QUANZHOU, China, April 29, 2025 /PRNewswire/ -- INLIF LIMITED (Nasdaq: INLF) (the "Company" or "INLIF"), a company engaged in the research, development, manufacturing, and sales of injection molding machine-dedicated manipulator arms, today announced its financial results for the year ended December 31, 2024.

Mr. Rongjun Xu, the chief executive officer of INLIF, remarked, "We are thrilled to report the performance for fiscal year 2024, with growth recorded across revenue, gross profit, and net income. This success was fueled by sustained demand from existing clients and new customers acquired through our strategic marketing initiatives. Our strategic expansion also played a pivotal role in driving sales growth and penetrating new sectors and emerging markets. These combined efforts resulted in a 25.26% year-over-year increase in revenue. As sales increased, our gross margin declined slightly to 28.83%, which contributed to a 9.49% increase in gross profit, highlighting our profitability and effective cost control measures.

"In preparation for our Nasdaq listing and to unlock greater opportunities in new markets, we launched proactive marketing campaigns and offered attractive incentive commissions to enhance brand recognition and order acquisition. These efforts included participation in exhibitions across China and exploration of overseas markets, particularly in Southeast Asia and India. Meanwhile, we have supported our revenue growth with only a moderate increase in operational costs. We continued to invest in research and development, and we plan to accelerate the acquisition of talents, patents, and technologies to meet the evolving and diversifying needs of the market.

"Thanks to the outstanding efforts of our team and the strong execution of our strategic initiatives, net income rose by 18.78% during our first financial report post-listing. Looking ahead, we anticipate opportunities for continued growth and development, supported by the enhanced visibility and access to capital provided by our Nasdaq listing. In addition, the rise of emerging technology innovations and the increasing adoption of automation infrastructure are expected to significantly accelerate growth in the manipulator arms industry. We are confident that our proactive and pragmatic business strategies will place us on a sustainable and thriving path, delivering long-term value to the Company and our shareholders."

Fiscal Year 2024 Financial Highlights

- Net revenue was $15.80 million for fiscal year 2024, representing an increase of 25.26% from $12.61 million for fiscal year 2023.

- Gross profit was $4.55 million for fiscal year 2024, representing an increase of 9.49% from $4.16 million for fiscal year 2023.

- Gross profit margin was 28.83% for fiscal year 2024, compared to 32.98% for fiscal year 2023.

- Net income was $1.61 million for fiscal year 2024, representing an increase of 18.78% from $1.35 million for fiscal year 2023.

- Basic and diluted earnings per share were $0.13 for fiscal year 2024, compared to $0.11 for fiscal year 2023.

Fiscal Year 2024 Financial Results

Net Revenue

Net revenue was $15.80 million for fiscal year 2024, representing an increase of 25.26% from $12.61 million for fiscal year 2023. The increase was primarily attributable to (i) an increase in sales of manipulator arms, including installation and warranty services, by approximately $0.51 million; (ii) an increase in sales of manipulator arms accessories by approximately $0.44 million; (iii) an increase in sales of raw materials and scraps by approximately $2.27 million; and (iv) a decrease in sales of installation services by approximately $0.04 million.

- Sales of manipulator arms and installation and warranty services were $10.33 million for fiscal year 2024, representing an increase of 5.23% from $9.82 million for fiscal year 2023.

- Sales of accessories were $1.44 million for fiscal year 2024, representing an increase of 44.08% from $1.00 million for fiscal year 2023.

- Sales of raw materials and scraps were $3.93 million for fiscal year 2024, representing an increase of 136.61% from $1.66 million for fiscal year 2023.

- Sales of installation services were $95,442 for fiscal year 2024, representing a decrease of 29.14% from $134,697 for fiscal year 2023.

Cost of Revenue

Cost of revenue was $11.24 million for fiscal year 2024, representing an increase of 33.03% from $8.45 million for fiscal year 2023. The increase was primarily attributable to the Company's business growth and an increase in sales resulting in an increase in costs accordingly.

