Double-Digit Annual Total Revenue Growth Led by Music Publishing

Continued Expansion of Portfolio Across Genres and Geographies

Fiscal 2026 Financial Outlook Expects Mid-Single-Digit Top & Bottomline Growth

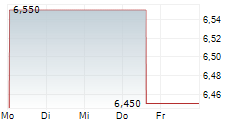

NEW YORK, NY / ACCESS Newswire / May 28, 2025 / Reservoir Media, Inc. (NASDAQ:RSVR) ("Reservoir" or the "Company"), an award-winning independent music company, today announced financial results for the fourth quarter and full year for fiscal 2025 ended March 31, 2025.

Fiscal Year 2025 Highlights:

Revenue of $158.7 million, increased 7% organically, or 10% including acquisitions year-over-year

Music Publishing Revenue increased 12% year-over-year

Recorded Music Revenue increased by 4% year-over-year

Operating Income of $35.1 million, an increase of 43% year-over-year

OIBDA ("Operating Income Before Depreciation & Amortization") of $61.4 million, an increase of 24% year-over-year

Net Income $7.7 million, or $0.12 per diluted share, 11 cents higher than the prior year period

Adjusted EBITDA of $65.7 million, up 18% year-over-year

Signed publishing deals with Snoop Dogg and Death Row Records, k.d. lang, Wrabel, Travis Heidelman, Jon Decious, Aaron Zuckerman, Jeff Trott, Lewis Thompson, and Omar Kamal, among others

Struck deals for rights to the publishing catalog of Lebo M and recorded music catalog of Jack Douglas

Acquired the publishing catalogs of Lastrada Entertainment, Big D Evans, and Billy Strange

Fourth Quarter 2025 & Recent Highlights:

Revenue of $41.4 million, increased 4% organically, or 6% including acquisitions year-over-year

Music Publishing Revenue increased 6% year-over-year

Recorded Music Revenue increased 7% year-over-year

Operating Income of $10.4 million, increased 19% year-over-year

OIBDA of $17.2 million, an increase of 14% year-over-year

Net Income of $2.7 million versus $2.9 million in the year-ago period, or $0.04 per diluted share

Adjusted EBITDA of $18.2 million, an increase of 14% year-over-year

Expanded recorded music business with the acquisition of U.K. dance and electronic label New State

Signed publishing deal with five-time Grammy-nominated R&B songwriter and performer El DeBarge

Launched Off Road Records in partnership with hit country writer-producer David Fanning

Strengthened international footprint with new Mumbai-based subsidiary, PopIndia, and a publishing deal with YouTube star Yohani

Management Commentary:

"Fiscal 2025 was a year marked by significant strategic capital deployment, expanding Reservoir's portfolio and geographic footprint. In addition to notable publishing deals with Snoop Dogg, k.d. lang, and many more, we executed several important acquisitions across the publishing and recorded businesses. In particular, the additions of U.K. dance and electronic label New State and publishing catalog Lastrada Entertainment were key scale drivers of growth, showcasing the team's depth of expertise and our platform's solid infrastructure for ingesting meaningful large-scale catalogs," said Golnar Khosrowshahi, Founder and Chief Executive Officer of Reservoir Media.

Khosrowshahi continued, "Following this past year's double-digit topline growth, we have begun fiscal 2026 with financial and operational strength. The recent launch of our new subsidiary, PopIndia, positions us to further amplify Reservoir's international presence. With expertise now based in Mumbai, we look forward to building on our existing efforts across the Middle East and North Africa, and bolstering our reputation as best-in-class partners in these markets. Whether signing active writers, acquiring assets or expanding territories, we remain firm in our overarching strategy to identify high-quality assets with significant return potential while maintaining a prudent approach to cost management."

