New Results Continue to Build on Resource Size

12.4 g/t gold over 10.7 m including 27.9 g/t gold over 4.5 m

Discovery of a New Exploration Corridor at Depth

6.2 g/t gold over 7.8 m CW and 4.4 g/t gold over 16.0 m CW

Exploration Driving Production Growth for the Future

TORONTO, May 07, 2025 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce an update on activity at the Fox Complex's Grey Fox Project. Included in this press release are some of the best drill results we have seen from Gibson. Additionally, drilling has identified a new exploration corridor at depth, successfully refining our previous knowledge and interpretation of the gold bearing structures at Grey Fox.

The current resource at Grey Fox consists of 1,538,000 gold ounces at 3.64 g/t Indicated and 458,000 gold ounces at 3.30 g/t Inferred (see press release of February 4th, 2025). Ongoing drilling is focusing on increasing the known resource at Grey Fox as well as identifying new discoveries below its current endowment.

Unless specified as core widths (CW), all assay intervals in this press release are presented as true widths (TW).

Highlights From Multiple Grey Fox Zones

- Impressive Intercepts at Gibson Zone: Hole 25GF-1539 returned 12.4 g/t gold over 10.7 m, including a high-grade interval of 27.9 g/t gold over 4.5 m. Hole 25GF-1548 returned 4.0 g/t gold over 30.1 m, including an interval of 7.8 g/t gold over 11.5 m. The 30.1 meters interval may represent a local or larger scale thickening of typical Gibson mineralization, which is usually up to 5 meters in true width.

