Foussemagne (France), April 14, 2025 - 7:30 am CEST - McPhy Energy, manufacturer of alkaline electrolyzers ("McPhy"), announces the opening, by decision of the President of the Tribunal de Commerce of Belfort dated April 10, 2025, of a conciliation procedure and the appointment of SCP Abitbol & Rousselet, represented by Maître Joanna Rousselet, as conciliator.

The opening of these proceedings was driven by the Company's current financial position, with its cash runway at the end of June 20251 and to strengthen its chances of finding a new partner as soon as possible.

In this context, McPhy, together with the conciliator, has decided to initiate, in parallel with the ongoing search for in bonis2 offers, a call for tenders for takeover as a sale plan with a view to the implementation, if necessary, of a pre-pack sale, in order to have the most appropriate legal framework to preserve the fundamentals of the Company. The pre-pack sale offers a framework for preparing a (total or partial) sale of the Company's assets and activities while preserving the best interests of the Company. In the event of a takeover as a disposal plan, McPhy Energy, including its assets and activities not taken over, could be subject to judicial liquidation procedure resulting in the delisting of McPhy's shares, the anticipated residual value of which would then be minimal or nil.

McPhy has chosen to make this information, which is usually confidential, public in order to unite employees, shareholders and stakeholders around this process and thus maximize its chances of finding new partners.

In this regard, McPhy announces that it has already received a first expression of interest from a European industrial player which, if confirmed, will be examined as part of the above-mentioned tender procedure.

McPhy and the conciliator inform that the deadline for the submission of offers is set for May 9, 2025 at noon. The market will be informed of any developments in the situation.

ABOUT MCPHY

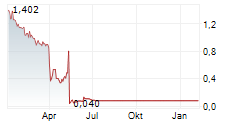

Specialized in hydrogen production equipment, McPhy is contributing to the global deployment of low-carbon hydrogen as a solution for energy transition. With its complete range of products dedicated to the industrial, mobility and energy sectors, McPhy offers its customers turnkey solutions adapted to their applications in industrial raw material supply, recharging of fuel cell electric vehicles or storage and recovery of electricity surplus based on renewable sources. As designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production centers in Europe (France, Italy, Germany). Its international subsidiaries provide broad commercial coverage for its innovative hydrogen solutions. McPhy Energy is listed on Euronext Growth Paris (ISIN code: FR0011742329, ticker: ALMCP).

CONTACTS

| Investor Relations NewCap Théo Martin/ Aurélie Manavarere T. +33 (0)1 44 71 94 94 mcphy@newcap.eu | Press Relations McPhy Maïté de Laboulaye maite.de-la-boulaye@mcphy.com T. +33 (0) 6 98 85 86 57 |

Follow us on

@McPhyEnergy

1 Possibly, end of 3rd quarter 2025, subject to completion of certain hypothesis. For further details, please refer to press release dated March 31, 2025 "McPhy 2024 Annual Results and Update on Financial Situation".

2 A Latin phrase that legally characterizes the situation of a person who has full rights of use and disposal that the law confers on him or her over his or her property.