4basebio Plc - Final Results and Notice of AGM

PR Newswire

LONDON, United Kingdom, May 27

27 May 2024

4basebio plc

("4basebio", the "Company" or the "Group")

Final Results and Notice of AGM

The Board of 4basebio plc is pleased to report the results for the financial year ended 31 December 2024.

The annual report and accounts together with a notice of the Company's annual general meeting, which is to be held on 27 June 2025 at 9:00am in the offices of 4basebio plc are expected to be uploaded to the Company's website and posted to shareholders shortly.

The annual general meeting will be followed by a presentation from the Company through the Investor Meet Company platform on 30 June 2025 at 10am. Investors can sign up to Investor Meet Company for free and register interest here: https://www.investormeetcompany.com/4basebio-plc/register-investor.

Highlights

- Revenue Growth: The Group doubled its revenues from DNA sales against the previous year, with overall revenues of £933k.

- Product Supply for clinical trial purposes: 4basebio supplied opDNA to its client HelixNano Technologies Inc. for the manufacture of an mRNA vaccine product for use in a first in human trial; the Group also commenced supply of HQ and GMP grade synthetic DNA into a tier one pharma company's vaccine program.

- MHRA regulatory approval to manufacture GMP: The Group received its GMP manufacturing licence from the UK regulator, the Medicines and Healthcare products Regulatory Agency.

- Expanded Intellectual Property: The Group continues to develop its technology platform with the intellectual property portfolio now comprising 29 patent families, reinforcing its leading position in synthetic DNA.

- Successful Equity Raise: The £40 million primary equity investment which concluded in November 2024 underpins the Group's continued growth plans.

- Strategic Advisory Board: The Group formed a Strategic Advisory Board during the year to support the board in developing the strategic direction of the business.

Overview

4basebio PLC (AIM: 4BB) is a Cambridge, UK-based AIM-quoted life sciences service Company for the 4basebio group of companies ("the Group"), which has commercial, manufacturing and R&D operations in the UK and Spain. It is a market leader in the development, manufacture and commercialisation of synthetic DNA and thermostable, non-viral delivery systems for use in cell & gene therapy and vaccine markets, across mRNA therapeutics and vaccines, AAV, gene editing and DNA vaccines.

4basebio's objective is to displace incumbent plasmid DNA with its synthetic DNA for large scale manufacture of DNA for clinical and commercial use. Its products offer its customers application specific product and performance benefits addressing critical customer needs in the cell & gene therapy and vaccine markets. This also includes much quicker manufacturing turnaround times relative to plasmid DNA.

4basebio also continues to invest in research and development activities to further develop its platforms and expand its product offering, particularly focussed on different nucleic acid modalities. Consequently, the Group continues to file significant numbers of patents each year.

Dr Heikki Lanckriet, CEO and CSO for 4basebio, said: "2024 has been a transformational year of growth for 4basebio, closing the strategic investment by Elevage and M&G, securing MHRA certification and continuing to expand our commercial capabilities and client base.

We are delighted to have supplied product during the year for our client HelixNano to progress its mRNA vaccine programme, as well as the supply of DNA for a tier one pharma vaccine programme. We anticipate continued commercial success and strong revenue growth in the year ahead."

For further enquiries, please contact:

4basebio PLC Dr. Heikki Lanckriet, CEO | +44 (0)1223 967 943 | ||

Nominated Adviser Cairn Financial Advisers LLP Jo Tuner / Sandy Jamieson / Ed Downes | +44 (0)20 7213 0880 | ||

Joint Broker RBC Capital Markets Matthew Coakes / Sandrine Cailleteau / Kathryn Deegan | +44 (0)20 7653 4000 | ||

Joint Broker Cavendish Capital Markets Limited Geoff Nash / Nigel Birks | +44 (0)20 7220 0500 |

Chairman's statement

Performance

The 2024 financial year has been another strong year for 4basebio with a doubling of its DNA revenues over the period, continued expansion of its customer base and further development of its DNA platform.

Another key milestone during the year was the equity investment of £40 million from Elevage Medical Technologies and M&G Investments into the Company, first announced in July 2024 and concluded in November 2024, following regulatory approval. This investment was concluded at a market valuation for the Company of £192 million and offered clear endorsement of 4basebio's technology and future growth prospects.

The Company is delighted to welcome these highly regarded investors to the share register. With this funding, the Group expects to be able to rapidly scale its commercial and operational capabilities.

Following the investment, 4basebio moved quickly to strengthen its commercial team, which included the recruitment of four staff based in the USA. As a result of these changes, the Group anticipates an acceleration of its revenue generation over the next year and beyond.