Fourth Quarter & Fiscal Year 2025 Financial Results

Summary Financials |

| Q4'25 |

|

| Q4'24 |

|

| Change |

|

| FY25 |

|

| FY24 |

|

| Change |

| ||||||

Total Revenue |

| $ | 41.4 |

|

| $ | 39.1 |

|

|

| 6 | % |

| $ | 158.7 |

|

| $ | 144.9 |

|

|

| 10 | % |

Music Publishing Revenue |

| $ | 27.9 |

|

| $ | 26.4 |

|

|

| 6 | % |

| $ | 107.4 |

|

| $ | 96.2 |

|

|

| 12 | % |

RecordedMusic Revenue |

| $ | 12.0 |

|

| $ | 11.2 |

|

|

| 7 | % |

| $ | 44.3 |

|

| $ | 42.4 |

|

|

| 4 | % |

Operating Income |

| $ | 10.4 |

|

| $ | 8.8 |

|

|

| 19 | % |

| $ | 35.1 |

|

| $ | 24.6 |

|

|

| 43 | % |

OIBDA |

| $ | 17.2 |

|

| $ | 15.1 |

|

|

| 14 | % |

| $ | 61.4 |

|

| $ | 49.6 |

|

|

| 24 | % |

Net Income |

| $ | 2.7 |

|

| $ | 2.9 |

|

|

| (5 | )% |

| $ | 7.7 |

|

| $ | 0.8 |

|

| NM |

| |

Adjusted EBITDA |

| $ | 18.2 |

|

| $ | 16.0 |

|

|

| 14 | % |

| $ | 65.7 |

|

| $ | 55.6 |

|

|

| 18 | % |

| (Table Notes: $ in millions; Quarters ended March 31st; Unaudited; NM = Not meaningful) | |||||||||||||||||||||||

Total Revenue in the fourth quarter of fiscal 2025 increased 6% to $41.4 million, compared to $39.1 million in the fourth quarter of fiscal 2024. The increase was spread across both Music Publishing and Recorded Music, which saw growth of 6% and 7%, respectively.Total Revenue for fiscal 2025 increased 10% to $158.7 million, compared to $144.9 million in fiscal 2024. The year-over-year improvement was driven by the 12% growth of the Music Publishing segment, inclusive of the acquisitions of various catalogs.

Operating Income in the fourth quarter of fiscal 2025 was $10.4 million, an increase of 19% compared to Operating Income of $8.8 million in the fourth quarter of fiscal 2024. OIBDA in the fourth quarter of fiscal 2025 increased 14% to $17.2 million, compared to $15.1 million in the prior year quarter. Adjusted EBITDA in the fourth quarter of fiscal 2025 was $18.2 million, compared to $16.0 million last year. The increases in Operating Income, OIBDA, and Adjusted EBITDA in the fourth quarter were primarily driven by strong revenue and gross margin results in both segments. The gain in all three metrics was partially offset by higher administration expenses, while the increase in operating income was partially offset by higher Amortization and Depreciation expense.

Operating Income in fiscal 2025 was $35.1 million, an increase of 43% compared to Operating Income of $24.6 million in fiscal 2024. OIBDA in fiscal 2025 increased 24% to $61.4 million, compared to $49.6 million in the prior year. Adjusted EBITDA in fiscal 2025 increased 18% to $65.7 million, compared to $55.6 million last year. The increase in Operating Income, OIBDA, and Adjusted EBITDA for the year was driven by revenue growth and higher gross margin. Additionally, Operating Income and OIBDA benefited from the nonrecurrence of a recoupable legal fee write-off. See below for calculations and reconciliations of OIBDA and Adjusted EBITDA to Operating Income and Net Income, respectively.

Net Income in the fourth quarter of fiscal 2025 was $2.7 million, or $0.04 per share, compared to $2.9 million, or $0.04 per share, in the year-ago quarter. The decrease in Net Income for the fourth quarter was driven by a loss on the fair value of swaps and higher interest expense versus the fourth quarter of fiscal 2024, partially offset by higher operating income. Net Income in fiscal year 2025 was $7.7 million, or $0.12 per diluted share, compared to $0.8 million, or $0.01 per share in fiscal year 2024. The year-over-year increase in net income was largely due to an increase in operating income, partially offset by a loss on fair value of interest rate swaps and an increase in income tax expense.

