Detection Technology Plc company announcement 24 April 2025 at 09:00 (EEST)

DETECTION TECHNOLOGY PLC BUSINESS REVIEW JANUARY-MARCH 2025

Detection Technology Q1 2025: Growth in medical

January-March 2025 highlights

- Net sales decreased by -2.0% to EUR 22.2 million (22.7)

- Net sales of Americas decreased by -3.9% to EUR 0.9 million (0.9)

- Net sales of APAC (Asia-Pacific) increased by 2.1% to EUR 16.0 million (15.6)

- Net sales of EMEIA (Europe, Middle East, India and Africa) decreased by -12.2% to EUR 5.4 million (6.2)

- Net sales of industrial applications increased by 4.2% to EUR 3.8 million (3.6)

- Net sales of medical applications increased by 13.7% to EUR 10.8 million (9.5)

- Net sales of security applications decreased by -20.0% to EUR 7.7 million (9.6)

- Operating profit (EBITA) was EUR 1.4 million (2.3)

- Operating margin (EBITA-%) was 6.3% of net sales (10.0%)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.)

Business outlook

Detection Technology expects its year-on-year total net sales to remain stable in Q2 and Q3 of 2025.

Detection Technology has refined its earlier estimate of double-digit total net sales growth for Q2 2025 (published on 6 February 2025) and now expects sales to be at the same level as in the comparison period. The main reasons for this are exchange rate changes and the postponement of security system deployments.

Geopolitical situation, new US import tariffs, U.S.-China relations, U.S.-EU relations, global economy, China's healthcare reform, price competition especially in China, the indirect impacts of the war in Ukraine, and events in the Middle East create uncertainty.

Detection Technology aims to increase its sales by at least 10% per annum and to achieve an operating margin (EBITA) of 15% in the medium term.

President and CEO, Hannu Martola:

"The Q1 outcome, in the big picture, was as expected, although exchange rate fluctuations impacted sales toward the end of the quarter. We were particularly pleased that our medical sales returned to growth - a turnaround we have been anticipating for a long time. There are signs that the demand backlog caused by China's anti-corruption campaign has begun to ease, and our APAC sales increased slightly as a result. Furthermore, it was encouraging to see significant growth in TFT (thin-film transistor) flat panel detector sales in industrial applications.

At the same time, demand for security applications remained sluggish, and the dip was bigger than anticipated. A delay in aviation CT (computed tomography) system installations in Europe, partly due to regulatory reasons related to the so-called 100 ml liquid rule, negatively affected EMEIA sales. We believe this is a short-term dip, as our customers have indicated that their order backlog is strong. Security application demand was also weaker than expected in the Americas. Sudden exchange rate changes at the end of the quarter led to a slight decline in our total net sales.

The drop in net sales, a less favourable sales mix compared to the reference period, and the timing of other income and certain expenses resulted in modest profitability for Q1. Exchange rate fluctuations are affecting sales in EUR, but the impact on the result is mitigated by a similar currency mix in costs.

Global markets have become increasingly unstable and unpredictable, and the ongoing transformation in the dynamics of international trade is impacting our business. The direct impact of the new tariffs on our business currently appears to be limited, but indirect effects are difficult to foresee. In addition, currency fluctuations may affect our reported sales. Despite these challenges, we also see opportunities. Rising global insecurity is driving demand for X-ray imaging applications, and large-scale investments in the defense industry are opening new doors.

Due to significantly increased market uncertainty, we estimate that year-on-year total net sales will remain stable in Q2. Demand for medical applications remains good, especially in the APAC region. Demand for industrial applications is also developing positively. The temporary dip in demand for security applications appears to be prolonged and will negatively affect EMEIA sales in particular. In the Americas, we expect sales to return to growth in Q2. Visibility continues to be limited, creating uncertainty in the outlook for Q3. We expect Q3 total net sales to remain stable or show slight growth."