The Board was also restructured to offer representation to 4basebio's two major shareholder groups, Elevage / M&G and Deutsche Balaton. As a result, the Board increased from five members following the Annual General Meeting in June to eight members by the end of the year.

The synthetic DNA business continued to make excellent progress during 2024. A significant achievement was the supply of 4basebio opDNA product for use in a first-in-human mRNA vaccine trial by HelixNano Technologies in March 2024. The Group also commenced supply of HQ and GMP synthetic DNA for a Tier 1 pharmaceutical company mRNA vaccine programme. This commercial development underscores the market's growing acceptance of synthetic DNA in preference to plasmid DNA.

The Group is delighted that following the year end the 4basebio also received its GMP manufacturing licence from the UK regulator, the Medicines and Healthcare products Regulatory Agency. This enables the Group to supply GMP critical starting materials as well as GMP drug substance into customer clinical trials and represents another key milestone for 4basebio on its commercial journey.

We expect the Group's commercial development to accelerate further with this recent announcement as customers can be confident that 4basebio can now support their programmes through each phase of their clinical development.

Alongside DNA, 4basebio also continues to invest into its Hermes® non-viral delivery system. Optimising the platform for vaccine applications continued to be funded by a grant from the Bill and Melinda Gates Foundation and the Group continues to develop its platform through collaborative projects.

Finally, in July 2024, the Company formed a Strategic Advisory Board ("SAB") and welcomed senior industry executives to support the management team and board with advice and industry insight spanning technical, operational, commercial and strategic matters as well as supporting the Group in the realisation of its growth goals and objectives.

Overall, the Group continues to make excellent progress and the Board believes the Group is well placed to grow 2025 revenues strongly and to continue innovating and providing new solutions to its clients. The Group will continue to be loss making in 2025 as it continues to invest in its technology and people and will draw on cash balances to fund those losses.

Strategy

4basebio's strategy remains focussed on becoming the global leader in DNA for cell & gene therapies and vaccine applications. Its synthetic DNA products offer speed, safety, and application-specific benefits. The 4basebio platform can be tailored to diverse applications from mRNA and gene editing to AAV and DNA vaccines.

The Group's application validation teams work with clients during their journey with 4basebio to demonstrate the benefits and advantages of its DNA, recognising the different characteristics of synthetic DNA relative to plasmid DNA may mean that customer processes may not be optimised for synthetic DNA.

Through this collaborative approach, 4basebio's objective is to become a strategic partner for its clients as they progress from early stage research through to pre-clinical, clinical and commercial stages. As clients progress through these stages, both the quantity and quality of DNA required increases, with customer revenues expected to increase significantly over time.

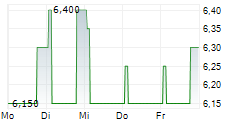

Share Price

The share price opened the year at 680 pence and reached a high of 1,820 pence in June before closing the year at 1,210 pence, a 78% uplift against the 2023 closing price. Trading volumes during the year represented approximately 4% of shares in issue, with a typical daily trading volume of 2,440 shares.

At year end, approximately 73% of the Company's shares were closely held between the Company's largest shareholders and Board Directors. The Board has limited visibility on holdings below the reporting threshold of 3% as holdings in the Company are typically held in nominee accounts. The Board believes that a significant portion of the remaining shares is owned by long term shareholders.

Environmental, Social and Governance

In 2024, the Company engaged with EcoVadis, a globally recognised provider of sustainability ratings for supply chains and corporate ESG performance.

This engagement reflects the Group's proactive approach to ESG and its commitment to continuous improvement in these areas. The insights derived from EcoVadis will inform the Group's strategic planning, stakeholder engagement, and operational practices to ensure long-term sustainability and accountability.

People and Culture

The Group has continued to strengthen its teams across all disciplines and remains science led with over 80% of its workforce holding scientific degrees. The team has expanded geographically with staff now in the USA and Dubai, alongside long standing teams in the UK and Spain. 4basebio seeks to attract the right skills into the organisation and welcomes 22 nationalities across its various locations.

The Group maintains a relatively flat organisational structure and strives to maintain an open, informal and supportive culture. There is an emphasis on staff welfare and development with resultant strong staff retention.

The Board would like to thank all staff for their commitment and dedication over the past year which has been instrumental in 4basebio's continued progress.