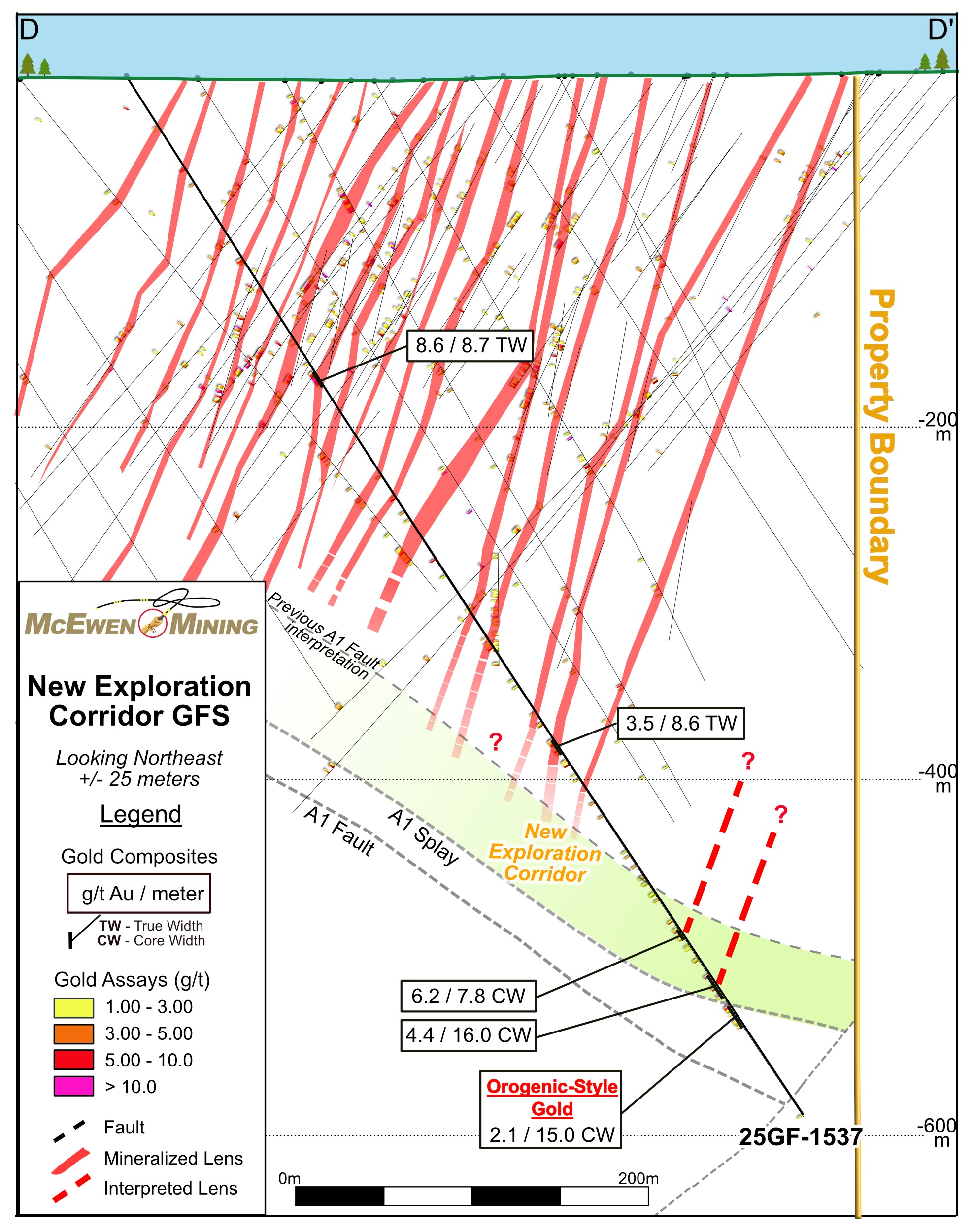

- Deeper drilling at Grey Fox South (GFS) Zone: The bulk of the resource at GFS lies above 300 m depth. New mineralization 250 meters further below this horizon has been identified and is open along strike and dip; drillhole 25GF-1537 returned multiple good grading intersections, including 6.2 g/t gold over 7.8 m CW and 4.4 g/t gold over 16.0 m CW.

- At the 147 Zone: Drillhole 25GF-1563, which had an impressive amount of coarse visible gold, returned an assay value of 48.5 g/t gold over 0.8 m and may represent a new mineralized lens.

- Geophysical Target Near Whiskey Jack (WJ) Zone: Promising results were returned, as seen in drillhole 25GF-1532, which graded 5.2 g/t gold over 11.6 m CW.

Discussion of the Q1 2025 Drilling Campaign Results

Table 1 lists the new drilling results that are discussed in this press release.

Table 1. Grey Fox Drill Results

| Hole ID | From (m) | To (m) | Core Width (CW) (m) | True Width (TW) (m) | Grade Uncapped (g/t Au) | Figure Reference |

| 25GF-1526 | 314.0 | 323.0 | 9.0 | - | 3.6 | 3, 4, 5 |

| 25GF-1528 | 46.0 | 59.0 | 13.0 | 10.5 | 5.5 | 5 |

| Including | 51.0 | 57.0 | 6.0 | 5.2 | 11.0 | |

| And | 261.8 | 265.1 | 3.3 | 2.1 | 10.0 | 5 |

| 25GF-1530 | 286.0 | 292.8 | 6.8 | - | 3.7 | 3, 4,5 |

| 25GF-1532 | 350.2 | 361.8 | 11.6 | - | 5.2 | 3, 4, 5 |

| 25GF-1537 | 198.1 | 208.4 | 10.3 | 8.7 | 8.6 | 8 |

| And | 447.0 | 457.0 | 10.0 | 8.6 | 3.5 | 8 |

| And | 575.3 | 583.0 | 7.8 | - | 6.2 | 8 |

| And | 607.1 | 623.1 | 16.0 | - | 4.4 | 8 |

| And | 628.0 | 643.0 | 15.0 | - | 2.1 | 8 |

| 25GF-1538 | 302.0 | 304.6 | 2.6 | - | 16.3 | 3, 4, 5 |

| 25GF-1539 | 90.6 | 103.0 | 12.4 | 10.7 | 12.4 | 5, 6 |

| Including | 91.6 | 96.8 | 5.2 | 4.5 | 27.9 | |

| And | 207.0 | 209.0 | 2.0 | 1.7 | 2.7 | 5, 6 |

| 25GF-1544 | 338.0 | 346.0 | 8.0 | 6.2 | 4.3 | 5 |

| 25GF-1548 | 129.0 | 164.0 | 35.0 | 30.1 | 4.0 | 5, 6 |

| Including | 147.0 | 160.4 | 13.4 | 11.5 | 7.8 | |

| And | 243.9 | 247.6 | 3.7 | 2.4 | 17.8 | 5, 6 |

| 25GF-1563 | 113.4 | 114.3 | 0.9 | 0.8 | 48.5 | 7 |

Figure 1 is a plan view map showing the zones referenced in this press release, located on the Fox Complex Eastern Property.