Fourth Quarter & Fiscal Year 2025 Segment Review

Music Publishing |

| Q4'25 |

|

| Q4'24 |

|

| Change |

|

| FY25 |

|

| FY24 |

|

| Change |

| ||||||

Revenue by Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Digital |

| $ | 13.6 |

|

| $ | 13.0 |

|

|

| 5 | % |

| $ | 60.5 |

|

| $ | 51.6 |

|

|

| 17 | % |

Performance |

| $ | 6.5 |

|

| $ | 7.5 |

|

|

| (13 | )% |

| $ | 21.1 |

|

| $ | 22.8 |

|

|

| (7 | )% |

Synchronization |

| $ | 5.5 |

|

| $ | 3.6 |

|

|

| 51 | % |

| $ | 18.2 |

|

| $ | 15.1 |

|

|

| 20 | % |

Mechanical |

| $ | 1.2 |

|

| $ | 1.2 |

|

|

| (6 | )% |

| $ | 3.9 |

|

| $ | 3.4 |

|

|

| 13 | % |

Other |

| $ | 1.2 |

|

| $ | 1.0 |

|

|

| 15 | % |

| $ | 3.7 |

|

| $ | 3.3 |

|

|

| 14 | % |

Total Revenue |

| $ | 27.9 |

|

| $ | 26.4 |

|

|

| 6 | % |

| $ | 107.4 |

|

| $ | 96.2 |

|

|

| 12 | % |

Operating Income |

| $ | 5.7 |

|

| $ | 4.3 |

|

|

| 33 | % |

| $ | 18.7 |

|

| $ | 9.9 |

|

|

| 88 | % |

OIBDA |

| $ | 10.5 |

|

| $ | 9.2 |

|

|

| 13 | % |

| $ | 37.3 |

|

| $ | 28.9 |

|

|

| 29 | % |

| (Table Notes: $ in millions; Quarters ended March 31st; Unaudited) | |||||||||||||||||||||||

Music Publishing Revenue in the fourth quarter of fiscal 2025 was $27.9 million, an increase of 6% compared to $26.4 million in last fiscal year's fourth quarter. The increase in Revenue was largely driven by higher Synchronization revenue which was partially offset by lower Performance and Mechanical Revenue. Music Publishing Revenuein fiscal 2025 was $107.4 million, representing an increase of 12% compared to $96.2 million in fiscal 2024. Growth for the year was driven by double-digit gains in all types except for Performance, which had a 7% year-over-year decline.

In the fourth quarter of fiscal 2025, Music Publishing OIBDA increased 13% to $10.5 million, compared to $9.2 million in the fourth quarter of fiscal 2024. During fiscal 2025, Music Publishing OIBDA increased 29% to $37.3 million, compared to $28.9 million in fiscal 2024. Music Publishing OIBDA margin in the fourth quarter increased from 35% to 37%. Music Publishing OIBDA margin in fiscal 2025 increased from 30% to 35%. The increase in the fourth quarter and fiscal 2025 OIBDA margins reflects an increase in gross margin, the non-recurrence of a recoupable legal fee write-off, and improved operating leverage as revenues increased.

Recorded Music |

| Q4'25 |

|

| Q4'24 |

|

| Change |

|

| FY25 |

|

| FY24 |

|

| Change |

| ||||||

Revenue by Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Digital |

| $ | 8.8 |

|

| $ | 7.4 |

|

|

| 19 | % |

| $ | 30.7 |

|

| $ | 26.9 |

|

|

| 14 | % |

Physical |

| $ | 1.3 |

|

| $ | 1.8 |

|

|

| (26 | )% |

| $ | 6.2 |

|

| $ | 8.9 |

|

|

| (31 | )% |

Neighboring Rights |

| $ | 1.1 |

|

| $ | 1.0 |

|

|

| 15 | % |

| $ | 4.2 |

|

| $ | 3.6 |

|

|

| 17 | % |

Synchronization |

| $ | 0.7 |

|

| $ | 0.9 |

|

|

| (29 | )% |

| $ | 3.1 |

|

| $ | 2.9 |

|

|

| 8 | % |

Total Revenue |

| $ | 12.0 |

|

| $ | 11.2 |

|

|

| 7 | % |

| $ | 44.3 |

|

| $ | 42.4 |

|

|

| 4 | % |

Operating Income |

| $ | 4.5 |

|

| $ | 4.1 |

|

|

| 12 | % |

| $ | 15.2 |

|

| $ | 13.2 |

|

|

| 15 | % |

OIBDA |

| $ | 6.5 |

|

| $ | 5.5 |

|

|

| 19 | % |

| $ | 22.7 |

|

| $ | 19.1 |

|

|

| 19 | % |

| (Table Notes: $ in millions; Quarters ended March 31st; Unaudited) | |||||||||||||||||||||||

Recorded Music Revenue in the fourth quarter of fiscal 2025 was $12.0 million, an increase of 7% compared to $11.2 million in last fiscal year's fourth quarter. Recorded Music Revenue in fiscal 2025 was $44.3 million, an increase of 4% compared to $42.4 million in fiscal 2024. Growth in both periods was driven by a double-digit improvement within Digital revenue as the global growth of music streaming continues to be a tailwind, partially offset by lower Physical revenue in both periods and by lower Synchronization revenue in the fourth quarter.

