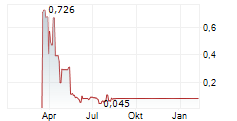

MORRISTOWN, N.J., May 12, 2025 (GLOBE NEWSWIRE) -- Hepion Pharmaceuticals, Inc. (NASDAQ:HEPA), a clinical stage biopharmaceutical company that had been developing a treatment for non-alcoholic steatohepatitis ("NASH"), hepatocellular carcinoma ("HCC"), and other chronic liver diseases which has transitioned to a developer and distributor of diagnostic tests for celiac disease, respiratory multiplex (Covid/Influenza A/B and RSV), H. pylori and HCC, today announced that on May 9, 2025, the Company received written notice (the "Notice") from the Office of General Counsel of The Nasdaq Stock Market ("Nasdaq") indicating that the Nasdaq Hearings Panel has determined to delist the Company's shares from Nasdaq due to the Company's failure to meet Nasdaq's continued listing standards. As previously disclosed, the Company has not been compliant with the requirements under Nasdaq Listing Rule 5550(a)(2) to maintain a minimum bid price of $1.00 per share and Nasdaq Listing Rule 5101 indicating that Nasdaq believes the Company is a public shell. The Notice indicated that trading in the Company's shares of common stock (the "Common Stock") on Nasdaq will be suspended effective at the open of trading on Tuesday, May 13, 2025.

Upon suspension of the trading of its Common Stock on Nasdaq, the Company expects that its Common Stock will be quoted under its existing symbol "HEPA" on the OTC Markets Group.

About Hepion Pharmaceuticals

Hepion's primary asset, Rencofilstat, is a potent inhibitor of cyclophilins, which are involved in many disease processes. Rencofilstat has been shown to reduce liver fibrosis and hepatocellular carcinoma tumor burden in experimental disease models.

In April 2024, Hepion announced that it was winding down its ASCEND-NASH clinical trial. This trial was designed as a Phase 2b, randomized, multi-center, double-blinded study with first patient screened in August 2022, to evaluate the safety and efficacy of Rencofilstat dosed for 12 months, with a target enrollment of 336 subjects. Enrollment was paused in April 2023, with 151 subjects randomized. To date, approximately 80 subjects have completed their Day 365 visits and are evaluable for both safety and efficacy.

On May 9, 2025, Hepion entered into a license agreement with New Day Diagnostics LLC to in-license diagnostic tests for celiac disease, respiratory multiplex (Covid/Influenza A/B and RSV), helicobacter pylori (H. pylori) and hepatocellular carcinoma (HCC). The celiac, respiratory multiplex and H. pylori tests have CE marks and are eligible to be sold in Europe at the present time.

Forward-Looking Statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as "anticipate," "believe," "forecast," "estimated," and "intend," among others. These forward-looking statements are based on Hepion Pharmaceuticals' current expectations and actual results could differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, substantial competition; our ability to continue as a going concern; our need for additional financing; uncertainties of patent protection and litigation; risks associated with delays; uncertainties with respect to lengthy and expensive clinical trials, that results of earlier studies and trials may not be predictive of future trial results; uncertainties of government or third party payer reimbursement; limited sales and marketing efforts and dependence upon third parties; and risks related to failure to obtain FDA clearances or approvals and noncompliance with FDA regulations. Hepion Pharmaceuticals does not undertake an obligation to update or revise any forward-looking statement. Investors should read the risk factors set forth in Hepion Pharmaceuticals' Form 10-K for the year ended December 31, 2024, and other periodic reports filed with the Securities and Exchange Commission.

For further information, please contact:

Hepion Pharmaceuticals

info@hepionpharma.com