Figure 1. Plan View Map of the Fox Complex Eastern Property

Within the overall Grey Fox resource, the Gibson Zone accounts for approximately 18% of the Indicated resource with 290,000 ounces, and 50% of the Inferred resource with 245,000 ounces (February 4th, 2025 press release).

In Q1 2025, drilling concentrated primarily in and around the highly prospective Gibson Zone. In addition, a geophysical survey was aimed at enhancing the understanding of potential new Grey Fox mineralization and identifying structural trends that have not been detected through diamond drilling or conventional geological interpretations.

Figure 2 shows a geophysical map of part of the Grey Fox deposit. The northwest-southeast trending geophysical anomalies (chargeability highs) align with the WJ zone, which also trends northwest-southeast.

In early Q1, five holes were drilled across this anomaly, four of which returned good results, including 25GF-1532, which intersected 5.2 g/t gold over 11.6 m CW. These results will be further discussed and represented in plan view and section figures.

Figure 2 also shows that the modelled mineralized lenses (in red) are located coincident with the trend of the chargeability high. This could be an indication of constraints or control of the mineralization and is considered worthy of follow-up as it could enhance grade continuity in this orientation.

The chargeability high may be due to a high carbon (graphite) content observed in drill core. Graphite is often associated with similar gold deposit styles in the region such as at the Macassa Mine in Kirkland Lake (60 km to the southeast). This could be indicative of controlling structures (orientated in a northwest direction) and it will be evaluated going forward.

Figure 2. Plan View Map of the Northwest Area of Grey Fox Showing Highlights of Geophysical Target Drilling

Figure 3 is a surface map with a background of the most recent geological and structural interpretations for Grey Fox that continue to aid in understanding and modelling the mineralized zones. It also shows the positions of the cross sections further presented, A-A', B-B', C-C' and D-D' as straight white lines.

Figure 3. Plan View Map of Grey Fox Showing the Location of Cross Sections A-A', B-B', C-C' and D-D'

Figure 4 is a cross-section showing the five new holes drilled across the geophysical anomalies, together with the potential new lens orientation based on the new drill results. The new modelled lens of steeply dipping mineralization shows good continuity and is parallel to the trend of the Whiskey Jack zone. The extent of the geophysical anomalies is also shown - this is coincident with the surface projection of the mineralized zones seen in Figure 3. This new lens of mineralization remains open for drilling at depth.

Figure 4. New Lens Interpretation; Cross Section A-A' of the Select Geophysical Target Drilling Near WJ Zone