Tim McCarthy

Chairman

Consolidated statement of profit or loss and other comprehensive income

for the year ended 31 December 2024

| [in £'000] | 2024 | 2023 | ||||||

| Revenues | 933 | 506 | ||||||

| Cost of goods sold | (303) | (166) | ||||||

| Gross profit | 630 | 340 | ||||||

| Administration expenses | (13,866) | (8,813) | ||||||

| Other operating expenses | (114) | (85) | ||||||

| Other operating income | 1,308 | 506 | ||||||

| Loss from operations | (12,042) | (8,052) | ||||||

| Finance income | 140 | 0 | ||||||

| Finance expense | (752) | (302) | ||||||

| Financial result | (612) | (302) | ||||||

| Loss before tax | (12,654) | (8,354) | ||||||

| Income tax income | 321 | 689 | ||||||

| Loss for the year | (12,333) | (7,665) | ||||||

| Loss per share | ||||||||

| (0.94) | (0.62) | ||||||

| Items that may be reclassified to the income statement in subsequent periods | ||||||||

| Exchange differences on translation of foreign operations | (313) | (172) | ||||||

| Total comprehensive income | (12,646) | (7,837) | ||||||

Consolidated statement of financial position

31 December 2024

| [in £'000] | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||

| Intangible assets | 3,480 | 2,669 | |||||||||||||||||||||||||||||||||||

| Property, plant and equipment | 4,326 | 4,197 | |||||||||||||||||||||||||||||||||||

| Other non-current assets | 33 | 34 | |||||||||||||||||||||||||||||||||||

| Non-current assets | 7,839 | 6,900 | |||||||||||||||||||||||||||||||||||

| Inventories | 374 | 332 | |||||||||||||||||||||||||||||||||||

| Trade receivables | 283 | 107 | |||||||||||||||||||||||||||||||||||

| Other current assets | 1,627 | 1,514 | |||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | 34,604 | 3,069 | |||||||||||||||||||||||||||||||||||

| Current assets | 36,888 | 5,022 | |||||||||||||||||||||||||||||||||||

| Total assets | 44,727 | 11,922 | |||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||

| Financial liabilities | (188) | (392) | |||||||||||||||||||||||||||||||||||

| Trade payables | (1,694) | (694) | |||||||||||||||||||||||||||||||||||

| Other current liabilities | (1,383) | (1,191) | |||||||||||||||||||||||||||||||||||

| Current liabilities | (3,265) | (2,277) | |||||||||||||||||||||||||||||||||||

| Financial liabilities | (15,028) | (10,065) | |||||||||||||||||||||||||||||||||||

| Other liabilities | (54) | (72) | |||||||||||||||||||||||||||||||||||

| Non-current liabilities | (15,082) | (10,137) | |||||||||||||||||||||||||||||||||||

| Total liabilities | (18,347) | (12,414) | |||||||||||||||||||||||||||||||||||

| Net (liabilities) / assets | 26,380 | (492) | |||||||||||||||||||||||||||||||||||

| Share capital | 13,772 | 11,132 | |||||||||||||||||||||||||||||||||||

| Share premium | 37,250 | 706 | |||||||||||||||||||||||||||||||||||

| Merger reserve | 688 | 688 | |||||||||||||||||||||||||||||||||||

| Capital reserve | 13,864 | 13,530 | |||||||||||||||||||||||||||||||||||

| Foreign exchange reserve | (471) | (158) | |||||||||||||||||||||||||||||||||||

| Profit and loss reserve | (38,723) | (26,390) | |||||||||||||||||||||||||||||||||||

| Total Equity | 26,380 | (492) | |||||||||||||||||||||||||||||||||||

Consolidated statement of changes in equity

for the year ended 31 December 2024

| [in £'000] | Share capital | Share premium | Merger reserve | Capital reserve | Foreign exchange reserve | Profit and loss reserve | Total equity |

| Balance at 1 January 2024 | 11,132 | 706 | 688 | 13,530 | (158) | (26,390) | (492) |

| Loss for the year | - | - | - | - | - | (12,333) | (12,333) |

| Shares issued in period | 2,640 | 36,544 | - | - | - | - | 39,184 |

| Foreign Exchange difference arising on translation of 4basebio S.L.U. | - | - | - | - | (313) | - | (313) |

| Share based payments | - | - | - | 334 | - | - | 334 |

| Balance at 31 December 2024 | 13,772 | 37,250 | 688 | 13,864 | (471) | (38,723) | 26,380 |

| [in £'000] | Share capital | Share premium | Merger reserve | Capital reserve | Foreign exchange reserve | Profit and loss reserve | Total equity |

| Balance at 1 January 2023 | 11,130 | 706 | 688 | 13,307 | 14 | (18,725) | 7,120 |

| Loss for the year | - | - | - | - | - | (7,665) | (7,665) |

| Shares issued in period | 2 | - | - | - | - | - | 2 |

| Foreign Exchange difference arising on translation of 4basebio S.L.U. | - | - | - | - | (172) | - | (172) |

| Share based payments | - | - | - | 223 | - | - | 223 |

| Balance at 31 December 2023 | 11,132 | 706 | 688 | 13,530 | (158) | (26,390) | (492) |

