The results reflect Catena's capacity and strong position in a market that remained cautious during the quarter.

28 April 2024 3.00 p.m CEST

- Rental income rose by 31 percent to SEK 644 million (493).

- Net operating surplus increased by 36 percent to SEK 536 million (394).

- Profit from property management rose by 40 percent to SEK 398 million (285).

- Earnings per share from property management was SEK 6.60 (5.58).

- EPRA Earnings per share totalled SEK 6.23 (5.31).

- The change in the value of properties amounted to SEK 101 million (-199).

- Profit for the period increased to SEK 426 million (120), corresponding to earnings per share of SEK 7.06 (2.35).

- EPRA NRV Long-term net asset value per share rose to SEK 429.48 (398.75).

- A total of 53 percent of lettable area, corresponding to 1,581,000 m², is environmentally certified.

Catena's CEO Jörgen Eriksson comments on the interim report:

"Catena's earnings per share from property management rose by 18 percent on the previous year, clearly reflecting the benefits of profitable investments made in the preceding year. A low loan-to-value ratio combined with strong cash flow creates a solid foundation, which enables us to act when the time is right."

"Our highly engaged property management organisation is available to our customers on a day-to-day basis and pro-actively identifies new needs and opportunities. Our market presence is also key when it comes to creating new projects and business."

At 10.00 a.m. on April 29, the webcast will commence for the interim report for January - March 2025. Follow the webcast via this link: https://catena.events.inderes.com/q1-report-2025/register.

For further information, please contact

Jörgen Eriksson, CEO, Tel. + 46 730-70 22 42, jorgen.eriksson@catena.se

Follow us: catena.se / LinkedIn

This information is such that Catena AB (publ) is obliged to publish under the EU Market Abuse Regulation (EU nr 596/2014). The information was provided by the contact persons mentioned in this press release, for publication at the time stated above.

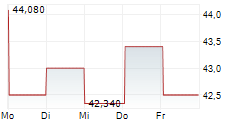

Catena is a listed property company that sustainably and through collaboration develops and durably manages efficient logistics facilities. Its strategically located properties supply the Scandinavian metropolitan areas and are adapted for both current and future goods flows. The overarching objective is to generate strong cash flow from operating activities to enable sustainable growth and stable returns. As of 31 March 2025, the properties had a total value of SEK 41,476 million. Catena's shares are traded on NASDAQ Stockholm, Large Cap.