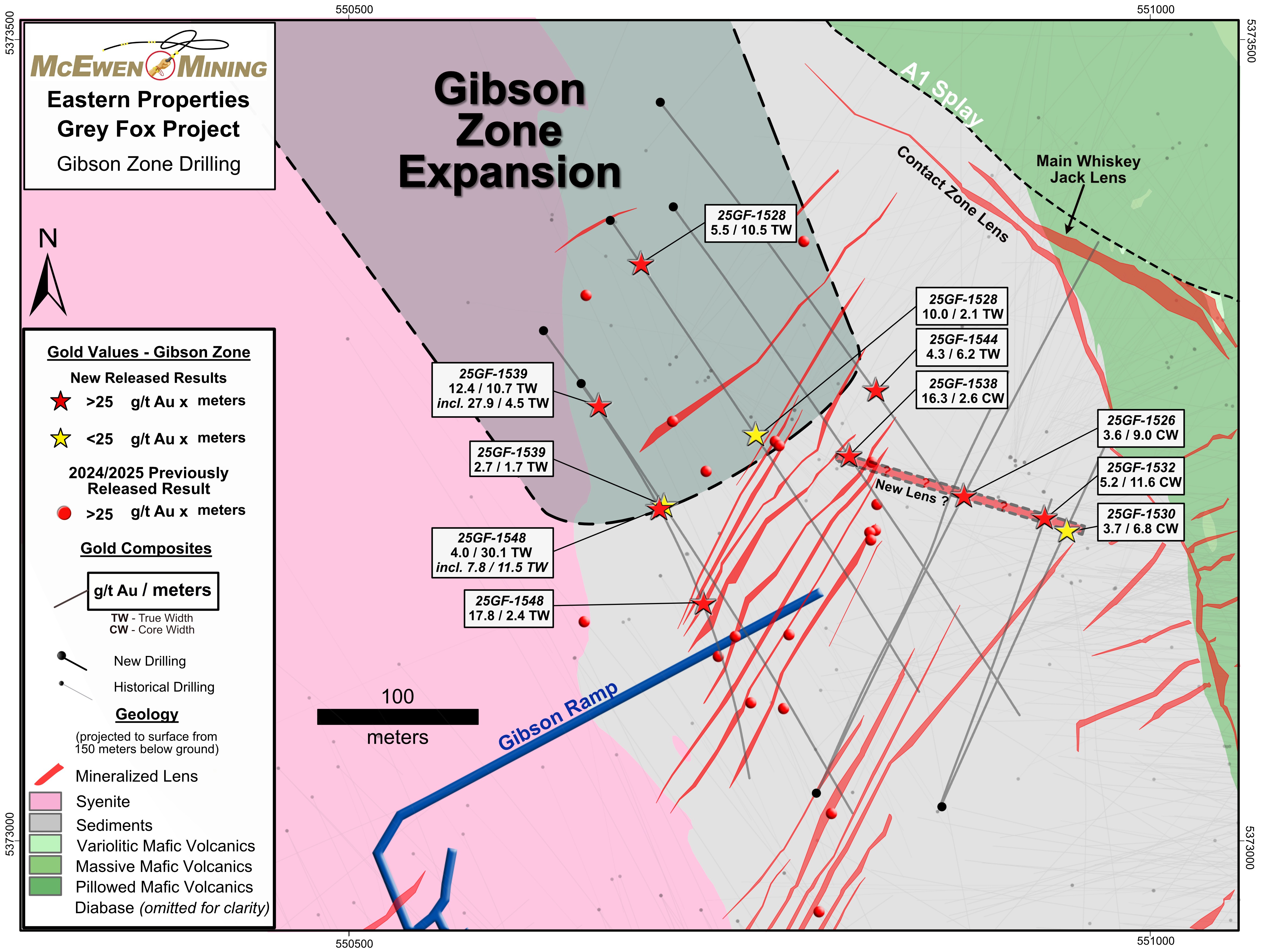

Figure 5 shows key new results from the drilling at the Gibson Zone Expansion. Approximately one third of the meters assigned to the current drilling program is allocated to the Gibson Zone Expansion, due to the better grades and widths seen here (see press release dated February 27th, 2025) and its proximity to the historical Gibson Ramp.

Of particular interest are drillholes 25GF-1539, which graded 12.4 g/t gold over 10.7 m and 25GF-1548, which graded 4.0 g/t gold over an impressive width of 30.1 m. The orientation of these new intercepts, which will be further investigated, could align with the geophysical anomaly described earlier (Figure 2), presenting a new northwest mineralizing corridor perpendicular to the typical northeast trend.

Figure 5. Plan View Map for the Gibson Zone Expansion Drilling and Possible New Lens Orientation