In the fourth quarter of fiscal 2025, Recorded Music OIBDA increased 19% to $6.5 million, versus $5.5 million in the year-ago period. During fiscal 2025, Recorded Music OIBDA increased 19% to $22.7 million, compared to $19.1 million in fiscal 2024. Recorded Music OIBDA margin in the fourth quarter increased from 49% to 54%, and in fiscal 2025 increased from 45% to 51%. The increase in the fourth quarter and fiscal 2025 OIBDA margins reflects an increase in gross margin and improved operating leverage as revenues increased.

Balance Sheet and Liquidity

During fiscal 2025, cash provided by operating activities was $45.3 million, an increase of $9.1 million compared to the same period last fiscal year. The increase in cash provided by operating activities was primarily attributable to an increase in earnings, partially offset by a reduction in cash provided by working capital.

As of March 31, 2025, Reservoir had cash and cash equivalents of $21.4 million and $58.2 million available for borrowing under its revolving credit facility, for total available liquidity of $79.6 million. Total debt was $388.1 million (net of $3.7 million of deferred financing costs) and Net Debt was $366.7 million (defined as total debt, less cash and equivalents and deferred financing costs). This compares to cash and cash equivalents of $18.1 million and $114.2 million available for borrowing under its revolving credit facility, for total available liquidity of $132.3 million as of March 31, 2024. Total debt was $330.8 million (net of $5.0 million of deferred financing costs) and Net Debt was $312.7 million as of March 31, 2024.

Fiscal Year 2026 Outlook

Reservoir initiated the following financial outlook range for fiscal year 2026, and expects the financial results for the year ending March 31, 2026, to be as follows:

Outlook |

| Guidance |

|

| Growth (at mid-point) |

| ||

Revenue |

| $ | 164M - $169M |

|

|

| 5 | % |

Adjusted EBITDA |

| $ | 68M - $72M |

|

|

| 6 | % |

Jim Heindlmeyer, Chief Financial Officer of Reservoir, commented, "The 2025 fiscal year was another record performance for Reservoir. We continued to reap the benefits of our robust investment strategy, sustainably growing our catalog, and further driving growth through our value enhancement practices. We believe fiscal year 2026 will be another year of growth for Reservoir, with 5% expected for Revenue and 6% growth expected for Adjusted EBITDA at the mid-point of our provided guidance range."

Conference Call Information

Reservoir is hosting a conference call for analysts and investors to discuss its financial results for the fourth quarter and fiscal year ended March 31, 2025, and its business outlook at 10:00 a.m. EDT today, May 28, 2025. The conference call can be accessed via webcast in the investor relations section of the Company's website at https://investors.reservoir-media.com/news-and-events/events-and-presentations.

Interested parties may also participate in the call using the following registration link:Here. Once registered, participants will receive a webcast link to enter the event. Alternatively, participants may dial into the call using the following phone number: +1 201-389-0921 (Toll-free: +1 877-407-0989). Shortly after the conclusion of the conference call, a replay of the audio webcast will be available in the investor relations section of Reservoir's website for 30 days after the event.

ABOUT RESERVOIR

Reservoir is an independent music company based in New York City and with offices in Los Angeles, Nashville, Toronto, London, Abu Dhabi, and Mumbai. Reservoir is the first female-founded and led publicly traded independent music company in the U.S. Founded as a family-owned music publisher in 2007, Reservoir represents copyrights and master recordings including titles dating as far back as 1900 and hundreds of #1 releases worldwide. Reservoir frequently holds a Top 10 U.S. Market Share according to Billboard's Publishers Quarterly, was twice named Publisher of the Year by Music Business Worldwide's The A&R Awards and won Independent Publisher of the Year at the 2020 and 2022 Music Week Awards.

