Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250416198393/en/

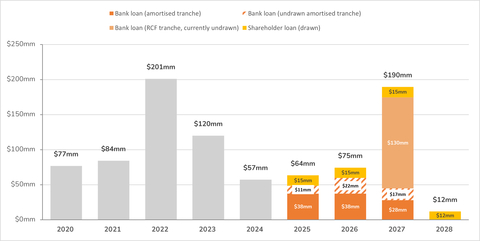

Debt repayment profile after finalisation of the accordion on 10 April 2025

Maurel Prom(Paris:MAU):

- M&P working interest production in Q1 2025: 38,534 boepd, up 6% on Q4 2024 and higher for each of the Group's assets

- M&P working interest production of 15,684 bopd in Gabon, up 6%

- M&P working interest production of 4,478 bopd in Angola, up 3%

- M&P working interest gas production of 60.8 mmcfd in Tanzania, up 5%

- M&P Iberoamerica working interest oil production of 8,236 bopd in Venezuela, up 9%

- Valued production of $136 million, up 3% compared with Q4 2024

- The sale price of oil was $74.9/bbl for the period, stable compared with Q4 2024 ($74.2/bbl)

- Contribution to sales of $4 million for service activities

- Sales of $64 million, down sharply due to lifting imbalances (negative impact of $76 million, with only one cargo sold over the period, in Angola) and the absence of oil trading

- Completion of the acquisition of the 40% stake in the Sinu-9 gas permit in Colombia expected by June

- Application filed with the Colombian National Hydrocarbon Agency ("ANH") for approval of the transaction

- Balance of $130 million to be settled upon completion of the transaction (subject to adjustment from the economic effective date of 1 February 2025), following payment of a $20 million deposit at the end of February

- Sinu-9 currently produces around 12 mmcfd (gross) as part of the production test, and is expected to see its production capacity increase over 40 mmcfd (gross) by the beginning of Q3 2025

- Excellent financial position and available liquidity of $377 million enabling it to balance implementation of the growth strategy with shareholder returns

- Positive net cash position of $50 million at the end of March ($197 million in cash, $147 million in debt)

- Available liquidity of $377 million thanks to the signature on 11 April of an accordion of $113 million on the existing bank loan under the same favourable conditions

- Proposed dividend of €0.33 per share (for a total amount of approximately $70 million) to be put to the vote at M&P's annual general meeting on 27 May 2025 for payment in August 2025

Key indicators for Q1 2025

Q1

| Q2

| Q3

| Q4

| Q1 2025 | Change Q1 2025 vs. | |||||||

Q1 2024 | Q4 2024 | |||||||||||

M&P working interest production | ||||||||||||

Gabon (oil) | bopd | 15,499 | 15,553 | 16,437 | 14,838 | 15,684 | +1% | +6% | ||||

Angola (oil) | bopd | 4,634 | 4,621 | 3,592 | 4,369 | 4,478 | -3% | +3% | ||||

Tanzania (gas) | mmcfd | 76.9 | 61.7 | 49.2 | 58.2 | 60.8 | -21% | +5% | ||||

Total interests in consolidated entities | boepd | 32,953 | 30,450 | 28,226 | 28,904 | 30,298 | -8% | +5% | ||||

Venezuela (oil) | bopd | 5,353 | 5,472 | 5,993 | 7,558 | 8,236 | +54% | +9% | ||||

Total production | boepd | 38,305 | 35,922 | 34,219 | 36,461 | 38,534 | +1% | +6% | ||||

Average sale price | ||||||||||||

Oil | $/bbl | 84.3 | 83.6 | 81.5 | 74.2 | 74.9 | -11% | +1% | ||||

Gas | $/mmBtu | 3.91 | 3.89 | 3.91 | 3.90 | 4.02 | +3% | +3% | ||||

Sales | ||||||||||||

Gabon | $mm | 109 | 115 | 118 | 95 | 98 | -10% | +3% | ||||

Angola | $mm | 30 | 30 | 23 | 25 | 26 | -11% | +4% | ||||

Tanzania | $mm | 14 | 12 | 11 | 12 | 11 | -17% | -3% | ||||

Valued production | $mm | 153 | 157 | 151 | 132 | 136 | -11% | +3% | ||||

Service activities | $mm | 9 | 10 | 10 | 10 | 4 | ||||||

Trading of third-party oil | $mm | 39 | 38 | 1 | 46 | |||||||

Restatement for lifting imbalances inventory revaluation | $mm | 11 | -6 | -15 | 61 | -76 | ||||||

