Sales Increase Approximately 50% Sequentially as 2025 Growth Strategy Drives New Sales Activity with Both Internal and External Brand Assets Across Multiple Categories

Preparing First VLN® Partner Brand Shipments with Smoker Friendly and Others

Filings Made for New Reduced Nicotine Content and Conventional Product Authorizations in All 50 States

Launch of Smoker Friendly Black Label - Tobacco and Water natural style cigarettes

MOCKSVILLE, N.C., May 13, 2025 (GLOBE NEWSWIRE) -- 22nd Century Group, Inc. (Nasdaq: XXII), a tobacco products company that is leading the fight against nicotine dependence and believes smokers should have a choice about their nicotine consumption, today announced results for the first quarter-ended March 31, 2025, and provided an update on recent business highlights.

"Our first quarter results demonstrate the positive trends we expect to build on in 2025 as we secure new opportunities to drive volume across our VLN®, core CMO and filtered cigar businesses, with a particular emphasis on leveraging both our own and customer driven campaigns for partner branded products," said Larry Firestone, CEO of 22nd Century Group.

"The investments we made in 2024 to transition to profitable CMO activity have begun to pay off as we secure new and increased volumes at existing, returning and new customers for 2025. Sales increased by approximately 50% from the fourth quarter and the operating leverage is flowing through our low-cost operating model."

"We are excited about the upcoming launch of now two partner branded VLN® products, both for chains with substantial retail store counts, bringing additional partner supported marketing and outreach activity to grow sales volumes in the VLN® category. We are moving ahead on these and other opportunities ahead as we continue to execute our growth strategy in 2025."

First Quarter 2025 Financial Results (compared to Fourth Quarter 2024, except as noted)

All figures reported below reflect continuing operations, excluding discontinued operations related to the sale and exit of the Company's hemp/cannabis business in late 2023.

- Net revenues increased approximately 50% sequentially to $6.0 million, compared to $4.0 million.

- Gross profit (loss) declined to $(0.6) million, compared to $(1.3) million.

- Operating expenses decreased to $2.0 million, compared to $2.8 million, the lowest quarterly amount since the restructuring began in 2023.

- Operating loss decreased to $2.6 million, compared to net loss of $4.1 million.

- Net loss decreased to $3.3 million, compared to $4.2 million.

- Adjusted EBITDA loss was $2.3 million, improved from a loss of $3.9 million.

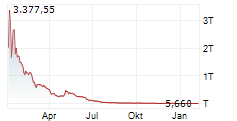

- Ended first quarter 2025 with net debt of $3.4 million.

Recent Business Highlights

- Implemented a new VLN® logo, packaging and marketing plan for relaunch of the Company's branded products.

- Launched VLN® Red, joining VLN® Gold and Green, expanding the reduced nicotine content category for adult smokers.

- Submitted regulatory filings in all 50 states for VLN®, partner VLN® brands and other products planned for 2025 launches.

- Readying for shipments of the first VLN® partner brand products, now expected with two of 22nd Century's largest customers.

- Advanced customer negotiations with new customers to expand VLN® distribution and launch additional VLN® partner brands, further diversifying the reduced nicotine content product category.

- Began shipments of conventional products under a new five-year expanded license and manufacturing agreement with Smoker Friendly, covering 11 existing products plus eight new premium products.

- Began shipments of Smoker Friendly Black Label branded tobacco and water natural style cigarettes

- Secured two new long-term filtered cigar agreements with proven customers under newly priced contracts.

- Reduced total operating expenses to the lowest level since the restructuring began in 2023.

First Quarter 2025 Product Line Net Revenues

- Cigarette net revenues were $5.0 million, increased from $3.3 million in the fourth quarter of 2024 reflecting additional volume from new customer contracts with largest CMO customer effective January 1, 2025, including the initial impact of accounting for revenue accruals recorded as over-time revenue recognition. Q1 2025 cigarette carton volumes increased to 319 thousand compared to 228 thousand in the fourth quarter of 2024.

