Lose It! AI-Powered Voice (Say It!) and Photo (Snap It!) Food Logging and Meal Tracking Features Drive Better Weight Loss Outcomes, Faster Meal Logging, and Increased Engagement

BOSTON, MA / ACCESS Newswire / April 22, 2025 / Lose It!, a leading health and nutrition app trusted by over 57 million members, today released data on the efficacy of two groundbreaking, AI-powered features: voice and photo logging, both designed to simplify meal tracking and make it faster and more accurate than ever before. With these revolutionary tools, Lose It! is making it easier to lose weight and heighten nutritional mindfulness. Now, to log food in Lose It!, you can just: Snap It!, Say It!, Scan It!, and Log It!.

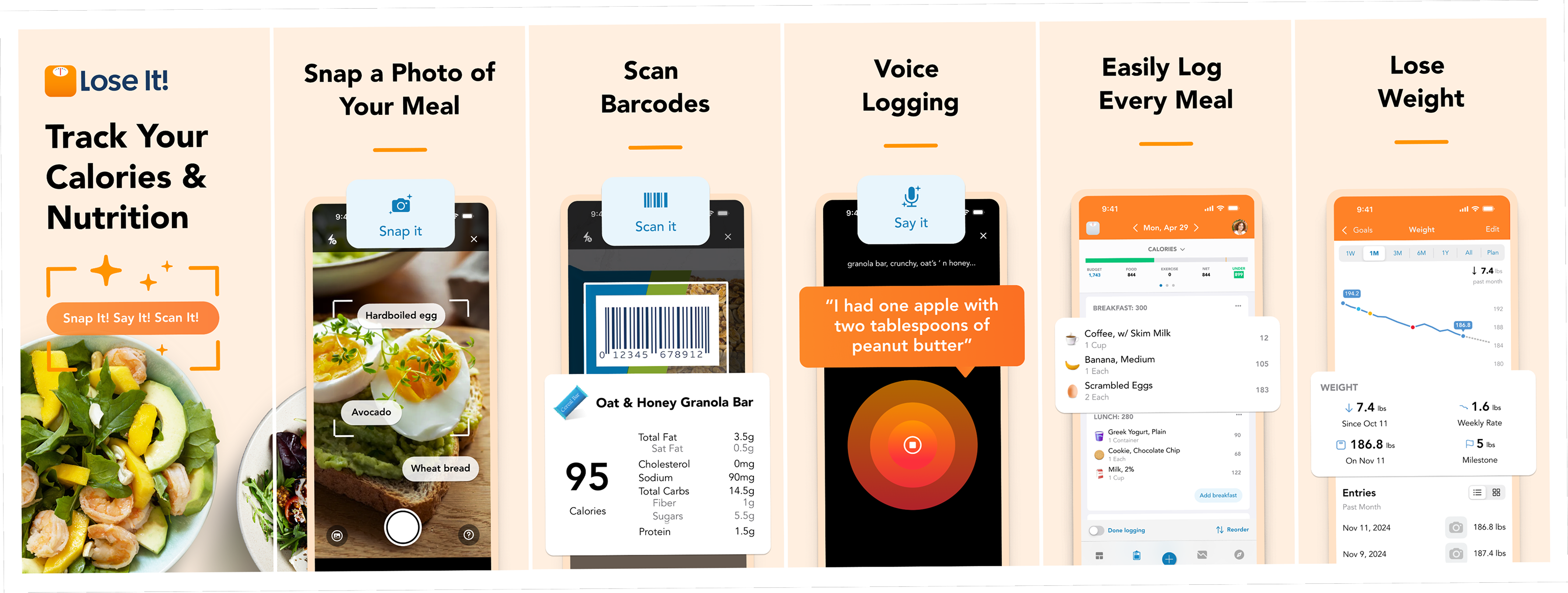

App Store screenshots explaining the Snap It, Scan It, Say It, AI features

Since their introduction, voice and photo logging have revolutionized member behavior and increased plan adherence. Say It! voice logging empowers members to simply describe their food to the app, which immediately matches their selections with the most appropriate food from the database of over 63 million food items- a food database that is one of the largest, most complete, and most accurate in the world. Snap It! leverages the same food-matching functionality, allowing members to fully and accurately log their meals by simply taking a picture.

