Starbreeze AB ("Starbreeze" or the "Company") has entered into an agreement with PLAION GmbH ("PLAION"), which will enable Starbreeze to fully acquire the publishing rights for PAYDAY 3 from PLAION. In connection therewith and within the authorization granted by the annual general meeting on 15 May 2024, the Board of Directors of Starbreeze has resolved to carry out a directed share issue of 147,676,204 class B shares, corresponding to approximately SEK 33 million (the "Directed Share Issue"). The subscription price in the Directed Share Issue has been set at SEK 0.2235 per share. The Directed Share Issue has been subscribed for by PLAIONs parent company Embracer Group AB (publ) ("Embracer").

"This agreement enables Starbreeze to fully acquire the publishing rights to PAYDAY 3 from Plaion, significantly accelerate our content development roadmap, and pursue broader strategic opportunities for the PAYDAY franchise as a whole. We appreciate PLAION's support, which underscores their confidence in Starbreeze' future and strengthens our strategic alignment with major global industry players." says Thomas Lindgren, Board Member of Starbreeze.

Background and rationale

- Starbreeze has reached a mutual agreement with PLAION regarding the publishing rights for PAYDAY 3. With the game now on the market for over 18 months, the timing is opportune for Starbreeze to assume full publishing responsibility.

- This will enable Starbreeze to accelerate content development and pursue broader business opportunities for the PAYDAY franchise as a whole.

- While this agreement marks the conclusion of the current publishing arrangement, it also lays the groundwork for a long-term partnership between Starbreeze and PLAION on future PAYDAY franchise projects.

- To finance the transaction, Starbreeze will issue new shares representing 10 percent of its outstanding share capital.

The Directed Share Issue

Based on the outcome of the negotiations and as part of the negotiations with PLAION, the Board of Directors of Starbreeze has resolved on a directed share issue of a total of 147,676,204 class B shares at a subscription price of 0.2235 SEK per share. The Directed Share Issue amounts to a total of approximately SEK 33 million before transaction costs, which are estimated to approximately SEK 250,000. SEK 29 million of the proceeds will be used to repay PLAION under the previous agreement relating to PAYDAY 3, settling certain outstanding claims. The Board of Directors resolution to issue new shares is made based on the authorization granted by the annual general meeting on 15 May 2024.

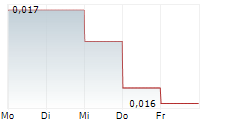

The subscription price represents a premium of approximately 15 percent compared to the closing price on Nasdaq Stockholm on 5 May 2025 and a premium of approximately 18 percent compared to the volume weighted average price over the last ten days of trading on Nasdaq Stockholm. The Directed Share Issue has been subscribed for by PLAION's parent company Embracer, which prior to the completion of the Directed Share Issue was not a shareholder in the Company.

The Directed Share Issue will result in a dilution of approximately 9.1 percent of the number of shares and approximately 5.4 percent of the votes in the Company (calculated as the number of newly issued shares divided by the total number of shares in the Company after the Directed Share Issue). The number of outstanding class B shares and votes will increase by 147,676,204, from 1,476,762,040 to 1,624,438,244. The share capital will increase by 2,953,524.090280 SEK, from 29,535,240.902796 SEK to 32,488,764.993076 SEK.

Deviation from the shareholders' pre-emptive rights

The Board of Directors of the Company has made an overall assessment and carefully considered the possibility of raising capital through a share issue with preferential rights for the Company's shareholders. The Board of Directors considers that the reasons for deviating from the shareholders' preferential rights are (i) that a rights issue would take significantly longer to implement and entail a higher risk of a negative effect on the share price, especially in light of the current volatile and challenging market conditions; (ii) that the implementation of a directed share issue can be done at a lower cost and with less complexity than a rights issue; and (iii) to diversify and strengthen the Company's shareholder base with a qualified strategic investor. Considering the above, the Board of Directors has made the assessment that a directed new issue of class B shares with deviation from the shareholders' preferential rights is the most favourable alternative for the Company to carry out the capital raising.

Advisers

Setterwalls Advokatbyrå AB is legal adviser to the Company connection with the Directed Share Issue.

For more information, please contact:

Thomas Lindgren, Board Member, Starbreeze AB

Christin Rankin, Board Member, Starbreeze AB

Telephone: +46(0)8-209 229

E-mail: ir@starbreeze.com

About Starbreeze

Starbreeze is an independent developer, publisher and distributor of PC and console targeting the global market, with studios in Stockholm, Barcelona, Paris and London. Housing the smash hit IP PAYDAY, Starbreeze develops games based on proprietary and third-party rights, both in-house and in partnership with external game developers. Starbreeze shares are listed on Nasdaq Stockholm under the tickers STAR A and STAR B. For more information, please visit www.starbreeze.com and corporate.starbreeze.com.

This information is information that Starbreeze is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-05-06 08:50 CEST.