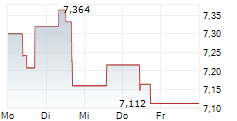

LONDON (dpa-AFX) - Global aerospace technology company Melrose Industries Plc (MRO.L), on Wednesday, reported a strong start to 2025, with revenue, profit, and cash levels in the first quarter aligning with expectations.

During the first quarter, Melrose recorded a 6% increase in Group revenue compared to the same period last year. Growth was particularly strong in the Engines segment, which saw a 9% rise, while Structures reported a 4% increase. Thanks to restructuring and business improvement efforts, adjusted operating profit exceeded last year's figures, and both net debt and free cash flow remained in line with expectations.

The Engines division benefited from strong original equipment volumes and a favorable product mix, contributing to improved operating margins. Growth in the aftermarket sector, including RRSPs and repair services, was a key driver of success. However, military sales were lower compared to 2024, which was a strong year for the sector.

Revenue growth in the Structures division met expectations, aided by supply chain improvements in specific areas that allowed backlog fulfillment for individual platforms. However, broader sector-wide supply chain constraints continued to impact overall volumes. The division's adjusted operating profit surpassed the comparative period, largely due to business exits and efficiency improvements, which are set to be completed later this year.

The company's evaluation of newly imposed tariffs has focused on their direct impact, particularly concerning product shipments to U.S. customers and the supply chain feeding into manufacturing sites. While certain exemptions and contractual protections mitigate some effects, Melrose is implementing various strategies such as supply chain adjustments, drawback mechanisms, and negotiations with partners. These actions have enabled the company to reduce its direct exposure at current tariff levels. Melrose noted that it remains vigilant in monitoring the situation and stands ready to respond to any further developments.

Despite tariff uncertainties, the company has maintained its full-year guidance for 2025, expecting revenues between £3.55 billion and £3.70 billion. Adjusted operating profit is projected at £700 million, excluding £30 million in PLC costs. Additionally, free cash flow is expected to exceed £100 million after interest and tax, with profit and cash flow remaining second-half weighted, resulting in negative free cash flow in the first half. These projections are based on an average exchange rate of US$1.25.

With strong market fundamentals, advanced aerospace technologies, and established positions across global aircraft platforms, Melrose believes it is well-positioned for growth in 2025 and the years ahead.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News