- Filtered cigar net revenues increased to $1.1 million, compared to $0.8 million in the immediately preceding quarter, reflecting additional volume from new contracts with CMO customers executed in March 2025.

- Cigarillo distribution net revenues for both the first quarter 2025 and fourth quarter 2024 were negligible and reflect the time necessary for initial stocking orders in 2024 to be sold through our distributors before additional reorders are fulfilled in the second half of 2025.

- VLN® cigarette net revenues reflect return accruals for product previously shipped. The Company has announced new branding for its VLN® products and its first partner brand VLN® products with large existing customers. Additional partner brand agreements are in progress as part of a relaunch of its VLN® reduced nicotine content products.

Balance Sheet

- The Company reported total debt of approximately $4.6 million at quarter end, and net debt of approximately $3.4 million.

- Subsequent to the quarter end, the Company further reduced debt to approximately $3.9 million, and has now reduced debt by $3.7 million year-to-date while simultaneously funding its working capital needs for inventory and receivables.

Conference Call

22nd Century will host a live webcast today at 8:00 a.m. E.T. to discuss its first quarter 2025 financial results and business highlights. The live and archived webcast will be accessible in the Events section on 22nd Century's Investor Relations website at https://ir.xxiicentury.com/events.

Summary Financial Results

(dollars in thousands, except per share data)

| Three Months Ended | |||||||||||||

| March 31, | Change | ||||||||||||

| 2025 | 2024 | $ | % | ||||||||||

| Revenues, net | $ | 5,956 | $ | 6,469 | (513 | ) | (7.9 | ) | |||||

| Gross profit (loss) | $ | (609 | ) | $ | (1,129 | ) | 520 | (46.1 | ) | ||||

| Operating loss | $ | (2,570 | ) | $ | (4,434 | ) | 1,864 | (42.0 | ) | ||||

| Net loss from continuing operations | $ | (3,274 | ) | $ | (5,450 | ) | 2,176 | (39.9 | ) | ||||

| Basic and diluted loss per common share from continuing operations | $ | (1.89 | ) | $ | (230.82 | ) | 229 | (99.2 | ) | ||||

| Adjusted EBITDA (a) | $ | (2,319 | ) | $ | (3,500 | ) | 1,181 | 33.8 | |||||

| (a) Adjusted EBITDA is a non-GAAP financial measure. Please see "Notes Regarding Non-GAAP Financial Information" for additional information regarding our use of non-GAAP financial measures. Refer to Tables A at the end of this release for reconciliations of adjusted amounts to the closest corresponding GAAP financial measures. | |||||||||||||

Summary Product Line Results

(in thousands)

| Three Months Ended | |||||||||||||

| March 31, | |||||||||||||

| 2025 | 2024 | Change | |||||||||||

| $ | Cartons | $ | Cartons | $ | Cartons | ||||||||

| Contract Manufacturing | |||||||||||||

| Cigarettes | 5,013 | 319 | 2,760 | 91 | 2,253 | 228 | |||||||

| Filtered Cigars | 1,103 | 159 | 3,626 | 536 | (2,523 | ) | (377 | ) | |||||

| Cigarillos | (5 | ) | - | - | - | (5 | ) | - | |||||

| Total Contract Manufacturing | 6,111 | 478 | 6,386 | 627 | (275 | ) | (149 | ) | |||||

| VLN® | (155 | ) | (2 | ) | 83 | 1 | (238 | ) | (3 | ) | |||

| Total Product Line Revenues | 5,956 | 476 | 6,469 | 628 | (513 | ) | (152 | ) | |||||

About 22nd Century Group, Inc.

22nd Century Group is the pioneering nicotine harm reduction company in the tobacco industry enabling smokers to take control of their nicotine consumption.