Consolidated statement of cash flows

for the year ended 31 December 2024

| [in £'000] | 2024 | 2023 | ||||

| Net loss for the period | (12,333) | (7,665) | ||||

| Adjustments to reconcile net loss for the period to net cashflows | ||||||

| Income taxes | (321) | (689) | ||||

| Interest income | (140) | 0 | ||||

| Interest expense | 752 | 302 | ||||

| Depreciation of property, plant and equipment | 800 | 676 | ||||

| Amortisation and impairment of intangible assets | 4 | 133 | 33 | |||

| Other non-cash items | 11 | (375) | 220 | |||

| Working capital changes: | ||||||

| (Increase)/decrease in trade receivables and other current assets | (76) | (109) | ||||

| Increase/(decrease) in trade payables and other current liabilities | 748 | 695 | ||||

| (Increase)/decrease in inventories | (49) | (202) | ||||

| Tax receipt | 117 | 561 | ||||

| Net Cash flows from operating activities | (10,744) | (6,178) | ||||

| Investments in property, plant and equipment | (697) | (871) | ||||

| Investments in capitalised development and intangible assets | (874) | (619) | ||||

| Cash flows from investing activities | (1,571) | (1,490) | ||||

| Net receipt/(payment) of loans | 4,812 | 6,584 | ||||

| Shares issued | 39,184 | 2 | ||||

| Interest received | 72 | 0 | ||||

| Interest paid | (86) | (67) | ||||

| Capital lease payments | (115) | (94) | ||||

| Cash flows from financing activities | 43,867 | 6,425 | ||||

| Net change in cash and cash equivalents | 31,552 | (1,243) | ||||

| Exchange differences | (17) | (39) | ||||

| Cash and cash equivalents at the beginning of the period | 3,069 | 4,351 | ||||

| Cash and cash equivalents at the end of the period | 34,604 | 3,069 | ||||

Notes to the financial statements

1. General

4basebio PLC (the "Company" or "4basebio") is registered in England and Wales with company number 13519889.

The Company is domiciled in England and the registered office of the Company is 25 Norman Way, Over, Cambridge CB24 5QE. 4basebio PLC is the parent of a group of companies (together, "the Group"). The Group focusses on life sciences and in particular the development of synthetic DNA and nanoparticles suitable for inclusion in, or delivery of, therapeutic payloads for gene therapies and gene vaccines.

The Company trades on London Stock Exchange's AIM market. The international securities number (ISIN) number for its AIM traded shares is GB00BMCLYF79; its ticker symbol is 4bb.l.

The consolidated financial statements of 4basebio PLC and its subsidiaries for the year ended 31 December 2024 were authorised for issue in accordance with a resolution of the directors on 23 May 2025.

2. Basis of preparation

The consolidated financial statements of 4basebio UK PLC (or "the Group") for the financial year ending 31 December 2024 have been prepared using UK adopted international accounting standards.

The consolidated financial statements comprise the results of 4basebio PLC, 4basebio S.L.U., 4basebio UK Limited and 4basebio Discovery Limited for the whole year.

The above summary has been extracted from the report and financial statements and, accordingly, references to notes and page numbers may be incorrect. Shareholders are advised to read the full version of the report and financial statements which will be available from the Company's website shortly.

3. Earnings per share

| 2024 | 2023 | |

| Numerator [in £'000] | ||

| Result for the period | (12,333) | (7,665) |

| Denominator [number of shares] | ||

| Weighted average number of registered shares in circulation (ordinary shares) for calculating the undiluted earnings per share | 13,116,570 | 12,319.270 |

| Basic and diluted earnings per share (£) | (0.94) | (0.62) |

The calculation of the basic and diluted earnings per share for continuing operations was based on the weighted average number of shares as determined above. The numerator is defined as result after tax from continuing operations. The average number of share options outstanding during the period was 404,973 (2023: 653,771) which have not been included in the calculation of the diluted Earnings per share because they would be anti-dilutive since the business is loss making.

4. Approval of the financial statements

The financial statements were approved by the Board of directors and authorised for issue on 23 May 2025.