Regulatory News:

THERACLION (ISIN: FR0010120402; Mnemo: ALTHE), an innovative company developing a robotic platform for non-invasive high-intensity focused ultrasound (HIFU) therapy, announces its 2024 financial results and reviews the execution of its strategy and its growing commercial momentum. Building on recent breakthroughs-including U.S. market access, R&D progress, and strategic positioning in China-Theraclion is preparing for a robust commercial ramp-up in 2025 and 2026.

CEO Martin Deterre said, "We're very pleased with the momentum built in 2024. With our pivotal U.S. study treatments completed on schedule, strong product validation from clinical leaders, and preparations underway in key international markets, everything is falling into place. We're entering a new phase-one that positions us for strong commercial development.

Theraclion has sharpened its strategy around a single focus: the SONOVEIN®, an innovative non-invasive and robotic treatment for varicose veins. This strategy prioritizes product enhancements and commercial roadmap development, including:

- Clinical development milestones: The SONOVEIN has reached a new level of clinical maturity, with ongoing trials highlighted by numerous leading Key Opinion Leaders (KOLs) supporting the safety and efficacy profile of the SONOVEIN. The latest scientific publication to date, in March 2025, showed a 95.5% occlusion rate after a 2-year follow-up1

- Breakthroughs in technology: Significant strides have been made in AI, robotics, and acoustics features. A new acoustics innovation called 'SpeedPulse', aimed at substantially increasing treatment speed, has entered the clinical trial phase in January 2025.

- FDA pivotal clinical trial for U.S. market entry on schedule: Treatments were completed in June 2024 as planned. Completion of the 12-month patient follow-up phase is expected this summer.

- Expansion into China: A strategic partnership with Furui is accelerating market entry. The joint venture is already fully structured and actively executing its roadmap. Strong progress has been made in 2024 towards product registration and local manufacturing.

- Accelerating path to commercialization: Preparations are ramping up to bring the SONOVEIN to market at scale, particularly in key European and Middle Eastern markets. The company is currently strengthening its commercial team.

Pivotal FDA Trial Reaches Key Milestones

In the United States, the FDA-approved pivotal trial for SONOVEIN®, launched in 2023, reached a major milestone in June 2024 with the completion of all patient treatments on schedule. Conducted across four leading medical centers in the U.S. and Europe, the trial successfully enrolled 70 patients.

The six-month follow-up phase concluded in December 2024, marking another significant achievement. Twelve-month follow-up is now in progress, with final results expected by summer 2025.

Submission of the marketing authorization application to the FDA is planned for the second half of 2025, with potential approval anticipated in the first half of 2026, pending FDA review timelines.

These advances mark a critical step toward accessing the world's largest healthcare market and lay the groundwork for future strategic partnerships.

KOL Network Scientific Publications Continue to Drive Momentum for Sonovein®

Backed by a strong network of leading Key Opinion Leaders (KOLs), Theraclion benefits from expert clinical advocacy that helps accelerate awareness and demand for SONOVEIN®. Earlier this month, four distinguished KOLs spoke at the Vein in Venice conference, showcasing the therapeutic potential of the technology and reinforcing its growing recognition within the international medical community: Prof. Mark Whiteley (UK), Dr. Ruben Rodriguez Carvajal (Spain), Dr. Emanuele Nanni (Italy) and Dr. Guillaume Stalnikiewicz (France). These presentations complement those given in February and March 2025 by Dr. Elias and Dr. Casoni in the United States, the United Kingdom, and Italy.

Over the past six months only, four new peer-reviewed publications have featured the SONOVEIN®, further validating its clinical relevance and strengthening its profile among healthcare professionals.