The use of these AI-powered logging tools has had a dramatic impact on Lose It! Member success:

6% More Weight Loss

3.5x Faster Meal Logging

Twice as Many Foods Logged

"Journaling is a foundational tool for behavior change because it brings more awareness and mindfulness to food choices", says Anna Smith, MS, RDN, LDN, Chief Nutrition Officer for Lose It!, adding that "The biggest challenge has always been making tracking easy enough to stick with every day. To date, technology has lacked speed and accuracy. But Lose It!'s Snap It, Say It, and Scan It features are changing the game. These tools not only help our members track faster and more accurately, but they're also helping people track more often. These features address the biggest hurdles many face in building lifelong, consistent habits."

"Our mission at Lose It! has always been to make weight loss accessible, effective, and sustainable. By leveraging the power of AI, we're giving our members a simple, fast, and highly accurate way to track their food and achieve their goals," said Paul Apollo, Managing Director of FitNow, Inc, developer of the Lose It! app. "These new tools are not only helping people log their meals more efficiently but are also leading to better outcomes. Our team has consistently led the way in technological innovation, and it's exciting to see the profound impact these tools have had in improving the health of millions."

A Long-Term Commitment to Innovation

The primary technology behind Snap It! has been around for several years, but with the introduction of the latest Snap It! model, the technology is able to identify all foods of a meal in a single snapshot and map those foods to frequently logged items by the member.

"Our breakthrough technology combines visual recognition with advanced artificial intelligence to identify foods with remarkable speed and accuracy," says Will Lowe, PhD, Chief Data Scientist of FitNow, Inc and Senior VP of AI Product Innovation at Everyday Health Group. "The system understands not just what's in your photo, but also the context of your meal - from individual ingredients to complete dishes. This innovative approach has helped us achieve new levels of precision in automated food logging. The success of these new AI tools is just the beginning, as we are continually exploring even more ways to integrate AI to support members in their healthy living journeys."

Snap It! and Say It! voice logging are available for Lose It! Free Members to try before they buy Lose It! Premium. For more information on the new AI-powered tools or to download Lose It!, visit www.loseit.com.

About FitNow, Inc.

FitNow, Inc. is a leading producer of fitness and wellness mobile applications leveraging nearly two decades of real world data. Their flagship product, the Lose It! app, one of the first mobile applications on the Apple App Store in 2008, consistently ranks as one of the top weight loss apps in the country. It is one of the most popular state-of-the-art food, meal, nutrient, fitness and weight-tracking apps for healthy weight management and success.* Lose It! has helped over 57 million members lose over 150 million pounds. FitNow's 63 million food and fitness database powers its suite of health and wellness products. FitNow, Inc. also produces the Challenges app, a team wellness product that gamifies healthy eating and exercise behaviors, and the Cleveland Clinic Diet app, a US News and World Report 2025 Best Diet Overall and Best Heart-Healthy Diet. FitNow, Inc. is part of the Everyday Health Group, a division of Ziff Davis, Inc. (NASDAQ: ZD).

* https://pubmed.ncbi.nlm.nih.gov/27301853/

About Everyday Health Group

Everyday Health Group (EHG) is a recognized leader in patient and provider education, attracting an engaged audience of over 71 million health consumers and over 890,000 U.S. practicing physicians and clinicians to its premier health and wellness digital properties. Our mission is to drive better clinical and health outcomes through decision-making informed by highly relevant information, data and analytics. We empower healthcare providers and consumers with trusted content and services delivered through the Everyday Health Group's world-class brands, including: Everyday Health®, BabyCenter®, DailyOM®, Lose It!®, What to Expect®, MedPage Today®, Health eCareers®, PRIME® Education, and Castle Connolly Top Doctors®.

Everyday Health Group is a division of Ziff Davis, Inc. (NASDAQ: ZD), and is headquartered in New York City.

Contact Information

Carmen Tong

Marketing and Communications Manager

press@loseit.com

Related Video

https://www.youtube.com/watch?v=pROgC1n1hfs

SOURCE: FitNow, Inc

Related Images