Reservoir also represents a multitude of recorded music through Chrysalis Records, Tommy Boy Music, and Philly Groove Records and manages artists through its ventures with Blue Raincoat Music and Big Life Management.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. Forward-looking statements are typically identified by words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "forecast," "intend," "may," "might," "outlook," "plan," "possible," "potential," "predict," "project," "should," "target," "would" and other similar words and expressions. Forward-looking statements in this press release relate to, among other things: Reservoir's anticipated financial condition, results of operations and performance, expected growth, plans and objectives for future operations, business prospects and market conditions. Forward-looking statements are based on the current expectations and beliefs of management and information currently available to management. These statements are inherently subject to a number of risks, uncertainties and assumptions, many of which are outside of our control and could cause future events or results to be materially different from those stated or implied in this press release, including the risk factors that are described in Reservoir's Annual Report on Form 10-K for the year ended March 31, 2025 and our other filings with the SEC available on the SEC's website at www.sec.gov or Reservoir's website at www.reservoir-media.com. Any forward-looking statement made in this press release speaks only as of the date on which it is made and Reservoir undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Reservoir Media, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

Three and Twelve Months Ended March 31, 2025 versus March 31, 2024

(Unaudited)

(Expressed in U.S. dollars)

| Three Months Ended |

|

|

|

|

| Fiscal Year Ended |

|

|

|

| ||||||||||||

| 2025 |

|

| 2024 |

|

| % Change |

|

| 2025 |

|

| 2024 |

|

| % Change |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenues | $ | 41,417,784 |

