Financial highlights during first quarter 2025

• Revenue amounted to EUR 9 804 (9 486) thousand, an increase of 3% compared

with the previous year.

• Adjusted EBITDA (before items affecting comparability) was EUR 447 (1 232) thousand decreasing by 64% year-on-year and 62% quarter-on-quarter. EBITDA amounted to EUR 206 (3 884) thousand.

• Profit after tax was EUR -3 256 (2,806) thousand. Adjusted profit after tax (before items affecting comparability and currency effects) was EUR -759 (-381) thousand.

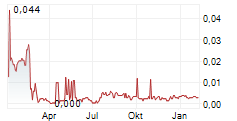

• Earnings per share amounted to EUR -0.003 (0.015). Adjusted earnings per share (before items affecting comparability and currency effects) was EUR -0.001 (-0.002).

• New Depositing Customers (NDC) amounted to 72 906 (45 531) increasing by 60% year-on-year and 69% quarter-on-quarter.

• Cash flow from operating activities amounted to EUR -1 131 (2 088) thousand.

Important events during the quarter

• Acroud announced on 14 January 2025 the approval in the written procedure under its outstanding bond loan and the end of the subscription period for super senior bonds.

More detailed information on press release: https:/www.acroud.com/en/cision/E8453430CE050CF8/

• Acroud announced on 24 January 2025 that the conditions in the written procedure under outstanding bond loan are fulfilled.

More detailed information on press release: https://www.acroud.com/en/cision/BFA11E679533580B/

• Acroud announced on 14 February 2024 that it has successfully completed the previously announced restructuring. As a result company's debt was reduced and Acroud owns 100% of all subsidiaries in the group.

More detailed information on press release:

https: //www.acroud.com/en/cision/C0D3BDFFF842A0BD/

• Acroud announced on 20 February 2025 a voluntary debt to equity swap offer to the bondholders of its outstanding bonds.

More detailed information on press release:

https: //www.acroud.com/en/cision/DDA243A298067636/

• Acroud announced on 11 March 2025 that the voluntary debt to equity swap offer has ended as the acceptance period expired and that no Bondholder elected to participate in the voluntary debt to equity swap offer.

More detailed information on press release:

https: //www.acroud.com/en/cision/1DA3EFBDD90A733B/

Important events after the quarter

• Acroud initiates written procedures under outstanding bond loans.

More detailed information on press release:

https: //www.acroud.com/en/cision/D5E2B9E4FBBC5516/

CEO comments: Restructure and transformation

The first quarter of 2025 presented mixed results, clearly illustrating both the resilience and adaptability of Acroud in the face of challenging market conditions. Revenue amounted to EUR 9.8 million, representing a modest increase of 3% compared to the same period last year. However, adjusted EBITDA significantly decreased by 64% year-on-year to EUR 0.4 million, reflecting substantial pressures primarily stemming from regulatory changes in Brazil.

The Brazilian market, historically significant for Acroud, implemented new licensing and registration requirements at the beginning of the year. This process led to a temporary but considerable disruption, as player activity notably declined, particularly in January and February. Furthermore, the impact of harsher-than-expected tax conditions further suppressed our profitability within the iGaming Affiliation segment, where revenues decreased by 34% year-on-year to EUR 3.8 million, with EBITDA dropping sharply to EUR 0.2 million. While these impacts were substantial, we remain confident in the long-term potential of this market and have already seen encouraging recovery trends as compliance measures are increasingly embraced by users.

In contrast, our SaaS segment demonstrated strong resilience and encouraging performance, achieving a 62% increase in revenue year-on-year to EUR 6.0 million. EBITDA within this segment grew by 42% to EUR 0.5 million, driven by strong adoption of our Network model and other strategic shifts.

Despite the short-term operational challenges, strategic initiatives taken during this quarter have significantly strengthened Acroud's financial structure. The successful completion of our comprehensive restructuring process marks a pivotal milestone and transformative moment in Acroud's history. This comprehensive initiative included the issuance of approximately SEK 65.3 million in Super Senior Bonds, which provided critical liquidity to bolster our balance sheet and pursue new growth opportunities. Additionally, we successfully converted around SEK 70 million of bond debt into equity, substantially reducing our financial leverage and creating a more sustainable financial framework.

A particularly significant achievement of our restructuring was the acquisition of the remaining 49% of Acroud Media Ltd from RAIE Media for EUR 12 million, paid through a combination of cash and newly issued shares. This critical step has fully consolidated Acroud Media Ltd into our operations, further strengthening our market position and strategic alignment. Following the restructuring, RAIE Media Ltd now holds approximately 39% of Acroud shares, solidifying them as a major strategic partner and aligning stakeholder interests for long-term success. Additionally, PMG, representing SMD Group Ltd., PMG Group A/S, and other affiliates, now holds around 16.3% of our total outstanding shares, further emphasizing stakeholder confidence and the collective commitment to our long-term strategy.

These restructuring efforts have resulted in Acroud achieving full ownership of all subsidiaries, significantly simplifying our corporate structure and enhancing operational efficiency. With clearer governance and streamlined operations, we can now better focus on strategic initiatives aimed at innovation, market expansion, and delivering enhanced shareholder value.

Looking ahead, initial signs of recovery have emerged in April, aligning closely with our budget expectations, and this positive momentum has continued into May. Our tactical and strategic initiatives, especially within the Brazilian market, are beginning to deliver measurable results. Furthermore, ongoing cost-saving measures, including significant administrative cost reductions will further enhance our operational efficiency from the second quarter onwards.

I am incredibly proud of our team's dedication, agility, and perseverance in navigating these challenging times. With our newly fortified financial foundation, strategic clarity, and innovative approach to market challenges, Acroud is exceptionally well-positioned for sustained growth and enhanced profitability in the coming quarters and beyond.

Thank you for your continued support and trust in our journey.

Join the Ride!

Robert Andersson, President, CEO

27 May 2025

Responsible parties

This information constitutes inside information that Acroud AB (publ) is required to disclose under the EU Market Abuse Regulation 596/2014. The information in this press release has been published through the agency of the contact persons below, at the time specified by Acroud AB's (publ) news distributor Cision for publication of this press release. The persons below may also be contacted for further information.

For further information, please contact:

Robert Andersson, President and CEO

+356 9999 8017

Andrzej Mieszkowicz, CFO

+356 9911 2090

ACROUD AB (publ)

Telephone: +356 9999 6019

E-mail:info@acroud.com

Website: www.acroud.com

Certified Adviser: FNCA Sweden AB, info@fnca.se

From May 2024 (Q1 Report) Acroud has changed reporting and company language to English. This means that Interim Reports and the correlated press releases will be issued in English only.

About ACROUD AB

ACROUD is a fast-growing global challenger that operates and develops comparison and news sites within Poker, Sports Betting and Casino. Acroud also offers SaaS solutions for the iGaming affiliate industry. In past years, a number of companies have joined the ride and thus several experienced individuals in the industry leads Acroud's journey to become "The Mediahouse of The Future". Our mission is to connect people, Content Creators (Youtubers, Streamers, Affiliates) and businesses. We are growing fast and remain a leading global player in the industry with just over 70 people in Malta, United Kingdom, Denmark and Sweden. Acroud has been listed on the Nasdaq First North Growth Market since June 2018.