BURBANK (dpa-AFX) - Media and entertainment major Walt Disney Co. (DIS) reported Wednesday a huge profit for the second quarter compared to a loss last year, reflecting sharply lower charges and strong performance at the Entertainment and Experiences businesses. Both adjusted earnings per share and quarterly revenues topped analysts' estimates.

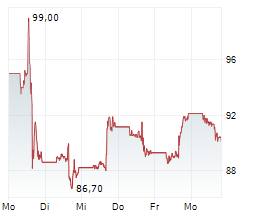

On the NYSE, the company's shares are currently trading at $101.24, up $9.07 or 9.84 percent.

'Our outstanding performance this quarter-with adjusted EPS up 20% from the prior year driven by our Entertainment and Experiences businesses-underscores our continued success building for growth and executing across our strategic priorities,' said CEO Robert Iger.

For the second quarter, Disney's net income attributable to the company was $3.28 billion or $1.81 per share, compared to a net loss of $20 million or $0.01 per share in the prior-year quarter.

Excluding items, adjusted earnings for the quarter were $1.45 per share, compared to $1.21 per share in the year-ago quarter.

On average, 22 analysts polled expected the company to report earnings of $1.21 per share for the quarter. Analysts' estimates typically exclude special items.

Total segment operating income improved 15 percent from last year to $4.44 billion, boosted by 61 percent entertainment segment operating income growth due to improved results at Direct-to-Consumer and Content Sales/Licensing and Other.

Revenues for the quarter grew 7 percent to $23.62 billion from $22.08 billion in the same quarter last year. Analysts expected revenues of $23.13 billion for the quarter.

Entertainment segment revenues grew 9 percent from last year to $10.68 billion, Sports segment revenues grew 5 percent to $4.53 billion, and Experiences segment revenues improved 6 percent to $8.89 billion from last year.

In the quarter, paid subscribers at Disney+ Domestic, from U.S. and Canada, was at 57.8 million, up 2 percent from the preceding quarter end.

Total Disney+ paid subscribers grew 1 percent to 126.0 million sequentially, and total Hulu paid subscribers gained 2 percent to 54.7 million sequentially.

'Following an excellent first half of the fiscal year, we have a lot more to look forward to, including our upcoming theatrical slate, the launch of ESPN's new DTC offering, and an unprecedented number of expansion projects underway in our Experiences segment,' Iger added.

Looking ahead to fiscal 2025, the company now projects adjusted earnings of $5.75 per share, compared to the prior guidance for a high-single digit growth. The Street is looking for earnings of $5.44 per share for the year.

The company said it continues to monitor macroeconomic developments for potential impacts to its businesses and recognize that uncertainty remains regarding the operating environment for the balance of the fiscal year.

Separately, the company also announced an agreement with Miral, Abu Dhabi's creator of immersive destinations and experiences, to create a landmark waterfront Disney theme park resort at the Yas Island in Abu Dhabi, United Arab Emirates to connect travelers from the Middle East and Africa, India, Asia, Europe, and beyond.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News