New 'SpeedPulse' feature in Clinical Trial and major R&D Breakthroughs in 2024

In 2024, substantial advancements were achieved in the development of new features, particularly in the areas of artificial intelligence, acoustics, and 3D robotics, all aimed at improving clinical efficiency and accelerating treatment times. Beginning in January 2025, the first patients were treated with 'SpeedPulse', a breakthrough technology that combines enhanced acoustics with optimized therapeutic ultrasound pulses. This innovation, designed to significantly boost treatment speed, is currently being evaluated in a clinical study led by Professor Jaroslav Strejcek in Prague.

These advancements are designed to accelerate adoption in treatment centers, expand the addressable market, and support Theraclion's growth trajectory over the coming years.

Secured financing for 2025

Early 2025, Theraclion announced the reserved issuance of convertible bond loans for a maximum amount of €6.58 million. This financing is structured through the issuance of warrants to subscribe to bonds convertible into shares of the company. The transaction is led by Furui and Unigestion, the company's two largest shareholders, who have already subscribed for €3 million, with the option to invest an additional €3 million under the same terms later this year. This investment reflects the shareholders' support and confidence in the company's strategy. Also, a strong participation from the company's management-including the Chairman, most board Directors, the CEO, and several employees-underscores the collective commitment to Theraclion's development strategy and long-term value creation.

2024 Results

In K€ | 31/12/2024 | 31/12/2023 | Var % |

Turnover | 830 | 1 822 | -54% |

from system sales | 149 | 1 201 | -88% |

from consumable sales | 484 | 504 | -4% |

from services sales | 198 | 117 | 70% |

Grants | 141 | 2 | 6925% |

Other products | 1 191 | 2 093 | -43% |

Total Revenues | 2 162 | 3 917 | -45% |

COGS (purchase and stocks variation) | 1 428 | 330 | 333% |

External charges | 3 228 | 2 572 | 25% |

Personnel charges | 3 357 | 3 153 | 6% |

Other operational Charges | 968 | 1 014 | -5% |

Total operating expenses | 8 981 | 7 070 | 27% |

Operating result | -6 819 | -3 153 | 116% |

Financial result | 49 | -1 955 | -102% |

Non recurring result | 30 | 384 | -92% |

R&D tax credit | -984 | -1 049 | -6% |

Net result | -5 757 | -3 675 | 57% |

Accounts approved by the Board of Directors on April 25th, 2024. | |||

Revenue for the year 2024, excluding an adjustment related to the issuance of a credit note on the Echopulse business amounting to €680K, reached €1,510K. The stronger activity in the second half of 2024 compared to the first half is attributed to the sale of a SONOVEIN system in the Middle East and to the growth in recurring revenue.

Sales of consumables and services, combined, increased by 9% compared to 2023, reflecting a rise in recurring revenues.

Since the 2024 priorities were not yet focused on sales as they are today, system sales were limited. This factor, along with the €680K credit note issued to Theraclion China in 2024, explains the -88% variation compared to 2023.

Theraclion had so far concentrated on supporting centers equipped with SONOVEIN® systems to improve their experience, rather than on prospecting for new clients. In 2024, the company dedicated its resources to product and treatment protocol improvements, as well as clinical trials, to ensure the success of its U.S. clinical study. Starting in 2025, given the progress made in clinical trials and R&D, the Company will focus on commercial development, primarily in Europe and the Middle East.

Operating income amounted to €2,162K, including €953K of capitalized production related to machines placed at client sites (PPU), initially recorded as inventory. The decrease in operating income in 2024 is largely due to the €2,000K in non-recurring licensing revenue from the Theraclion China joint venture recorded in 2023.

Operating expenses for the year totaled €8,981K, compared to €7,070K in 2023, and include notably:

- Purchases and inventory changes amounting to €1,428K, including the transfer of machines placed with clients (PPU) now capitalized for €953K.

- Personnel expenses (wages, salaries, and social charges) amounting to €3,357K compared to €3,153K the previous year, up 6%, mainly due to increases in social contributions and exceptional costs. Excluding these factors, the payroll very slightly decreased compared to 2023.