|

| $ | 39,145,631 |

|

|

| 6 | % |

| $ | 158,705,736 |

|

| $ | 144,855,690 |

|

|

| 10 | % |

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

| 14,249,476 |

|

|

| 14,342,049 |

|

|

| (1 | )% |

|

| 57,430,005 |

|

|

| 55,478,286 |

|

|

| 4 | % |

Amortization and depreciation |

| 6,770,836 |

|

|

| 6,372,662 |

|

|

| 6 | % |

|

| 26,299,233 |

|

|

| 24,985,688 |

|

|

| 5 | % |

Administration expenses |

| 9,977,954 |

|

|

| 9,667,044 |

|

|

| 3 | % |

|

| 39,915,464 |

|

|

| 39,815,892 |

|

|

| - |

|

Total costs and expenses |

| 30,998,266 |

|

|

| 30,381,755 |

|

|

| 2 | % |

|

| 123,644,702 |

|

|

| 120,279,866 |

|

|

| 3 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

| 10,419,518 |

|

|

| 8,763,876 |

|

|

| 19 | % |

|

| 35,061,034 |

|

|

| 24,575,824 |

|

|

| 43 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

| (6,086,654 | ) |

|

| (5,222,389 | ) |

|

|

|

|

|

| (21,883,321 | ) |

|

| (21,087,713 | ) |

|

|

|

|

Gain (loss) on foreign exchange |

| 750,493 |

|

|

| (32,006 | ) |

|

|

|

|

|

| 578,251 |

|

|

| (101,834 | ) |

|

|

|

|

(Loss) gain on fair value of swaps |

| (1,681,378 | ) |

|

| 649,275 |

|

|

|

|

|

|

| (4,213,819 | ) |

|

| (1,124,770 | ) |

|

|

|

|

Other income (expense), net |

| (80,798 | ) |

|

| (99,490 | ) |

|

|

|

|

|

| 329,976 |

|

|

| (1,089,442 | ) |

|

|

|

|

Income before income taxes |

| 3,321,181 |

|

|

| 4,059,266 |

|

|

|

|

|

|

| 9,872,121 |

|

|

| 1,172,065 |

|

|

|

|

|

Income tax expense |

| 600,135 |

|

|

| 1,207,467 |

|

|

|

|

|

|

| 2,140,724 |

|

|

| 334,804 |

|

|

|

|

|

Net income |

| 2,721,046 |

|

|

| 2,851,799 |

|

|

|

|

|

|

| 7,731,397 |

|

|

| 837,261 |

|

|

|

|

|

Net (income) loss attributable to noncontrolling interests |

| (53,584 | ) |

|

| (56,527 | ) |

|

|

|

|

|

| 18,516 |

|

|

| (192,324 | ) |

|

|

|

|

Net income attributable to Reservoir Media, Inc. | $ | 2,667,462 |

|

| $ | 2,795,272 |

|

|

|

|

|

| $ | 7,749,913 |

|

| $ | 644,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic | $ | 0.04 |

|

| $ | 0.04 |

|

|

|

|

|

| $ | 0.12 |

|

| $ | 0.01 |

|

|

|

|

|

Diluted | $ | 0.04 |

|

| $ | 0.04 |

|

|

|

|

|

| $ | 0.12 |

|

| $ | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| 65,248,387 |

|

|

| 64,834,304 |

|

|

|

|

|

|

| 65,161,373 |

|

|

| 64,757,112 |

|

|

|

|

|

Diluted |

| 66,077,568 |

|

|

| 65,600,530 |

|

|

|

|

|

|

| 65,949,366 |

|

|

| 65,255,901 |

|

|

|

|

|

Reservoir Media, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

March 31, 2025 versus March 31, 2024

(Unaudited)

(Expressed in U.S. dollars)

|

| March 31, |

|

| March 31, |

| ||

|

|

|

|

|

|

| ||

Assets |

|

|

|

|

|

| ||

Current assets |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 21,386,140 |

|

| $ | 18,132,015 |

|

Accounts receivable |

|

| 37,848,611 |

|

|

| 33,227,382 |

|

Current portion of royalty advances |

|

| 15,182,463 |

|

|

| 13,248,008 |

|

Other current assets |

|

| 4,867,081 |

|

|

| 6,300,915 |

|

Total current assets |

|

| 79,284,295 |

|

|

| 70,908,320 |

|

|

|

|

|

|

|

|

|

|

Intangible assets, net |

|

| 719,673,219 |

|

|

| 640,222,000 |

|

Equity method and other investments |

|

| 1,100,000 |

|

|

| 1,451,924 |

|

Royalty advances, net of current portion and reserves |

|

| 55,508,155 |

|

|

| 56,527,557 |

|

Property, plant and equipment, net |

|

| 406,784 |

|

|

| 551,410 |

|

Operating lease right of use assets, net |

|

| 5,949,418 |

|

|

| 6,988,340 |

|

Fair value of swap assets |

|

| 1,828,303 |

|

|

| 5,753,488 |

|

Other assets |

|

| 1,376,836 |

|

|

| 1,131,529 |

|

Total assets |

| $ | 865,127,010 |

|

| $ | 783,534,568 |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

| $ | 5,394,755 |

|

| $ | 9,015,939 |

|

Royalties payable |

|

| 47,210,727 |

|

|

| 40,395,205 |

|

Accrued payroll |

|

| 2,588,758 |

|

|

| 2,043,772 |

|

Deferred revenue |

|

| 1,885,462 |

|

|

| 1,163,953 |

|

Other current liabilities |

|

| 7,954,208 |

|

|

| 7,313,615 |

|

Income taxes payable |

|

| 803,342 |

|

|

| 439,152 |

|

Total current liabilities |

|

| 65,837,252 |

|

|

| 60,371,636 |

|

|

|

|

|

|

|

|

|

|

Secured line of credit |

|

| 388,134,754 |

|

|

| 330,791,607 |

|

Deferred income taxes |

|

| 38,228,099 |

|

|

| 30,471,978 |

|

Operating lease liabilities, net of current portion |

|

| 5,723,930 |

|

|

| 6,720,287 |

|

Fair value of swap liability |

|

| 410,008 |

|

|

| 121,374 |

|

Other liabilities |

|

| 593,185 |

|

|

| 572,705 |

|

Total liabilities |

|

| 498,927,228 |

|

|

| 429,049,587 |

|

|

|

|

|

|

|

|

|

|

Contingencies and commitments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