Gross Profit and Gross Profit Margin

Gross profit was $4.55 million for fiscal year 2024, representing an increase of 9.49% from $4.16 million for fiscal year 2023. The increase mainly due to (i) an increase in gross profit from sales of manipulator arms, including installation and warranty services, by approximately $0.47 million; (ii) a decrease in gross profit from sales of manipulator arms accessories by approximately $0.11 million; (iii) an increase in gross profit from sales of raw materials and scraps by approximately $0.06 million; and (iv) a decrease in gross profit from sales of installation services by approximately $0.03 million.

Gross profit margin was 28.83% for fiscal year 2024, compared to 32.98% for fiscal year 2023.

Operating Expenses

Operating expenses were $3.27 million for fiscal year 2024, representing an increase of 17.74% from $2.77 million for fiscal year 2023.

- Selling expenses were $0.94 million for fiscal year 2024, representing an increase of 36.46% from $0.69 million for fiscal year 2023. The increase was mainly due to (i) an increase in exhibition expenses by approximately $0.12 million, resulting from participation in an additional four exhibitions across four cities in China in 2024; (ii) an increase in salary by approximately $0.12 million, as the growth in revenue has led to higher commissions for sales personnel, alongside the addition of three sales representatives in 2024 compared to 2023; and (iii) an increase in transportation fees by approximately $0.19 million, due to increase of sales to customers from other provinces, such as Guangdong, Zhejiang, and Jiangsu, resulting in a rise in related transportation costs.

- General and administrative expenses were $0.76 million for fiscal year 2024, representing an increase of 5.58% from $0.72 million for fiscal year 2023. The increase was mainly due to an increase in consulting fees for external public relations and internal control.

- Research and development expenses were $1.56 million for fiscal year 2024, representing an increase of 14.76% from $1.36 million for the same period of last year. The increase was primarily attributable to increased investment in research and corresponding material consumption to enhance the quality and performance of manipulator arms.

Net Income

Net income was $1.61 million for fiscal year 2024, representing an increase of 18.78% from $1.35 million for fiscal year 2023.

Basic and Diluted Earnings per Share

Basic and diluted earnings per share were $0.13 for fiscal year 2024, compared to $0.11 for fiscal year 2023.

Financial Condition

As of December 31, 2024, the Company had cash and cash equivalents of $2.47 million, compared to $0.60 million as of December 31, 2023.

Net cash provided by operating activities was $1.58 million for fiscal year 2024, compared to $0.40 million for fiscal year 2023.

Net cash provided by investing activities was $0.32 million for fiscal year 2024, compared to net cash used in investing activities of $0.22 million for fiscal year 2023.

Net cash provided by financing activities was $0.22 million for fiscal year 2024, compared to $0.46 million for fiscal year 2023.

Recent Development

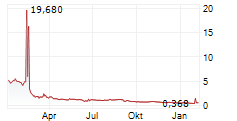

On January 3, 2025, the Company completed its initial public offering of 2,000,000 ordinary shares at a public offering price of US$4.00 per share. The Company's ordinary shares began trading on the Nasdaq Capital Market on January 2, 2025, under the ticker symbol "INLF."

About INLIF LIMITED

Through its operating entity in the People's Republic of China, Ewatt Robot Equipment Co. Ltd., established in September 2016, INLIF is engaged in the research, development, manufacturing, and sales of injection molding machine-dedicated manipulator arms. It is also a provider of installation services and warranty services for manipulator arms, and accessories and raw materials for manipulator arms. The Company produces an extensive portfolio of injection molding machine-dedicated manipulator arms, including transverse single and double-axis manipulator arms, transverse and longitudinal multi-axis manipulator arms, and large bullhead multi-axis manipulator arms, all developed by itself. For more information, please visit the Company's website: https://ir.yiwate88.com / .

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the "Risk Factors" section of the registration statement filed with the U.S. Securities and Exchange Commission (the "SEC"). Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and other filings with the SEC. Additional factors are discussed in the Company's filings with the SEC, which are available for review at www.sec.gov.