We created our flagship product, the VLN® cigarette, to give traditional cigarette smokers an authentic and familiar alternative that helps them take control of their nicotine consumption. VLN® cigarettes have 95% less nicotine than the traditional cigarette and have been proven to greatly reduce nicotine consumption. Instead of offering new ways of delivering nicotine to addicted smokers, we offer smokers the option to take control of their nicotine consumption and make informed and more productive choices, including the choice to avoid addictive levels of nicotine altogether.

Our wholly owned subsidiaries include a leading cigarette manufacturer that produces all VLN® products and provides turnkey contract manufacturing for other tobacco brands both domestically and internationally. The 60,000 square foot facility in Mocksville, North Carolina has the capacity to produce more than 45 million cartons of combusted tobacco products annually with additional space for expansion.

Our proprietary reduced nicotine tobacco blends are made possible by comprehensive and patented technologies that regulate nicotine biosynthesis activities in the tobacco plant, resulting in full flavor and high yield with 95% less nicotine. Our extensive patent portfolio has been developed to ensure we have the only low nicotine combustible cigarette in the United States and critical international markets. Our mission is to sell the last cigarette before the 22nd Century.

VLN® and Helps You Smoke Less® are registered trademarks of 22nd Century Limited LLC.

Learn more at xxiicentury.com, on X (formerly Twitter), on LinkedIn, and on YouTube.

Learn more about VLN® at tryvln.com.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all of the statements, expectations, and assumptions contained in this press release are forward-looking statements, including but not limited to our full year business outlook. Forward-looking statements typically contain terms such as "anticipate," "believe," "consider," "continue," "could," "estimate," "expect," "explore," "foresee," "goal," "guidance," "intend," "likely," "may," "plan," "potential," "predict," "preliminary," "probable," "project," "promising," "seek," "should," "will," "would," and similar expressions. Forward-looking statements include, but are not limited to, statements regarding (i) our cost reduction initiatives, (ii) our expectations regarding regulatory enforcement, including our ability to receive an exemption from new regulations, (iii) our financial and operating performance and (iv) our expectations for our business interruption insurance claim. Actual results might differ materially from those explicit or implicit in forward-looking statements. Important factors that could cause actual results to differ materially are set forth in "Risk Factors" in the Company's Annual Report on Form 10-K filed on March 20, 2025. All information provided in this release is as of the date hereof, and the Company assumes no obligation to and does not intend to update these forward-looking statements, except as required by law.

Notes regarding Non-GAAP Financial Information

In addition to the Company's reported results in accordance with generally accepted accounting principles in the United States of America ("GAAP"), the Company provides EBITDA and Adjusted EBITDA.

In order to calculate EBITDA, the Company adjusts net (loss) income by adding back interest expense (income), provision (benefit) for income taxes, and depreciation and amortization expense. Adjusted EBITDA consists of EBITDA adjusted by the Company for certain non-cash and/or non-operating expenses, including adding back equity-based employee compensation expense, restructuring and restructuring-related charges such as impairment, acquisition and transaction costs, and other unusual or infrequently occurring items, if applicable, such as inventory reserves and adjustments, gains or losses on disposal of property, plant and equipment, and gains or losses on investments.

The Company believes that the presentation of EBITDA and Adjusted EBITDA are important financial measures that supplement discussion and analysis of its financial condition and results of operations and enhances an understanding of its operating performance. While management considers EBITDA and Adjusted EBITDA to be important, these financial performance measures should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating (loss) income, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company's measurement of Adjusted EBITDA may not be comparable to those of other companies.

Net total debt is calculated as total principal amount of debt outstanding less cash and cash equivalents. In addition to the performance measures identified above, we believe that net total debt provides a meaningful measure of liquidity and a useful basis for assessing our ability to fund our activities, including the financing of scheduled debt repayments.

