DJ Coinsilium Group Limited: Yellow Network Progress and Upcoming Token Launch

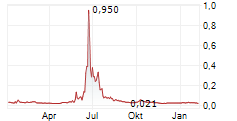

Coinsilium Group Limited (COIN)

Coinsilium Group Limited: Yellow Network Progress and Upcoming Token Launch

13-May-2025 / 09:36 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Coinsilium Group Limited

("Coinsilium" or the "Company")

Strategic Investment Update: Yellow Network Progress and Upcoming Token Launch

Gibraltar, 13 May 2025 - Coinsilium Group Limited (AQUIS:COIN, OTCQB:CINGF), the Web3 investor, advisor, and venture

builder is pleased to provide the following strategic update regarding the progress of Yellow Network ("Yellow"), a

Layer-3 decentralised clearing network for cryptocurrency trading infrastructure, in which the Company holds a vested

interest via a Simple Agreement for Future Tokens (SAFT).

Highlights

-- Early-stage investment in 2022: Coinsilium invested USUSD200,000 in Yellow Network during its early

strategic round, securing a material exposure to a potentially transformational Layer-3 infrastructure protocol.

-- Launch projected within two months: The USDYELLOW token launch is expected to take place within the next

two months, based on public statements by the Yellow team. The timeline is indicative only and may be subject to

change.

-- Strategic regulatory alignment: The upcoming token sale will be conducted under Regulation D in the U.S.,

with global access expected in accordance with local regulations. This aligns Yellow with evolving compliance

standards in institutional markets.

-- Valuation uplift confirmed: In September 2024, Yellow announced a USD 10 million seed round led by Chris

Larsen, Ripple Co-Founder, at a valuation exceeding USD 200 million - a significant uplift from Coinsilium's entry

point.

-- Transformational value potential: If successful in realising its intended adoption, Yellow could

represent a transformational long-term value driver for Coinsilium, with relevance across both DeFi and regulated

financial markets.

Development Timeline and Upcoming Token Launch

One of the most groundbreaking features of the Yellow Network is its ability to enable trustless transactions-a

transformative concept in the world of global trading. Traditionally, business is only conducted between parties who

trust each other, but this reliance on trust is a limiting factor, especially in fragmented and fast-moving markets. By

leveraging state channel technology, Yellow creates an environment where counterparties can trade securely and

instantly without the need for trust. This trustless architecture-much like Bitcoin's original breakthrough for value

transfer-removes the need for intermediaries or custodians, ensuring that the decentralised nature of each transaction

is embedded in the technology itself. The result is a trading ecosystem where value can be streamed in real-time,

profits can be distributed continuously, and the global marketplace can be dramatically expanded beyond traditional

boundaries.

Yellow continues to advance steadily in its development roadmap. The Yellow Protocol is set to engage over 10,000

participants worldwide by the end of 2025, focusing on retail and institutional traders looking for streamlined,

cross-chain trading infrastructure.

Based on public statements made by the Yellow team to its community and the broader market, the USDYELLOW token launch is

currently projected to take place within the next two months, however, this timeline is indicative only and should not

be relied upon, as it remains subject to change due to market conditions and other external factors.

Clearing fees on the network are paid in USDYELLOW tokens and are automatically directed to the Reserve Vault to uphold

system integrity. As Alexis Sirkia, Chairman of the Yellow Network, notes, this design reflects Bitcoin's core

philosophy of building trustless financial infrastructure. In the United States, the token sale is expected to be

conducted in accordance with Regulation D of the Securities Act, providing a compliant framework for participation by

accredited investors in that jurisdiction. This structure reflects Yellow's commitment to regulatory alignment in key

markets, particularly the U.S., while the broader token distribution is expected to include participation from global

markets in accordance with applicable local laws.

Based on these statements and the visible progress the project is making, Coinsilium is encouraged by the momentum and

views the forthcoming launch as a potentially significant milestone for Yellow and the broader digital asset ecosystem.

Alexis Sirkia, has previously expressed the view that the scale and ambition of this project position it among the most

notable network launches since the early years of the Ethereum era (2015/18). While this represents his own

perspective, Coinsilium recognises the robust technical foundations and strategic relevance of Yellow Network's

architecture, particularly as institutions begin to seek compliant access to decentralised market infrastructure.