For investor and media inquiries, please contact:

INLIF LIMITED

Investor Relations Department

Email: [email protected]

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: [email protected]

INLIF LIMITED | |||||||

CONSOLIDATED BALANCE SHEETS | |||||||

(Expressed in U.S. Dollars, except for the number of shares) | |||||||

As of | As of | ||||||

ASSETS | |||||||

CURRENT ASSETS: | |||||||

Cash and cash equivalents | $ | 2,467,638 | $ | 598,933 | |||

Accounts receivable, net | 3,840,120 | 3,789,214 | |||||

Inventories | 5,300,458 | 4,493,042 | |||||

Deferred offering costs, current | 1,482,558 | - | |||||

Prepayments and other current assets | 159,570 | 142,095 | |||||

Amounts due from related parties | 1,030 | 352,118 | |||||

TOTAL CURRENT ASSETS | $ | 13,251,374 | $ | 9,375,402 | |||

NON-CURRENT ASSETS: | |||||||

Property, plant, and equipment, net | $ | 3,037,312 | $ | 3,397,167 | |||

Land-use rights, net | 2,130,164 | 2,237,684 | |||||

Intangible assets, net | 43,773 | 50,297 | |||||

Deferred offering costs, non-current | - | 960,241 | |||||

Deferred tax assets | 5,169 | 452 | |||||

TOTAL NON-CURRENT ASSETS | $ | 5,216,418 | $ | 6,645,841 | |||

TOTAL ASSETS | $ | 18,467,792 | $ | 16,021,243 | |||

LIABILITIES | |||||||

CURRENT LIABILITIES: | |||||||

Accounts payable | $ | 3,132,613 | $ | 2,546,418 | |||

Bank loans | 4,630,581 | 3,662,023 | |||||

Contract liabilities | 1,712 | 65,073 | |||||

Accrued expenses and other payables | 222,247 | 259,648 | |||||

Income taxes payable | 27,337 | 12,058 | |||||

Amounts due to related parties | 186,768 | 513,018 | |||||

TOTAL CURRENT LIABILITIES | $ | 8,201,258 | $ | 7,058,238 | |||

TOTAL LIABILITIES | $ | 8,201,258 | $ | 7,058,238 | |||

COMMITMENTS AND CONTINGENCIES (NOTE 19) | |||||||

SHAREHOLDERS' EQUITY | |||||||

Ordinary shares ($0.0001 par value, 500,000,000 shares authorized, 12,500,000 | $ | 1,250 | $ | 1,250 | |||

Additional paid-in capital | 7,037,503 | 7,037,503 | |||||

Statutory reserve | 361,083 | 200,229 | |||||

Retained earnings | 3,201,818 | 1,756,183 | |||||

Accumulated other comprehensive loss | (335,120) | (32,160) | |||||

TOTAL SHAREHOLDERS' EQUITY | $ | 10,266,534 | $ | 8,963,005 | |||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 18,467,792 | $ | 16,021,243 | |||

* The share amounts are presented on a retrospective basis. | |||||||

INLIF LIMITED | |||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME | |||||||||||

(Expressed in U.S. Dollars, except for the number of shares) | |||||||||||

Years ended December 31, | |||||||||||

2024 | 2023 | 2022 | |||||||||

Revenues | 15,796,983 | 12,610,873 | 6,652,308 | ||||||||

Cost of revenues | (11,242,817) | (8,451,336) | (4,358,426) | ||||||||

Gross profit | 4,554,166 | 4,159,537 | 2,293,882 | ||||||||

Operating expenses: | |||||||||||

Selling expenses | (938,941) | (688,064) | (396,421) | ||||||||

General and administrative expenses | (764,530) | (724,147) | (742,620) | ||||||||

Research and development expenses | (1,563,059) | (1,362,058) | (504,711) | ||||||||

Total operating expenses | (3,266,530) | (2,774,269) | (1,643,752) | ||||||||

Operating income | 1,287,636 | 1,385,268 | 650,130 | ||||||||

Other income (expenses): | |||||||||||

Interest income | 3,274 | 6,884 | 2,625 | ||||||||

Interest expenses | (196,304) | (146,386) | (82,672) | ||||||||

Other income, net | 531,198 | 110,159 | 15,010 | ||||||||

Other expense, net | (8,370) | (17,410) | (44,274) | ||||||||

Exchange gain (loss) | 3,893 | 25,344 | (3,687) | ||||||||

Total other income (expenses), net | 333,691 | (21,409) | (112,998) | ||||||||

Income before income tax | 1,621,327 | 1,363,859 | 537,132 | ||||||||

Income tax (expenses) benefits | (14,838) | (11,348) | 423 | ||||||||

Net income | 1,606,489 | 1,352,511 | 537,555 | ||||||||

Comprehensive income | |||||||||||

Net income | 1,606,489 | 1,352,511 | 537,555 | ||||||||

Foreign currency translation adjustments, net of tax | (302,960) | (227,278) | 187,942 | ||||||||

