Highlights:

- Q2 Revenue of $2.19M and Q2 Gross Margin of $1.28M

- Q2 Operating Expenses of $1.37M vs $2.82M QoQ - a 51% sequential reduction

- Positive Adjusted EDITDA of $0.1M in Q2 - ahead of schedule

- Guidance for Q3 FY2025, ending June 30, 2025: the Company expects Revenue of $2.5M to $2.75M, and Gross Margin of $1.5M to $1.7M

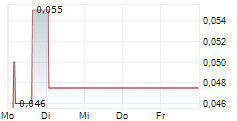

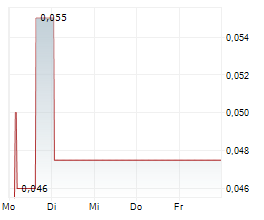

Vancouver, Canada--(Newsfile Corp. - May 21, 2025) - Turnium Technology Group Inc. (TSXV: TTGI) (FSE: E48) ("Turnium" or "the Company"), a global leader in Technology-as-a-Service (TaaS), announces its financial results for Fiscal Q2 2025. All financial information is provided in Canadian dollars unless otherwise indicated.

Doug Childress, Group CEO of Turnium, commented, "I am delighted to report that much of our team's operational and sales efforts have translated to a positive Adjusted EBTDA for the second quarter, well ahead of schedule. We are confident that we are well-positioned to meet our goal of achieving cash flow positivity on a go-forward basis. In the second quarter, our team executed and delivered on numerous contract renewals and new customer wins, which strengthens our ever-growing global market presence. Our focus remains - develop and deliver new and innovative TaaS solutions and expand our business organically by adding new global channel partners and increasing our monthly recurring revenue (MRR)."

The Consolidated Financial Statements and Management Discussion and Analysis ("MD&A") for the second fiscal quarter ended March 31, 2025, are available on the Company's SEDAR profile at www.sedar.com.

*Note: for YoY comparisons, Fiscal Q2 2024 results do not include Claratti, as the acquisition closed on August 22, 2024.

Fiscal Second Quarter 2025 Highlights:

Revenue increased to $2.19M, up 11.2% compared to $1.97M QoQ and up 60.1% compared to $1.37M YoY;

Gross Margin decreased to $1.28M (based on product mix), compared to $1.34M QoQ and $0.99M YoY;

Total Expenses decreased to $1.37M, down 51% compared to $2.82M QoQ and $1.37M YoY;

Net Loss decreased to ($0.44M), compared to ($1.87M) QoQ and ($0.40M) YoY;

Adjusted EBITDA(1) increased to $0.1M, compared to ($1.27M) QoQ and ($0.04M) YoY;

Number of Common Shares Outstanding (basic) at the end of the second quarter 2025 were 164,962,446. Current shares outstanding, as of May 21, 2025 are 164,962,446.

Fiscal Quarter Financial Highlights:

The Company's key financial results for the three months ended March 31, 2025, are as follows:

| Canadian Dollars | Q2 F2025 - For the three months ended March 31, 2025 | Q1 F2025 - For the three months ended December 31, 2024 | Q4 F2024 - For the three months ended September 30, 2024 | Q3 F2024 - For the three months ended June 30, 2024 |

| Total revenue | 2,189,664 | 1,973,697 | 1,545,810 | 1,357,317 |

| Gross margin | 1,279,799 | 1,344,216 | 925,672 | 849,670 |

| Total Expenses | 1,365,536 | 2,824,061 | 2,000,367 | 1,363,395 |

| Net income (loss) | (444,542) | (1,869,842) | (1,575,615) | (378,989) |

| Weighted average number of common shares outstanding | 164,962,446 | 164,962,446 | 136,923,348 | 107,968,303 |

| Basic and diluted loss per common share | (0.00) | (0.01) | (0.01) | (0.00) |

Special Notes:

It is anticipated that revenues and expenses may vary, perhaps materially, from quarter to quarter due to several factors, including changes in product mix, costs related to planned increase in market share, global expansion costs and ongoing corporate development initiatives. Although revenues may fluctuate from quarter to quarter, and such fluctuations may be material, management expects that revenues will increase year over year.

There are no known trends or seasonal impacts on the Company's business although seasonal trends may develop as the Company grows.

Promissory Notes Update:

Subject to regulatory approval, the Company is looking to extend up to $1M in promissory notes, with bonus warrants, to December 31, 2026.

Subsequent Highlights to the Fiscal Second Quarter:

May 15, 2025 - The Company secured two additional renewable network projects exceeding C$504K with Global Power Generation Australia. GPG Australia becomes one of Claratti's Top 10 Global Customers. (LINK)

May 07, 2025 - The Company secured a contract with Seafarer Connect for new CrewMate Lite Services. This agreement expands on the established partnership between Turnium's subsidiary, Claratti, and Seafarer Connect, further enhancing connectivity solutions for international seafarers. (LINK)

April 17, 2025 - The Company announced a strategic partnership with Clavister (SE: CLAV), a Swedish-based pioneer in cybersecurity solutions, to integrate Clavister's advanced Next Generation Firewall (NGFW) and AI-powered security technologies into Turnium's TaaS platform. (LINK)

April 14, 2025 - The Company announced a cross-selling success as Claratti delivers SD-WAN to Perth-based SLS Advisory. This milestone marks Claratti's first SD-WAN implementation, and demonstrates the synergistic potential created through the acquisition of Claratti. (LINK)

Highlights to the Fiscal Second Quarter:

March 28, 2025 - The Company announced a comprehensive Cybersecurity contract renewal with Australian-based Instyle Contract Textiles valued at AUD $280,000. (LINK)