- External expenses totaling €3,228K, up 25% compared to €2,572K in 2023, driven by the intensification of the U.S. clinical study, associated travel costs, and continued R&D efforts.

- Other operating expenses decreased by 5% compared to 2023.

Taking into account interest income from term deposits, financial income amounted to €49K.

The research tax credit stood at €984K at the end of December 2024, compared to €1,049K in 2023.

The net loss for 2024 amounts to €5,757K.

As of December 31, 2024, the company's cash position was €4.1M.

Net cash position

In K€ | 31/12/2024 | 31/12/2023 | Var. % | |

Treasury | 4 171 | 7 815 | -46,6% | |

Total cash and cash equivalents | 4 171 | 7 815 | -46,6% | |

Bank loans | -1 292 | -1 947 | -33,6% | |

Net cash position | 2 879 | 5 868 | -50,1% |

Cash Flow

Operations consumed €2M of cash in 2024 compared to €2.5M in 2023, representing a €0.5M decrease. This reduction is mainly due to the positive change in Working Capital requirements.

Financing flows are primarily related to the repayment of state-guaranteed loans (PGE). Cash decreased by €3.6M over the fiscal year.

The going concern assumption through December 31, 2025, has been adopted by the Board of Directors based on the following factors:

- As of December 31, 2024, Theraclion's available cash amounted to €4.1M.

- On February 20, 2025, the Company announced a reserved bond loan issuance of up to €6 million. This financing involves the issuance of warrants for the subscription of convertible bonds ("BEOCA") granting rights to subscribe to Theraclion's convertible bonds ("OCA"), reserved for Furui and Unigestion, the company two largest shareholders. They already subscribed to OCAs totaling €3 million, funds which were received during the first quarter of 2025.

- As the company committed to offering to other shareholders or investors the opportunity to subscribe for warrants with the same terms, on March 26, 2025, Theraclion announced an additional convertible bond issuance of up to €580K. Subscribers to this bond, including company's management, subscribed to OCAs for an amount of €290K, which was also received in the first quarter of 2025.

The minimum subscription amounts of €3M and €290K extend Theraclion's runway to the beginning of the first quarter of 2026, thus covering funding needs beyond the completion of the pivotal study and the U.S. regulatory submission.

Additional short-term cash inflows include the 2024 Research Tax Credit of €984K and a significantly higher revenue projection for 2025 compared to 2024.

Based on these elements, the Company has the means to finance its commercial development while continuing its R&D efforts and clinical studies.

About Theraclion

Theraclion is a French MedTech company committed to developing a non-invasive alternative to surgery through the innovative use of focused ultrasound.

High Intensity Focused Ultrasound (HIFU) does not require incisions or an operating room, leaves no scars, and enables patients to return to their daily activities immediately. The HIFU treatment method concentrates therapeutic ultrasounds on an internal focal point from outside the body.

Theraclion develops the HIFU, CE-marked, platform for varicose veins treatment SONOVEIN®, which has the potential to replace millions of surgical procedures every year. In the United States, SONOVEIN® is an investigational device limited to investigational use; it is not available for sale in the U.S.

Based in Malakoff (Paris), the Theraclion team is made up of some 30 people, most of them involved in technological and clinical development.

For more information, please visit www.theraclion.com and follow the LinkedIn account

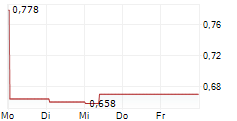

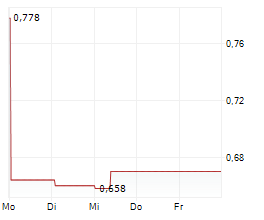

Theraclion is listed on Euronext Growth Paris

Eligible for the PEA-PME scheme

Mnemonic: ALTHE ISIN code: FR0010120402

LEI: 9695007X7HA7A1GCYD29

____________________

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20250429092219/en/

Contacts:

Theraclion contact

Martin Deterre

Chief Executive Officer

contact@theraclion.com