Comprehensive income | 1,303,529 | 1,125,233 | 725,497 | ||||||||

Earnings per share, basic and diluted | 0.13 | 0.11 | 0.04 | ||||||||

Weighted average number of shares* | 12,500,000 | 12,500,000 | 12,500,000 | ||||||||

* The share amounts are presented on a retrospective basis. | |||||||||||

INLIF LIMITED | |||||||||||

CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||

(Expressed in U.S. Dollars, except for the number of shares) | |||||||||||

For the years ended December 31, | |||||||||||

2024 | 2023 | 2022 | |||||||||

Cash flows from operating activities: | |||||||||||

Net income | 1,606,489 | 1,352,511 | 537,555 | ||||||||

Adjustments to reconcile net income (loss) to net cash used in operating | |||||||||||

Depreciation and amortization | 347,977 | 367,029 | 388,233 | ||||||||

Allowance for (reversal of) credit losses | (154) | (19,930) | 15,975 | ||||||||

Loss on disposal of property, plant, and equipment | - | 5,432 | - | ||||||||

Deferred tax assets | - | - | (423) | ||||||||

Changes in operating assets and liabilities: | |||||||||||

Accounts receivable | (50,752) | (1,552,991) | (716,876) | ||||||||

Intangible assets | - | (53,086) | - | ||||||||

Inventories | (807,416) | (2,025,725) | 1,093,218 | ||||||||

Prepayments and other current assets | (17,474) | 94,160 | 170,093 | ||||||||

Accounts payable, trade | 586,195 | 2,057,775 | (103,240) | ||||||||

Contract liabilities | (63,361) | 65,073 | (137,699) | ||||||||

Other payables and accrued liabilities | (37,401) | 98,485 | (7,507) | ||||||||

Tax payable | 15,279 | 11,505 | (301) | ||||||||

Net cash provided by operating activities | 1,579,382 | 400,238 | 1,239,028 | ||||||||

Cash flows from investing activities: | |||||||||||

Purchase of property, plant, and equipment | (25,759) | (219,121) | (18,165) | ||||||||

Disposal of property, plant, and equipment | - | 989 | - | ||||||||

Amount loan to related parties | (1,025) | - | - | ||||||||

Proceeds from repayment by related parties | 347,428 | - | - | ||||||||

Net cash provided by (used in) investing activities | 320,644 | (218,132) | (18,165) | ||||||||

Cash flows from financing activities: | |||||||||||

Capital Contributions | - | - | 6,760,538 | ||||||||

Proceeds from short-term loans | 7,143,130 | 3,671,841 | 2,526,378 | ||||||||

Repayment of short-term loans | (6,059,153) | (2,400,819) | (1,486,105) | ||||||||

Deferred offering costs | (522,318) | (919,207) | (42,060) | ||||||||

Amount financed from related parties | 181,116 | 977,418 | 515,678 | ||||||||

Amount repaid to related parties | (518,379) | (865,770) | (9,993,772) | ||||||||

Net cash provided by (used in) financing activities | 224,396 | 463,463 | (1,719,343) | ||||||||

Effect of exchange rate changes | (255,717) | (131,597) | 397,892 | ||||||||

Net increase (decrease) in cash | 1,868,705 | 513,972 | (100,588) | ||||||||

Cash and cash equivalents at beginning of the year | 598,933 | 84,961 | 185,549 | ||||||||

Cash and cash equivalents at end of the year | 2,467,638 | 598,933 | 84,961 | ||||||||

Supplemental disclosures of cash flows information: | |||||||||||

Cash paid for income taxes | 1,707 | 475 | 303 | ||||||||

Cash paid for interest expense | 191,859 | 143,727 | 82,672 | ||||||||

SOURCE INLIF LIMITED