Key figures

| (EUR 1,000) | 1-3/2025 | 1-3/2024 | 1-12/2024 |

| Net sales | 22,249 | 22,706 | 107,514 |

| Change in net sales, % | -2.0% | -0.2% | 3.6% |

| EBITA | 1,399 | 2,263 | 14,892 |

| EBITA, % | 6.3% | 10.0% | 13.9% |

| R&D costs | 2,634 | 2,512 | 11,379 |

| R&D costs, % of net sales | 11.8% | 11.1% | 10.6% |

| Cash flow from operating activities | 1,412 | 2,980 | 20,133 |

| Net interest-bearing debt at end of period | -28,492 | -14,508 | -27,767 |

| Investments | 390 | 1,132 | 2,218 |

| Return on investment (ROI), % | 17.0% | 11.2% | 17.4% |

| Gearing, % | -38.2% | -20.3% | -33.6% |

| Earnings per share, EUR | 0.05 | 0.11 | 0.76 |

| Earnings per share (diluted), EUR | 0.05 | 0.11 | 0.76 |

| Number of shares at the end of the period | 14,655,630 | 14,655,930 | 14,655,930 |

| Weighted average number of shares outstanding | 14,655,830 | 14,655,930 | 14,655,930 |

| Weighted average number of shares outstanding, diluted | 14,660,256 | 14,655,930 | 14,660,744 |

The development of net sales

In Q1, Detection Technology's total net sales decreased by -2.0% (-0.2%) and amounted to EUR 22.2 (22.7) million. Medical sales returned to growth in China, where unmet demand caused by an anti-corruption campaign targeting healthcare providers began to ease. In contrast, demand for security applications weakened in Europe, where regulatory requirements contributed to delays in CT system installations in the aviation sector. Similarly, demand for security applications was weaker than expected in the Americas. Ultimately, total net sales declined slightly due to exchange rate changes at the end of the quarter.

The APAC business unit's net sales increased by 2.1% (2.5%) and were EUR 16.0 (15.6) million. The EMEIA business unit's net sales declined by -12.2% (23.5%) and were EUR 5.4 (6.2) million. The Americas business unit's net sales declined by -3.9% (-63.8%) and were EUR 0.9 (0.9) million. APAC accounted for 71.8% (68.9%) of the company's total net sales, EMEIA for 24.3% (27.1%), and the Americas for 3.9% (4.0%).

Net sales from medical applications increased by 13.7% (-20.9%) and were EUR 10.8 (9.5) million. Net sales from security applications decreased by -20.0% (31.5%) and were EUR 7.7 (9.6) million. Net sales from industrial applications grew by 4.2% (5.3%) and were EUR 3.8 (3.6) million. Medical applications accounted for 48.7% (42.0%) of total net sales, security applications 34.4% (42.2%), and industrial applications 16.9% (15.9%).

The share of the five largest customers in Detection Technology's total net sales was 61.5% (53.2%).

NET SALES BY BUSINESS UNITS

| (EUR 1,000) | 1-3/2025 | 1-3/2024 | Change, % | 1-12/2024 |

| Americas | 871 | 907 | -3.9% | 6,591 |

| APAC | 15,969 | 15,639 | 2.1% | 70,525 |

| EMEIA | 5,410 | 6,160 | -12.2% | 30,398 |

| TOTAL | 22,249 | 22,706 | -2.0% | 107,514 |

NET SALES BY MAIN APPLICATIONS

| (EUR 1,000) | 1-3/2025 | 1-3/2024 | Change, % | 1-12/2024 |

| Industrial | 3,754 | 3,603 | 4.2% | 19,038 |

| Medical | 10,832 | 9,525 | 13.7% | 42,190 |

| Security | 7,664 | 9,578 | -20.0% | 46,285 |

| TOTAL | 22,249 | 22,706 | -2.0% | 107,514 |

Half-yearly report 2025

Detection Technology will publish the half-yearly report on 7 August 2025.

Board of Directors, Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@deetee.com

Nordea is the company's Certified Advisor under the Nasdaq First North GM rules, +358 9 5300 6774

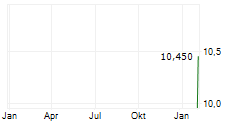

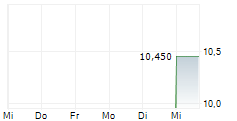

Detection Technology is a global provider of X-ray detector solutions and services for medical, security, and industrial applications. The company's solutions range from sensor components to optimized detector subsystems with ASICs, electronics, mechanics, software, and algorithms. It has sites in Finland, China, France, India, and the US. The company's shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com