continue to aggressively explore Santa Fe during 2023 and begin the process of evaluating development scenarios to bring the Santa Fe Mine back into production. Anthony Gesualdo, CPG, Consulting Geologist to Lahontan Gold Corp., is the Qualified Person for the Company and approved the technical content of this news release. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the Santa Fe Project Technical Report, Authors: Trevor Rabb and Darcy Baker, P. Geos. Effective Date: December 7, 2022, Report Date: March 2, 2023. The Technical Report is available on the Company's website and SEDAR.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a varietyof risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

SOURCE: Lahontan Gold Corp.

View the original press release on accesswire.com