Investor Relations & Media Contact

Matt Kreps

Investor Relations

22nd Century Group

mkreps@xxiicentury.com

214-597-8200

22nd CENTURY GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(amounts in thousands, except share and per-share data)

| March 31, | December 31, | |||||||

| 2025 | 2024 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,133 | $ | 4,422 | ||||

| Accounts receivable, net | 4,322 | 1,698 | ||||||

| Inventories | 2,555 | 2,015 | ||||||

| Insurance recoveries | 768 | 768 | ||||||

| GVB promissory note | - | 500 | ||||||

| Prepaid expenses and other current assets | 1,559 | 1,068 | ||||||

| Current assets of discontinued operations held for sale | 758 | 1,051 | ||||||

| Total current assets | 11,095 | 11,522 | ||||||

| Property, plant and equipment, net | 2,662 | 2,773 | ||||||

| Operating lease right-of-use assets, net | 1,572 | 1,639 | ||||||

| Intangible assets, net | 6,114 | 5,724 | ||||||

| Other assets | 15 | 15 | ||||||

| Total assets | $ | 21,458 | $ | 21,673 | ||||

| LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Notes and loans payable - current | $ | - | $ | 254 | ||||

| Current portion of long-term debt | 3,929 | 1,500 | ||||||

| Operating lease obligations | 272 | 261 | ||||||

| Accounts payable | 3,089 | 2,401 | ||||||

| Accrued expenses | 2,121 | 1,021 | ||||||

| Accrued litigation | 768 | 768 | ||||||

| Accrued payroll | 208 | 318 | ||||||

| Accrued excise taxes and fees | 3,849 | 2,038 | ||||||

| Deferred income | 79 | 20 | ||||||

| Other current liabilities | 1,223 | 100 | ||||||

| Current liabilities of discontinued operations held for sale | 858 | 1,281 | ||||||

| Total current liabilities | 16,396 | 9,962 | ||||||

| Long-term liabilities: | ||||||||

| Operating lease obligations | 1,363 | 1,437 | ||||||

| Long-term debt | - | 5,165 | ||||||

| Other long-term liabilities | 74 | 1,097 | ||||||

| Total liabilities | 17,833 | 17,661 | ||||||

| Shareholders' equity (deficit) | ||||||||

| Preferred stock, $.00001 par value, 10,000,000 shares authorized | ||||||||

| Common stock, $.00001 par value, 250,000,000 shares authorized | ||||||||

| Capital stock issued and outstanding: | ||||||||

| 2,733,232 common shares (730,148 at December 31, 2024) | ||||||||

| Common stock, par value | - | - | ||||||

| Capital in excess of par value | 401,824 | 397,883 | ||||||

| Accumulated deficit | (398,199 | ) | (393,871 | ) | ||||

| Total shareholders' equity | 3,625 | 4,012 | ||||||

| Total liabilities and shareholders' equity | $ | 21,458 | $ | 21,673 | ||||

22nd CENTURY GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(amounts in thousands, except share and per-share data)

| Three Months Ended | |||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Revenues, net | $ | 5,956 | $ | 6,469 | |||

| Cost of goods sold | 2,884 | 4,213 | |||||

| Excise taxes and fees on products | 3,681 | 3,385 | |||||

| Gross (loss) profit | (609 | ) | (1,129 | ) | |||

| Operating expenses: | |||||||

| Sales, general and administrative | 1,799 | 2,906 | |||||

| Research and development | 162 | 425 | |||||

| Other operating expense, net | - | (26 | ) | ||||

| Total operating expenses | 1,961 | 3,305 | |||||

| Operating loss from continuing operations | (2,570 | ) | (4,434 | ) | |||

| Other income (expense): | |||||||

| Other income (expense), net | (162 | ) | - | ||||

| Interest income, net | 16 | - | |||||

| Interest expense | (558 | ) | (1,016 | ) | |||

| Total other income (expense), net | (704 | ) | (1,016 | ) | |||

| Loss from continuing operations before income taxes | (3,274 | ) | (5,450 | ) | |||