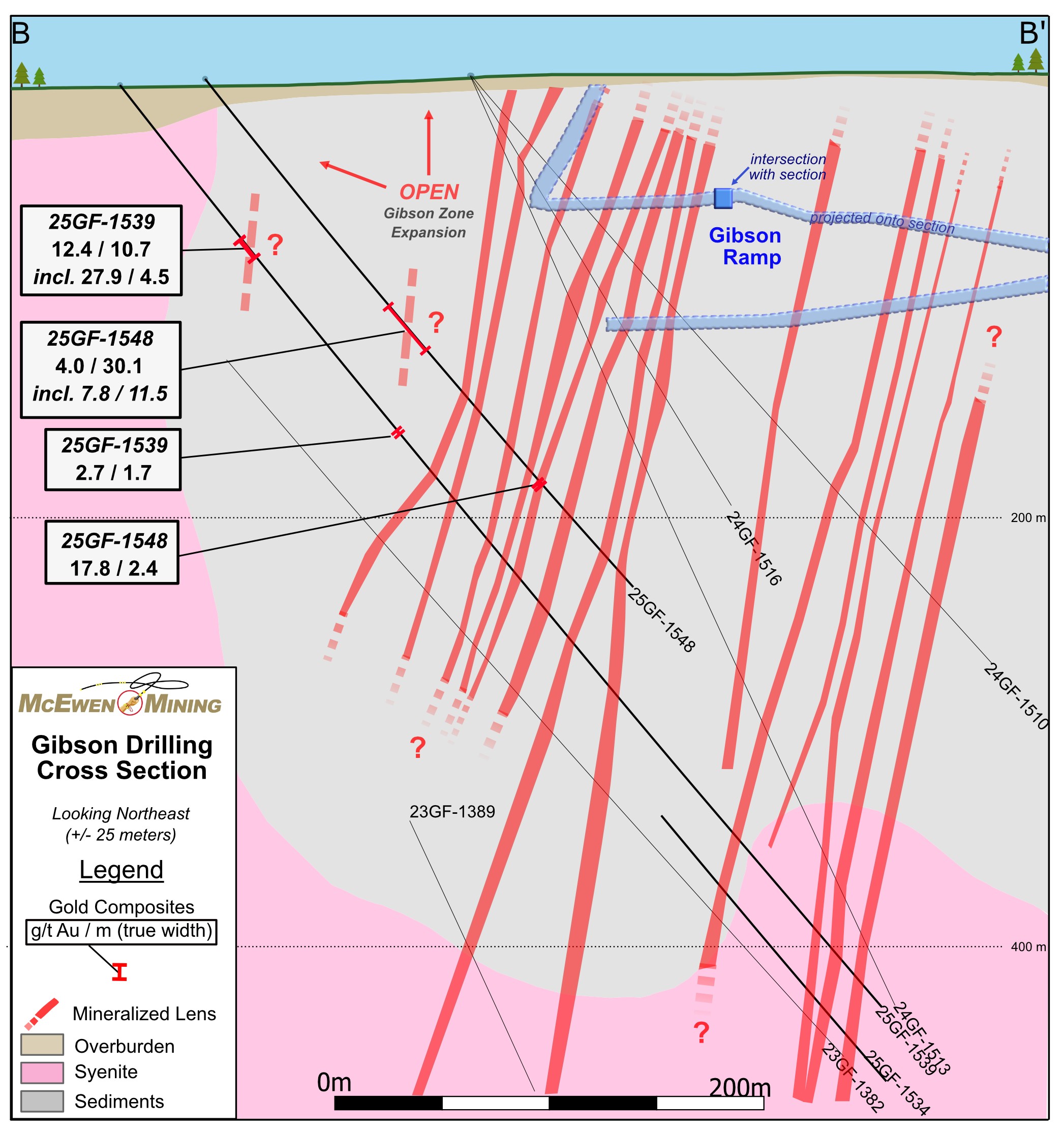

Figure 6 below shows new intercepts received for the Gibson Zone Expansion on a cross section view (section B-B' with location shown on Figure 3).

Given their significance and their proximity to surface (within 150 meters), follow-up drilling to delineate this mineralization is already underway. It is noteworthy that, to date, the typical widths of good grading mineralization at Gibson are usually up to 5 meters in true width, therefore the width of about 30m seen in 25GF-1548 either represents a thickening of the mineralization or the intersection of multiple lenses.

Figure 6. Cross Section B-B' Showing the New Intercepts Received for the Gibson Zone Expansion Drilling