Consolidated sales | $mm | 212 | 200 | 147 | 249 | 64 | -70% | -74% | ||||

M&P's total working interest production in Q1 2025 amounted to 38,534 boepd, at its highest historical level and an increase of 6% compared to Q4 2024.

M&P's consolidated working interest production in Q1 2025 amounted to 30,298 boepd, up 5% on Q4 2024. The average sale price of oil was $74.9/bbl for the period, up by a slight 1% compared with Q4 2024 ($74.2/bbl).

The Group's valued production (income from production activities, excluding lifting imbalances and inventory revaluation) was $136 million in Q1 2025. The restatement of lifting imbalances, net of inventory revaluation, had a negative impact of $76 million. Only one cargo was sold during the period in Angola, but several liftings are expected in the second quarter in Gabon and Angola, starting in April.

After the integration of $4 million in income relating to service activities, consolidated sales for Q1 2025 came to $64 million.

Olivier de Langavant, Chief Executive Officer of M&P, said: "Thanks to our substantial liquidity of $377 million and a particularly low breakeven point (around $30 per barrel at Group level for operating cash flow), we are ideally positioned to continue developing sustainably, even in the event of a prolonged downturn in crude oil prices. We have the financial capacity to carry through the growth projects already underway, while continuing to actively search for new opportunities that are arising in a favourable M&A environment. In this context, our investment decision earlier this year in a major gas asset, uncorrelated to crude prices, further strengthens the resilience of our asset portfolio. Additionally, we are closely monitoring developments in Venezuela, where we continue our operations under the wind-down license granted to us until 27 May.

Production activities

Gabon

M&P working interest oil production (80%) on the Ezanga permit amounted to 15,684 bopd in Q1 2025, up 6% on Q4 2024.

Tanzania

M&P working interest gas production (60%) on the Mnazi Bay permit amounted to 60.8 mmcfd in Q1 2025, up 5% on Q4 2024.

Angola

M&P working interest production from Blocks 3/05 (20%) and 3/05A (26.7%) amounted to 4,478 bopd in Q1 2025, up 3% on Q4 2024.

Venezuela

M&P Iberoamerica working interest oil production (40%) on the Urdaneta Oeste field amounted to 8,236 bopd in Q1 2025, up 9% on Q4 2024.

One lifting of about a million barrels was carried out at the end of March. Another lifting of 600 thousand barrels has been allocated for April, and loading is expected to start in the next few days. Since the beginning of 2025, M&P has received $23 million in dividends (net of the 20% paid to M&P Iberoamerica's minority shareholder) thanks to the debt payment mechanism in place for Petroregional del Lago.

The Office of Foreign Assets Control ("OFAC") of the U.S. Department of the Treasury informed M&P on 28 March 2025 that it was revoking the specific license granted to it in May 2024 for its activities in Venezuela. As part of this decision, OFAC authorised M&P to carry out the necessary work to complete the operations covered by that license for a wind-down period valid until 27 May 2025. M&P remains actively in contact with the US authorities, which it met immediately after the recent announcements, and continues to monitor developments closely.

Information on the ongoing acquisition of a 40% stake in the Sinu-9 gas permit in Colombia

On 9 February 2025, M&P signed a definitive agreement with NG Energy International Corp. ("NG Energy"), for the acquisition of a 40% operating working interest in the Sinu-9 gas permit in Colombia for $150 million, with an economic effective date of 1 February 2025. M&P paid a deposit of $20 million at the end of February and the remainder will be paid on closing of the transaction, with an adjustment to reflect cash flows for the period between the economic effective date and closing.

Closing of the transaction remains subject to obtaining regulatory approvals, including the approval of the Colombian National Hydrocarbon Agency ("ANH"). These approvals are currently being examined and the conditions precedents to the acquisition are expected to be met by June.

