JANUARY-MARCH 2025

- Rental income increased to SEK 230 m (227). For the like-for-like portfolio, rental income increased by 4.3 percent.

- Net operating income increased to SEK 107 m (91). For the like-for-like portfolio, net operating income increased by 19.4 percent due to both higher rental income and lower property management costs.

- Profit from property management increased by 156.2 percent to SEK 28 m (11) despite the absence of net operating income from seven properties that were divested during the preceding year.

- The property portfolio's value at the end of the period amounted to SEK 13,751 m (13,701) and change in value of the properties amounted to SEK 9 m (-131) for the period.

- Net profit for the period totaled SEK 28 m (-27).

- The net asset value amounted to SEK 44.91 per share (44.68).

SIGNIFICANT EVENTS DURING AND AFTER THE FIRST QUARTER

- Neobo recruited Andreas Wik as Head of Property Management and member of the management team. He will take office in the autumn.

- As of January 1, Neobo has increased the number of its regions from two to three, in order to ensure a customer-centric organization with a focus on long-term value creation.

CEO STATEMENT

Strong start to the year - profit more than doubled

Conditions in the external environment are marked by significant economic and geopolitical uncertainty, and the global stock markets are showing high levels of volatility and sharp downturns as a result of concerns over escalating trade conflicts and a potential economic slowdown.

Regardless of this turbulence, we got off to a strong start this year with a sharp improvement in earnings. Profit from property management increased to SEK 28 m (11), despite divesting seven properties during the previous year. Net operating income increased by 19 percent in the like-for-like portfolio, due to our conscious efforts to increase the return from our properties.

Value-creating refinement

Since year-end, we have invested SEK 41 m in value-creating measures that have increased our net operating income and made our residential areas more attractive and secure. This includes our renovation of about 17 apartments and a number of sustainability investments that have generated attractive returns and moved us one step closer to achieving our long-term sustainability targets.

Rent negotiations for 2025 are now complete, with an average rent increase of 4.8 percent. Just over half of the agreed rent increases took full effect as of January 1, and the remainder entered force on April 1.

The six-year rental contract that was signed with the Swedish Prison and Probation Service in the Träkolet 16 property in Sollentuna, Stockholm with an annual rental value of SEK 10 m will preliminarily begin on September 1 when the ongoing tenant adaptations have been completed, and the tenant moves in. In conjunction with this, the commercial vacancy rate in Neobo will fall by 2.9 percentage points and the total vacancy rate by 0.6 percentage points relative to the first quarter of 2025. At the same time, the total rental value will increase by SEK 5 m as rent for the lease is twice as high as the assumed vacancy rent in the property.

Stabilized yield requirement and positive changes in value

The transaction market came to life in the first quarter, and the total transaction volume in Sweden has increased by nearly 50 percent year-on-year, at the same time as the uncertain conditions in the external environment have resulted in a certain amount of caution in the market.

Stabilized yield requirements and increased net operating income have resulted in positive unrealized changes in value in the property portfolio of SEK 9 m (-131). The average yield requirement that has been used in the assessments has remained unchanged at 5.0 percent.

Well positioned for the next step

To better leverage the potential in our portfolio, we are strengthening our organization with an experienced head of property management, who will have overall responsibility for increasing the total yield of the properties. At the same time, we are establishing an additional region to ensure a customer-centric organization with a focus on long-term value creation - and to meet the growing demands for innovative, digital and sustainable property management.

A strong start to the year and a strengthened organization mean that we are well positioned to take the next step on our journey - with a continued focus on developing good housing for everyone and creating value for our customers and shareholders.

Stockholm, April 24, 2025

Ylva Sarby Westman, CEO

For more information, please contact:

Ylva Sarby Westman, CEO

mobile: +46 (0) 706 90 65 97 e-mail: ylva.sarby.westman@neobo.se

Maria Strandberg, CFO

mobile: +46 (0) 703 98 23 80 e-mail: maria.strandberg@neobo.se

About Us

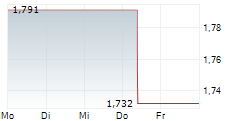

Neobo is a real estate company that manages and refines residential properties over the long term in municipalities with strong demand for rental apartments. Our vision is to create attractive and sustainable living environments where people can thrive and feel secure. Neobo's shares are listed on Nasdaq Stockholm under the ticker symbol NEOBO and ISIN code SE0005034550.

This information is information that Neobo Fastigheter AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-04-24 07:00 CEST.