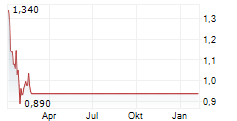

MANNHEIM, Germany, April 21, 2025 (GLOBE NEWSWIRE) -- Affimed N.V. (Nasdaq: AFMD), a clinical-stage immuno-oncology company committed to giving patients back their innate ability to fight cancer, announced today that it has received a written notice (the "Notice"), dated April 15, 2025, from the Listing Qualifications Department of The Nasdaq Stock Market LLC ("Nasdaq") indicating that, for the last thirty (30) consecutive business days, the bid price for the Company's common shares had closed below the minimum $1.00 per share requirement for continued listing on the Nasdaq under Nasdaq Listing Rule 5450(a)(1) (the "Minimum Bid Price Rule").

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided an initial period of 180 calendar days, or until October 13, 2025, to regain compliance. If the Company fails to regain compliance with the Minimum Bid Price Rule during this period, the Company may consider applying to transfer its securities from The Nasdaq Global Select Market to The Nasdaq Capital Market, provided that the Company meets the applicable market value of publicly held shares required for continued listing and all other applicable requirements for initial listing on The Nasdaq Capital Market (except for the bid price requirement). Such transfer would provide the Company with an additional 180 calendar days, or until April 13, 2025, to regain compliance. There can be no assurance that the Company would be eligible for the additional 180 calendar day compliance period, if applicable, or that the Nasdaq staff would grant the Company's request for continued listing.

The Notice has no immediate effect on the listing or trading of the Company's common shares.

The Company intends to monitor the bid price of its common shares and consider available options to regain compliance with the Minimum Bid Price Rule.

About Affimed N.V.

Affimed (Nasdaq: AFMD) is a clinical-stage immuno-oncology company committed to giving patients back their innate ability to fight cancer by actualizing the untapped potential of the innate immune system. The Company's innate cell engagers (ICE®) enable a tumor-targeted approach to recognize and kill a range of hematologic and solid tumors. ICE® are generated on the Company's proprietary ROCK® platform which predictably generates customized molecules that leverage the power of innate immune cells to destroy tumor cells. A number of ICE® molecules are in clinical development, being studied as mono- or combination therapy. Headquartered in Mannheim, Germany, Affimed is led by an experienced team of biotechnology and pharmaceutical leaders united by the bold vision to stop cancer from ever derailing patients' lives. For more about the Company's people, pipeline and partners, please visit: www.affimed.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as "anticipate," "believe," "could," "estimate," "expect," "goal," "intend," "look forward to," "may," "plan," "potential," "predict," "project," "should," "will," "would" and similar expressions. Forward-looking statements include, among other things, statements regarding the Company's compliance with the Minimum Bid Price Rule and listing or trading of the Company's common shares. Actual results may differ materially from the results anticipated by the Company's forward-looking statements due to certain risks, uncertainties and other factors described under the heading "Risk Factors" in the Company's filings with the Securities and Exchange Commission. Given these risks, uncertainties, and other factors, you should not place undue reliance on these forward-looking statements, and the Company assumes no obligation to update these forward-looking statements, even if new information becomes available in the future.

Investor Relations Contact

Alexander Fudukidis

Director, Investor Relations

E-Mail: a.fudukidis@affimed.com

Tel.: +1 (917) 436-8102

Media Contact

Mary Beth Sandin

Vice President, Marketing and Communications

E-Mail: m.sandin@affimed.com