M&P will have an option for a period of 12-months from completion to acquire an additional 5% interest in Sinu-9 from NG Energy under the same terms: consideration of $18.75 million, with the same economic effective date of 1 February 2025.

From an operational standpoint, a production test is currently ongoing with production of around 12 mmcfd (gross) following the commissioning of a mobile unit on the Brujo-1X platform in March. Initially and ahead of the next planned steps, production capacity is expected to be increased to over 40 mmcfd (gross) by the beginning of the third quarter of 2025 after the installation of equipment for the processing of condensates associated with gas production.

Financial position

The Group had a positive net cash position of $50 million at 31 March 2025 compared with $33 million at 31 December 2024. Its cash position was $197 million versus gross debt of $147 million, of which $94 million in bank loan and $53 million in shareholder loan. M&P repaid $13 million of gross debt in the first quarter of 2025 ($9 million of bank loan and $4 million of shareholder loan).

In order to fund its growth strategy, on 11 April 2025 M&P finalised an agreement on an accordion of $113 million on its existing bank loan. This includes a $50 million amortised tranche (with a repayment profile similar to the amortised portion of the existing bank loan) and a $63 million RCF (revolving credit facility) on top of the existing RCF of $67 million. The borrowing terms are similar to those of the existing loan, which matures in July 2027. A refinancing of this loan to extend its term is under review.

As a result, available bank liquidity amounts to $377 million (excluding the $100 million tranche of the available and undrawn shareholder loan), and includes:

- $197 million in cash;

- $50 million undrawn from the amortised loan (available until January 2026); and

- $130 million undrawn RCF (available until July 2027).

Debt structure at 31 March 2025 (pro forma finalisation of the accordion on 10 April 2025):

Rate | Maturity | Drawn amount | Available amount | Total | |

Bank loan amortised tranche | SOFR spread (0.11%) 2.00% | July 2027 | $94mm | $50mm | $144mm |

Bank loan RCF | SOFR spread (0.11%) 2.25% | July 2027 | $130mm | $130mm | |

Shareholder loan | SOFR 2.10% | July 2028 | $53mm | $100mm | $153mm |

Total debt | $147mm | $280mm | $427mm | ||

Cash | $197mm | ||||

Net cash | $50mm |

Glossary

Français | Anglais | ||

pieds cubes | pc | cf | cubic feet |

millions de pieds cubes par jour | Mpc/j | mmcfd | million cubic feet per day |

milliards de pieds cubes | Gpc | bcf | billion cubic feet |

baril | b | bbl | Barrel |

barils d'huile par jour | b/j | bopd | barrels of oil per day |

millions de barils | Mb | mmbbls | million barrels |

barils équivalent pétrole | bep | boe | barrels of oil equivalent |

barils équivalent pétrole par jour | bep/j | boepd | barrels of oil equivalent per day |

millions de barils équivalent pétrole | Mbep | mmboe | million barrels of oil equivalent |

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding the financial position, results, business and industrial strategy of Maurel Prom. By their very nature, forecasts involve risk and uncertainty insofar as they are based on events or circumstances which may or may not occur in the future. These forecasts are based on assumptions we believe to be reasonable, but which may prove to be incorrect and which depend on a number of risk factors, such as fluctuations in crude oil prices, changes in exchange rates, uncertainties related to the valuation of our oil reserves, actual rates of oil production and the related costs, operational problems, political stability, legislative or regulatory reforms, or even wars, terrorism and sabotage.

Maurel Prom is listed on Euronext Paris

SBF 120 CAC Mid 60 CAC Mid Small CAC All-Tradable PEA-PME and SRD eligible

Isin FR0000051070 Bloomberg MAU.FP Reuters MAUP.PA

View source version on businesswire.com: https://www.businesswire.com/news/home/20250416198393/en/

Contacts:

Maurel Prom

Shareholder relations

Tel.: +33 (0)1 53 83 16 45

ir@maureletprom.fr

NewCap

Investor/media relations

Tel.: +33 (0)1 44 71 98 53

maureletprom@newcap.eu