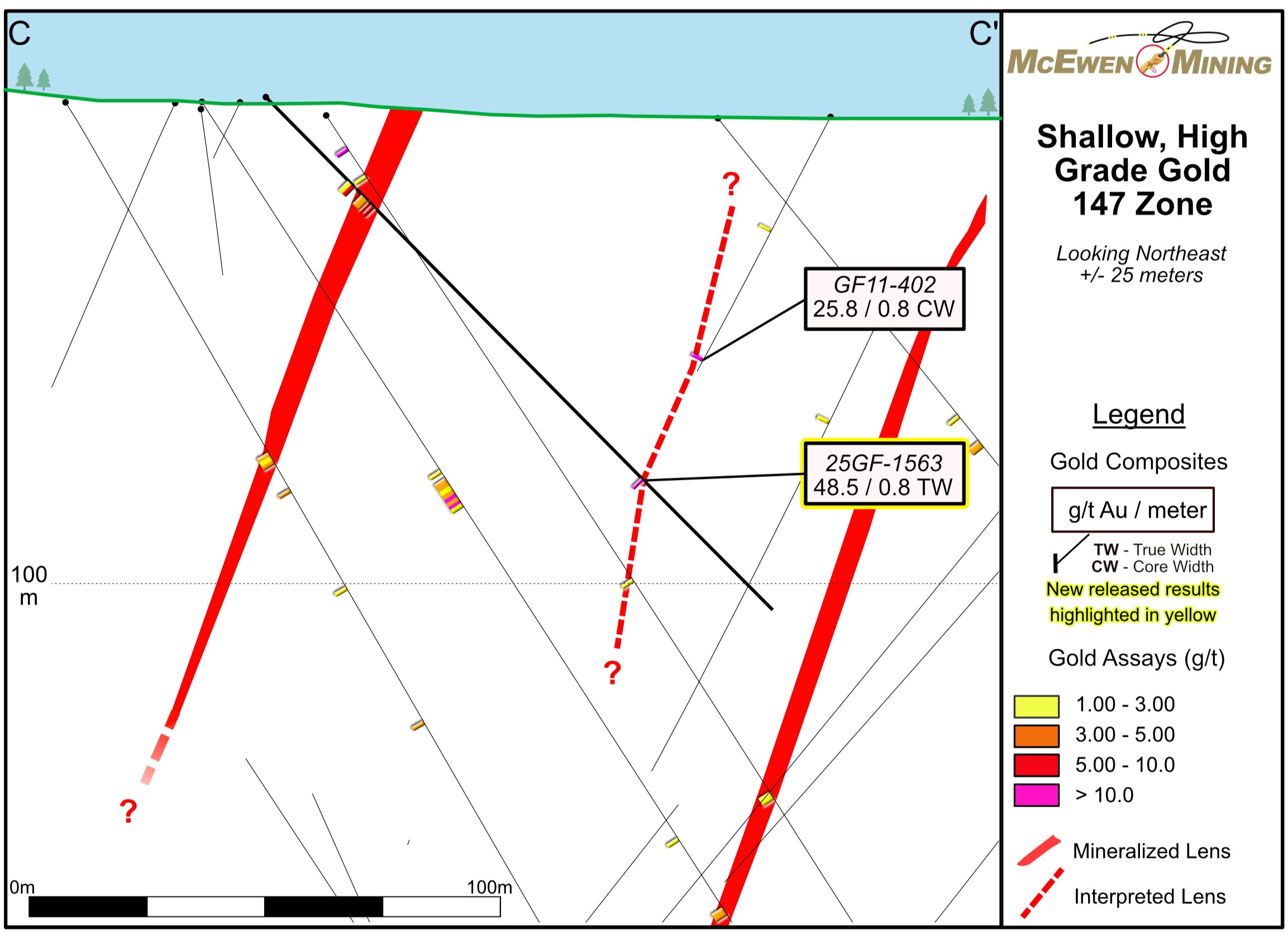

Figure 7 below is a cross-section view (C-C' with location shown in Figure 3) of the drilling focused on 147 zone to test for the continuity of mineralization.

Drillhole 25GF-1563 returned a narrow but high-grade intercept of 48.5 g/t gold over 0.8 m. Figure 7 shows this intercept located just 75 meters below surface and about 40 meters from the historical hole GF11-402, which graded 25.8 g/t gold over 0.8 m CW. These intercepts may represent the same new lens of higher-grade mineralization at the 147 Zone.

Figure 7. Cross Section C-C' Showing a Potential New Higher-Grade Mineralized Lens at the 147 Zone