March 20, 2025 - The Company announced a three-year supplier renewal agreement with Kaseya, valued at AUD $5m. The agreement has enabled the Company to launch Claratti's technology stack across Canada and the US. (LINK)

March 13, 2025 - The Company announced the General Availability of version 6.8 SD-WAN software. This version included a BETA version of version 7.0, which has now been successfully deployed to over fifty OEM partner's LAB / test environment. (LINK)

March 7, 2025 - The Company announced the revocation of the Management Cease Trade Order (MCTO), following the filing of its annual FYE 2024 results. (LINK)

March 6, 2025 - The Company announced its Fiscal First Quarter 2025 Financial Results. (LINK)

February 19, 2025 - The Company has renewed an annual contract with Australian-based Tyro Payments for the 11th consecutive year. (LINK)

February 10, 2025 - The Company was featured on SmallCapInterviews - Watch Webinar. (LINK)

February 7, 2025 - The Company has released its second podcast featuring global Chief Executive Officer Doug Childress and Vice President of product and development Josh Hicks - Listen to Podcast. (LINK)

January 30, 2025 - The Company announced a new strategic initiative to build an Intel-based next-generation universal edge device (or appliance) that will include advanced features such as artificial-intelligence-based dynamic traffic steering and post quantum cryptography (PQC). (LINK)

January 6, 2025 - The Company launched new podcast series. (LINK)

(1) Non-IFRS Financial Measures - Adjusted EBITDA

This MD&A references adjusted EBITDA, which is a non-IFRS financial measure. Adjusted EBITDA is not a recognized measure under IFRS, has no standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to adjusted EBITDA presented by other companies. Rather, it is provided as additional information to complement IFRS measures by providing further understanding of the Company's results of operations from management's perspective. Accordingly, adjusted EBITDA should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.

We use non-IFRS financial measures to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. We believe that securities analysts, investors, and other interested parties frequently use non-IFRS financial measures in the evaluation of issuers. There are certain limitations related to the use of non-IFRS financial measures versus their nearest IFRS equivalents. Investors are encouraged to review our financial statements and disclosures in their entirety and are cautioned not to put undue reliance on any non-IFRS financial measure and view it in conjunction with the most comparable IFRS financial measures. In evaluating non-IFRS financial measures, you should be aware that in the future we will continue to incur expenses similar to those adjusted in non-IFRS financial measures.

Adjusted EBITDA is a non-IFRS financial measure that we calculate as net income (loss) before tax excluding depreciation and amortization expense, share based expense, gain/loss on change on fair value of derivatives, loss on debt settlement, government grants, foreign exchange gain/loss, interest and accretion and SRED refund. Adjusted EBITDA is used by management to understand and evaluate the performance and trends of the Company's operations. The following table shows a reconciliation of adjusted EBITDA to net income (loss) before tax, the most comparable IFRS financial measure, for the three and six months ended March 31, 2025 and 2024:

| 6 Months ended Mar 31, 2025 | 6 Months ended Mar 31, 2024 | 3 Months ended Mar 31, 2025 | 3 months ended Mar 31, 2024 | |||

| $ | $ | $ | $ | |||

| Loss before tax | (2,324,401) | (1,028,087) | (444,542) | (403,245) | ||

| Amortization | 266,939 | 28,578 | 131,744 | 14,288 | ||

| Amortization of right-of-use assets | 78,842 | 81,824 | 40,484 | 37,686 | ||

| Share-based compensation | 32,839 | 476,863 | 9,175 | 281,333 | ||

| Gain/Loss on change in FV of derivative | 39,253 | (5,668) | 27,744 | (73) | ||

| Loss on debt settlement | - | 27,005 | - | - | ||

| Government Grant | - | (32,056) | - | - | ||

| Foreign exchange gain (loss) | (52,852) | (33,866) | (51,450) | (18,605) | ||

| Interest and accretion expense | 772,418 | 91,407 | 382,511 | 46,418 | ||

| M&A related one-time transaction costs | 11,751 | - | - | - | ||

| Adjusted EBITDA | (1,175,211) | (394,000) | 95,666 | (42,198) | ||

About Turnium Technology Group Inc.: "Let's get IT done."

Turnium Technology Group Inc. (TTGI) acquires companies that complement its Technology-as-a-Service (TaaS) strategy, integrates them to generate efficiencies, and delivers their solutions through a global channel partner program to customers worldwide. TTGI's mission is to provide IT providers with a complete, white-labeled portfolio of business technology solutions, enabling them to quickly add new services in response to customer demand.

In essence, Turnium is building a TaaS platform that incorporates all the services, platforms, and capabilities that ISPs, MSPs, IT Providers, VoIP/UCaaS, CCaaS, or Cloud Providers might need. Additionally, Turnium provides deployment resources, hardware, delivery, support, and marketing and sales enablement to help channel partners go to market quickly and deliver exceptional quality.

Turnium delivers secure, cost-effective, uninterrupted, and scalable global IT solutions to its channel partners and their end-customers, ensuring that "We get IT done, right."

For more information, contact sales@ttgi.io, visit www.ttgi.io, or follow us on Twitter @turnium.

# # #

Turnium Contact:

Investor Relations: Bill Mitoulas, Email: investor.relations@ttgi.io, Telephone: +1 416-479-9547

Media inquiries: please email media@ttgi.io.

Sales inquiries: please email sales@ttgi.io

www.ttgi.io, www.turnium.com, www.claratti.com

CAUTIONARY NOTES

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Some of these risks are described under the "Caution on Forward-Looking Information" section and "Risk Factors" section of the MD&A. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated by these statements. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/252903

SOURCE: Turnium Technology Group Inc.