U.S. Regulatory Shifts Support Yellow Network's Institutional Integration Potential

Recent developments in the U.S. regulatory landscape are paving the way for deeper integration between decentralised

finance (DeFi) and traditional banking - a trend highly relevant to Yellow Network and its institutional infrastructure

ambitions. Key updates include:

-- The Office of the Comptroller of the Currency (OCC) has clarified that federally chartered banks may

provide crypto-asset custody services and participate in decentralised networks, subject to appropriate risk

controls (OCC Interpretive Letter 1183 dated 7 March 2025).

-- The Federal Deposit Insurance Corporation (FDIC) has issued guidance confirming that FDIC-supervised

banks may engage in permissible crypto activities without requiring prior approval (FIL-7-2025 dated 28 March

2025).

-- On 24 April 2025, the Federal Reserve announced it had withdrawn earlier supervisory guidance that

required notification for crypto-asset activities, thus aligning these with existing oversight practices for

traditional financial products.

These regulatory changes are materially lowering barriers to entry for institutions seeking to engage with

crypto-native infrastructure, including custody, settlement, and token-based products - precisely the categories of

financial activity that Yellow Network is designed to support.

Yellow's design - enabling real-time, cross-chain settlement through trustless clearing infrastructure - aligns

strongly with emerging institutional needs. As banks and financial services providers move to meet demand for digital

asset services, Coinsilium believes Yellow is well-positioned to become a key layer within the evolving financial

architecture.

Coinsilium's Investment Interest in Yellow

As an early-stage investor, Coinsilium participated in Yellow's strategic investment round with a USUSD200,000 investment

under a SAFT structure in April 2022. While the precise quantum of tokens allocated under this agreement cannot yet be

disclosed, we anticipate being in a position to provide further details following the official launch and token

listing.

On 17 September 2024, Yellow Network announced that it had secured USD 10 million in seed funding, led by Ripple

Co-Founder and Silicon Valley technology pioneer Chris Larsen, at a post-money valuation in excess of USD 200 million.

This represents a significant uplift relative to the valuation at which Coinsilium made its early-stage investment in

April 2022.

Should Yellow begin to realise its intended adoption and utility across the decentralised finance and institutional

trading landscape, the Company believes the investment has the potential to deliver transformational long-term value

for Coinsilium.

Forward Outlook and Shareholder Value Creation

The Yellow protocol is targeting a critical layer of infrastructure - namely trustless, cross-chain settlement and

decentralised clearing - which sits at the heart of the emerging global digital asset economy. As regulatory conditions

improve and institutional interest accelerates, we believe that infrastructure providers capable of delivering

scalable, compliant solutions will attract disproportionate market attention and value.

While any immediate post-launch impact will depend on broader market conditions and liquidity dynamics, the strategic

relevance and ambition of the Yellow Network place it within a category of projects that, if successful, have

historically supported multi-billion-dollar valuations. From Coinsilium's perspective, this represents a rare

opportunity with the potential to redefine the Company's value trajectory in the coming cycles.

Coinsilium continues to closely track the progress and momentum of Yellow Network with a strong conviction in its

technical achievements and market potential. Execution is one of the most critical and difficult aspects to get right

in any venture, and what gives us particular confidence in Yellow is the clear evidence that this is being delivered.

The team's ability to meet key milestones and maintain operational focus is a strong validation of the project's

direction. This investment aligns closely with our strategy of backing high-impact, foundational blockchain projects

capable of delivering meaningful long-term value for our shareholders.

We also note that projects of comparable ambition and infrastructure scope - particularly those focused on critical

trading and settlement infrastructure in the crypto ecosystem - have historically commanded significant valuations once

market traction has been established. Notable examples include:

-- Chainlink (LINK) - a decentralised oracle network providing infrastructure to enable smart contracts,

with a market capitalization in the multi-billion-dollar range.

-- Polygon (MATIC) - a Layer-2 scaling platform for Ethereum, widely integrated across DeFi and enterprise

use cases.

-- Cosmos (ATOM) - a framework for building interoperable blockchain networks, aimed at solving

fragmentation across ecosystems.