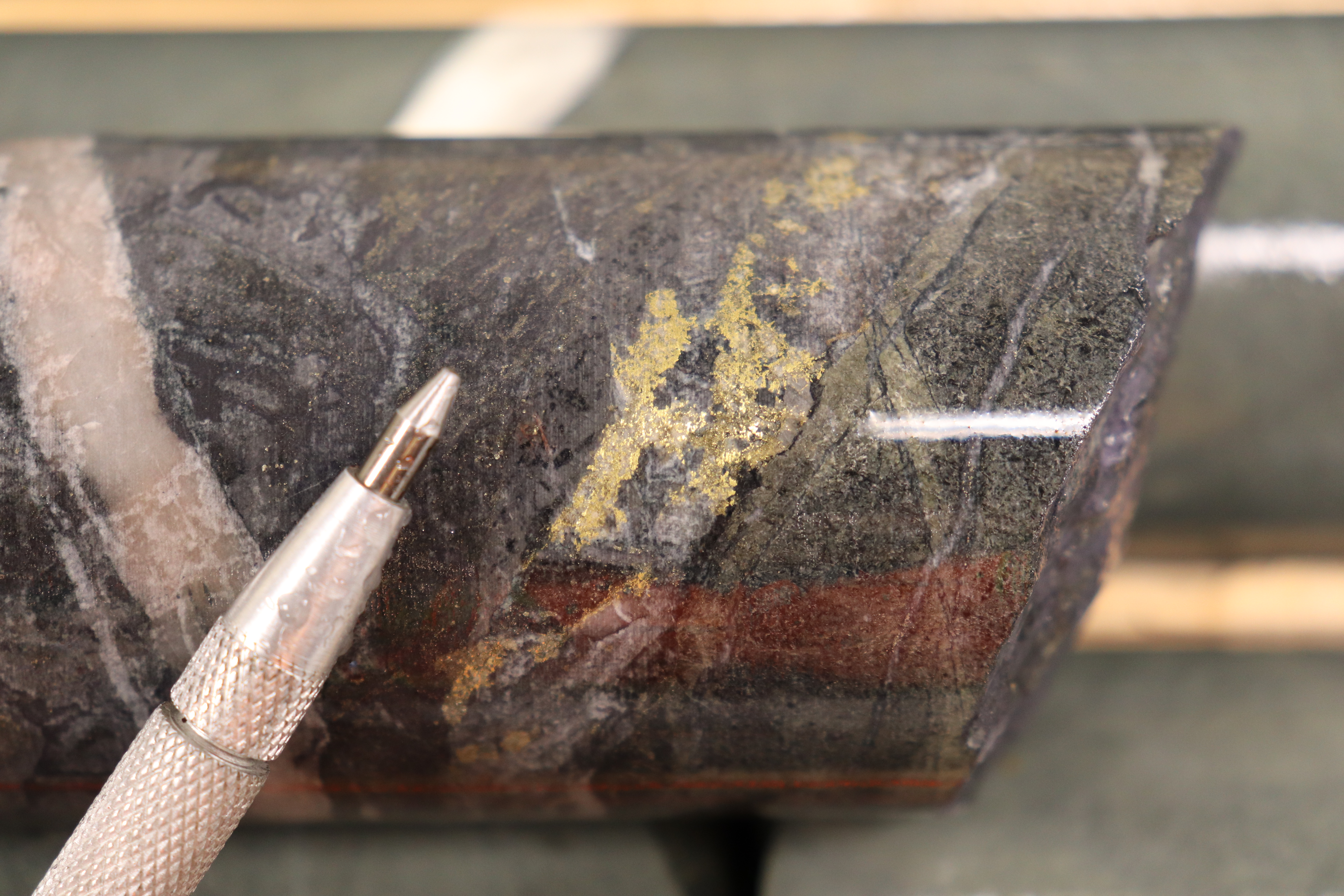

A close-up photo of the abundant Visible Gold (VG) noted for this intercept in 25GF-1563 is shown in Image 1. Conforming with industry Best Practices to avoid sampling bias in the random sampling protocol, the majority of the observed VG was left in the core box; nonetheless, the sample still returned a respectable grade of 48.5 g/t gold over 0.8 m.

Image 1. Close-Up Core Photo of the High-Grade Intercept for Drillhole 25GF-1563 (48.5 g/t Gold over 0.8 m)

At GFS drillhole 25GF-1537 intersected 8.6 g/t gold over 8.7 m, within the main corridor of mineralization, about 175 meters below surface (see Figure 8; section D-D' with location shown in Figure 3). In addition, a second intercept of 25GF-1537, which graded 3.5 g/t gold over 8.6 m appears to be the down-dip extension of an existing lens at GFS. It can also be seen from the figure that the majority of the defined mineralization is located within 300 meters of surface. This hole was drilled deeper than 300 meters below surface and intersected multiple new zones of mineralization. Some of these new intercepts include: 6.2 g/t gold over 7.8 m CW and 4.4 g/t gold over 16.0 m CW (see Figure 8).

Figure 8. Cross Section D-D' For the New Exploration Corridor Discovered at GFS

The relatively broader core lengths associated with these new intercepts may represent local thickening of typical GFS-style mineralization also described earlier for the Gibson Zone Expansion. It can also be seen in Figure 8 that if mineralization trends northeast-southwest, it remains open along strike in both directions. Further drilling is required to confirm the overall geometry and continuity of this new mineralization.