| Provision for income taxes | - | - | |||||

| Net loss from continuing operations | $ | (3,274 | ) | $ | (5,450 | ) | |

| Discontinued operations: | |||||||

| Loss from discontinued operations before income taxes | $ | (1,054 | ) | $ | (289 | ) | |

| Provision for income taxes | - | - | |||||

| Loss from discontinued operations | $ | (1,054 | ) | $ | (289 | ) | |

| Net loss | $ | (4,328 | ) | $ | (5,739 | ) | |

| Comprehensive loss | $ | (4,328 | ) | $ | (5,739 | ) | |

| Net loss | $ | (4,328 | ) | $ | (5,739 | ) | |

| Deemed dividends | - | (3,589 | ) | ||||

| Net loss available to common shareholders | $ | (4,328 | ) | $ | (9,328 | ) | |

| Basic and diluted loss per common share from continuing operations | $ | (1.89 | ) | $ | (230.82 | ) | |

| Basic and diluted loss per common share from discontinued operations | $ | (0.61 | ) | $ | (12.25 | ) | |

| Basic and diluted loss per common share from deemed dividends | $ | - | $ | (152.00 | ) | ||

| Basic and diluted loss per common share | $ | (2.50 | ) | $ | (395.07 | ) | |

| Weighted average shares outstanding - basic and diluted | 1,729,212 | 23,612 | |||||

Table A - Reconciliations of Non-GAAP Measures

(dollars in thousands, except share and per-share data)

Below is a table containing information relating to the Company's Net loss, EBITDA and Adjusted EBITDA for the three month periods ended March 31, 2025 and 2024, including a reconciliation of these Non-GAAP measures for such periods.

| Quarter Ended | ||||||||||||

| March 31, | ||||||||||||

| Amounts in thousands ($000's) | ||||||||||||

| except share and per share data | ||||||||||||

| (UNAUDITED) | ||||||||||||

| $ Change | ||||||||||||

| 2025 | 2024 | fav / (unfav)1 | ||||||||||

| Net loss from continuing operations | $ | (3,274 | ) | $ | (5,450 | ) | $ | 2,175 | ||||

| Interest (income)/expense, net | 543 | 1,016 | (473 | ) | ||||||||

| Provision (benefit) for income taxes | - | - | - | |||||||||

| Amortization and depreciation | 224 | 266 | (42 | ) | ||||||||

| EBITDA | $ | (2,507 | ) | $ | (4,168 | ) | $ | 1,661 | ||||

| Adjustments: | ||||||||||||

| Restructuring and impairment | - | (26 | ) | 26 | ||||||||

| Inventory write-down | - | 431 | (431 | ) | ||||||||

| Change in fair value of derivative liabilities | - | 82 | (82 | ) | ||||||||

| Change in fair value of warrant liabilities | 162 | - | 162 | |||||||||

| Equity-based employee compensation expense | 26 | 181 | (155 | ) | ||||||||

| Adjusted EBITDA | $ | (2,319 | ) | $ | (3,500 | ) | $ | 1,181 | ||||

| Adjusted EBITDA loss per common share | $ | (1.34 | ) | $ | (148.24 | ) | $ | 146.90 | ||||

| Weighted average common shares outstanding - basic and diluted | 1,729,212 | 23,612 | ||||||||||

1Fav = Favorable variance, which increases EBITDA and Adjusted EBITDA; Unfav = unfavorable variance, which reduces EBITDA and Adjusted EBITDA

Table B: Net Total Debt Reconciliation

(dollars in thousands)

| March 31, | December 31, | |||||

| 2025 | 2024 | |||||

| Total debt | $ | 3,929 | $ | 6,665 | ||

| Add: debt discounts and deferred issuance costs included in total debt | 628 | 1,025 | ||||

| Total principal amount of debt outstanding | 4,558 | 7,690 | ||||

| Less: Cash and cash equivalents | 1,133 | 4,422 | ||||

| Net total debt (Non-GAAP) | $ | 3,425 | $ | 3,268 | ||