-- Polkadot (DOT) - a protocol enabling cross-chain transfers and decentralised applications to operate

across multiple networks.

Each of these projects has introduced foundational infrastructure solutions, similar in ambition and technical

complexity to the aims of Yellow Network. Their success highlights the scale of market opportunity available to

protocols that deliver meaningful improvements in network interoperability, settlement efficiency, and trustless

coordination between market participants.

As such, Yellow represents a compelling example of the kind of opportunity Coinsilium seeks to support -

infrastructure-layer innovation with real-world applicability and institutional relevance. We encourage shareholders

and market observers to continue monitoring developments closely, particularly as we approach Yellow's anticipated

token launch.

Update on Forza and Bitcoin Treasury Strategy

In parallel to the progress with Yellow, shareholders are reminded of the Company's recent announcement on the

development of Forza!, a wholly owned subsidiary of Coinsilium, established to implement a Bitcoin-focused treasury

strategy powered by automated yield optimisation technologies.

Forza! represents an important part of Coinsilium's growing strategic focus on long-term digital asset value creation

and institutional-grade financial tooling. This initiative aligns with the Company's belief in Bitcoin as an emerging

global store of value and is designed to deliver capital efficiency, transparency, and sustainable yield opportunities

within the framework of a compliant treasury platform.

For full details of the Forza initiative, shareholders are encouraged to refer to the Company's regulatory announcement

dated 28 April 2025, available at:

??Forza! Operational Update and New Investor Presentation

Further updates will be provided in due course in accordance with our regulatory disclosure obligations.

The Directors of Coinsilium Group Limited take responsibility for this announcement.

Coinsilium Group Limited +350 2000 8223

Malcolm Palle, Executive Chairman +44 (0) 7785 381 089

Eddy Travia, Chief Executive www.coinsilium.com

Peterhouse Capital Limited

+44 (0) 207 469 0930

(AQUIS Growth Market Corporate Adviser and Corporate Broker)

SI Capital Limited (Joint Broker) +44 (0) 1483 413 500

Nick Emerson

Oberon Capital (Joint Broker)

+44 203 179 5300

Nick Lovering, Adam Pollock

Notes to Editors

About Coinsilium

Coinsilium is an investor, advisor and venture builder at the forefront of Web3 convergence. The Company invests in and accelerates Web3 and AI-powered technology start-ups whilst supporting their development and commercialisation.

Coinsilium also provides strategic advisory services to start-ups looking to issue tokens through token generation events. Coinsilium's wholly owned subsidiary, Coinsilium (Gibraltar) Limited, serves as the Company's operational hub in Gibraltar.

In 2025, the Company launched Forza Gibraltar Limited, its wholly owned Gibraltar-based subsidiary focused on holding Bitcoin and deploying digital asset strategies. In addition to acting as a Bitcoin treasury vehicle, Forza utilises stablecoins to generate yield, with the objective of enhancing the productivity of its Bitcoin holdings. Forza also promotes the broader adoption of digital assets, with a particular emphasis on Bitcoin.

In 2015, Coinsilium became the first blockchain company to IPO. Coinsilium shares are traded on the AQSE Growth Market in London, under the ticker symbol "COIN", and on the OTCQB Venture Market in the United States under the ticker symbol "CINGF".

About Yellow

Yellow Network is building the first decentralised clearing network for digital assets, addressing the inefficiencies of traditional crypto trading systems. By leveraging state channel technology and chain abstraction, the protocol drastically reduces latency, enables horizontal scalability, and improves capital efficiency, providing a secure, non-custodial solution to the modern trading ecosystem.

Yellow Network is a project under the Layer-3 Foundation, a non-profit organization dedicated to supporting the adoption of chain-agnostic technologies that accelerate the mass adoption of blockchain. To learn more, visit www.yellow.org.

----------------------------------------------------------------------------------------------------------------------- Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse Regulation (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: VGG225641015 Category Code: MSCM TIDM: COIN Sequence No.: 388052 EQS News ID: 2136416 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2136416&application_name=news&site_id=dow_jones%7e%7e%7ef1066a31-ca00-4e1a-b0a4-374bd7d0face

(END) Dow Jones Newswires

May 13, 2025 04:36 ET (08:36 GMT)