Results from drillhole 25GF-1537 may demonstrate that it has encountered Black Fox style mineralization below Grey Fox. This is of interest because the Black Fox Mine (3 kilometers to the northwest) produced over one million oz of gold. The upper intervals of 25GF-1537 (8.6 g/t gold over 8.7 m and 3.5 g/t gold over 8.6 m) demonstrate typical "epizonal style" mineralization seen at Grey Fox and is now recognized to occur deeper than first thought (6.2 g/t gold over 7.8 m CW and 4.4 g/t gold over 16.0 m CW) (see Figure 8). This drillhole was completed to a final depth of 600 meters and towards the end of the hole, appears to have intersected Black Fox orogenic-style gold mineralization that supports our previous conceptual ideas that it might occur below Grey Fox. Although of lower grade (2.1 g/t gold over 15.0 m CW), this intersection further confirms that there is orogenic-style gold mineralization below this area of Grey Fox (see press release dated February 27th, 2025). Future deep drilling based on refined geophysical-aided targeting may identify zones of higher-grade mineralization below Grey Fox that could develop into an additional resource base.

Image 2. Rob McEwen With Our Exploration Team Inspecting Drill Core on His Recent Visit to the Fox Complex

Following his recent visit to the Fox Complex, CEO and Chief Owner Rob McEwen commented:

"These encouraging results reinforce our confidence that Grey Fox, our next project in the production pipeline, will become a cornerstone asset for us for years to come.

In addition, we have also finally received the Closure Plan Permit for the Stock Project, which enables us to move forward with development and mining operations. We anticipate production to begin in 2026. The Stock Project currently hosts an Indicated resource of 281,000 oz of gold and an Inferred resource of 182,000 oz of gold."

A table of drill results at Grey Fox from February 16th, 2025 to April 24th, 2025 that includes hole locations and alignments is available on the Company's website and can be accessed by clicking here.

Technical Information

Technical information pertaining to the Fox Complex exploration contained in this news release has been prepared under the supervision of Sean Farrell, P.Geo., McEwen Ontario's Exploration Manager, who is a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

The technical information related to resource and reserve estimates in this news release has been reviewed and approved by Luke Willis, P.Geo., McEwen Mining's Director of Resource Modelling and a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

New analyses reported herein were submitted as ½ core samples and assayed by the photon assay method at the accredited laboratory MSA Labs (ISO 9001 & ISO 17025) in Timmins, Ontario, Canada.

CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining Inc. provides its shareholders with exposure to gold, copper and silver in the Americas by way of its 3 mines located in the United States of America, Canada and Argentina and its large advanced-stage copper development project in Argentina. It also has a gold and silver mine on care and maintenance in Mexico. Its Los Azules copper project aims to be one of the world's first regenerative copper mine and is committed to achieving carbon neutrality by 2038.

Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US$205 million and takes a salary of $1/year. He is a recipient of the Order of Canada and a member of the Canadian Mining Hall of Fame. His objective for MUX is to build its share value and establish a dividend, as he did while building Goldcorp Inc.

McEwen Mining's shares are publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol "MUX".

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/section=followUs

and receive news as it happens!

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com | McEwen Mining | Facebook: | facebook.com/mcewenmining | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| CONTACT INFORMATION | Twitter: | twitter.com/mcewenmining | ||||

| 150 King Street West | Instagram: | instagram.com/mcewenmining | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| Twitter: | twitter.com/mcewencopper | |||||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux | ||||

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa7654bb-aa44-4812-87d7-a3ef6aee2130

https://www.globenewswire.com/NewsRoom/AttachmentNg/af78c941-bc7d-4c37-9395-7cacf07a21c1

https://www.globenewswire.com/NewsRoom/AttachmentNg/f301fca6-2af8-46f7-bce8-a4399a341112

https://www.globenewswire.com/NewsRoom/AttachmentNg/a188ec41-bcba-4c4d-b6b5-fcb22dfb5334

https://www.globenewswire.com/NewsRoom/AttachmentNg/4f0e6276-5eb4-4a06-9f90-d76c750bdb21

https://www.globenewswire.com/NewsRoom/AttachmentNg/f391cbd4-2395-4758-9b90-8713d129ab84

https://www.globenewswire.com/NewsRoom/AttachmentNg/36fa9721-fc87-4caf-b9f2-2d5ac33101bb

https://www.globenewswire.com/NewsRoom/AttachmentNg/9a77f182-0543-411c-875d-b4838346e923

https://www.globenewswire.com/NewsRoom/AttachmentNg/94b3f1ac-fd87-4164-8efd-97a798b08538

https://www.globenewswire.com/NewsRoom/AttachmentNg/63d67a7f-aff5-4aed-914b-7909ef80d4c3