|

|

|

Preferred stock |

|

| - |

|

|

| - |

|

Common stock |

|

| 6,524 |

|

|

| 6,483 |

|

Additional paid-in capital |

|

| 344,145,789 |

|

|

| 341,388,351 |

|

Retained earnings |

|

| 23,147,570 |

|

|

| 15,397,657 |

|

Accumulated other comprehensive loss |

|

| (2,422,107 | ) |

|

| (3,797,733 | ) |

Total Reservoir Media, Inc. shareholders' equity |

|

| 364,877,776 |

|

|

| 352,994,758 |

|

Noncontrolling interest |

|

| 1,322,006 |

|

|

| 1,490,223 |

|

Total shareholders' equity |

|

| 366,199,782 |

|

|

| 354,484,981 |

|

Total liabilities and shareholders' equity |

| $ | 865,127,010 |

|

| $ | 783,534,568 |

|

Supplemental Disclosures Regarding Non-GAAP Financial Measures

This press release includes certain financial information, such as OIBDA, OIBDA margin, EBITDA, Adjusted EBITDA, and Net Debt, which has not been prepared in accordance with United States generally accepted accounting principles ("GAAP"). Reservoir's management uses these non-GAAP financial measures to evaluate Reservoir's operations, measure its performance and make strategic decisions. Reservoir believes that the use of these non-GAAP financial measures provides useful information to investors and others in understanding Reservoir's results of operations and trends in the same manner as Reservoir's management and in evaluating Reservoir's financial measures as compared to the financial measures of other similar companies, many of which present similar non-GAAP financial measures. However, these non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by Reservoir's management about which items are excluded or included in determining these non-GAAP financial measures and, therefore, should not be considered as a substitute for net income, operating income or any other operating performance measures calculated in accordance with GAAP. Using such non-GAAP financial measures in isolation to analyze Reservoir's business would have material limitations because the calculations are based on the subjective determination of Reservoir's management regarding the nature and classification of events and circumstances. In addition, although other companies in Reservoir's industry may report measures titled OIBDA, OIBDA margin, Adjusted EBITDA, and Net Debt, or similar measures, such non-GAAP financial measures may be calculated differently from how Reservoir calculates such non-GAAP financial measures, which reduces their overall usefulness as comparative measures. Because of these limitations, such non-GAAP financial measures should be considered alongside other financial performance measures and other financial results presented in accordance with GAAP. You can find the reconciliation of these non-GAAP financial measures to the nearest comparable GAAP measures in the tables below.

OIBDA

Reservoir evaluates operating performance based on several factors, including its primary financial measure of operating income before non-cash depreciation of tangible assets and non-cash amortization of intangible assets ("OIBDA"). Reservoir considers OIBDA to be an important indicator of the operational strengths and performance of its businesses and believes this non-GAAP financial measure provides useful information to investors because it removes the significant impact of amortization from Reservoir's results of operations. However, a limitation of the use of OIBDA as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in Reservoir's businesses and other non-operating income (loss). Accordingly, OIBDA should be considered in addition to, not as a substitute for, operating income, net income attributable to us and other measures of financial performance reported in accordance with GAAP. In addition, our definition of OIBDA may differ from similarly titled measures used by other companies. OIBDA Margin is defined as OIBDA as a percentage of revenue.

EBITDA and Adjusted EBITDA

EBITDA is defined as earnings (net income or loss) before net interest expense, income tax (benefit) expense, non-cash depreciation of tangible assets and non-cash amortization of intangible assets and is used by management to measure operating performance of the business. Adjusted EBITDA, in addition to adjusting net income to exclude income tax expense, interest expense and depreciation and amortization, further adjusts net income by excluding items or expenses such as, among others, (1) any non-cash charges (including any impairment charges and loss on early extinguishment of debt and to write-down an equity investment to its estimated fair value), (2) any net gain or loss on foreign exchange, (3) any net gain or loss resulting from interest rate swaps, (4) equity-based compensation expense and (5) certain unusual or non-recurring items.

Adjusted EBITDA is a key measure used by Reservoir's management to understand and evaluate operating performance, generate future operating plans, and make strategic decisions regarding the allocation of capital. However, certain limitations on the use of Adjusted EBITDA include, among others, (1) it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue for Reservoir's business, (2) it does not reflect the significant interest expense or cash requirements necessary to service interest or principal payments on Reservoir's indebtedness and (3) it does not reflect every cash expenditure, future requirements for capital expenditures or contractual commitments. In particular, Adjusted EBITDA measure adds back certain non-cash, unusual or non-recurring charges that are deducted in calculating net income; however, these are expenses that may recur, vary greatly and are difficult to predict. In addition, Adjusted EBITDA is not the same as net income or cash flow provided by operating activities as those terms are defined by GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs.

Net Debt

Reservoir defines Net Debt as total debt, less cash and equivalents and deferred financing costs.

Reservoir Media, Inc. and Subsidiaries

Reconciliation of Operating Income to OIBDA

Three and Twelve Months Ended March 31, 2025 versus March 31, 2024

(Unaudited)

(Dollars in thousands)

|

| For the Three Months Ended March 31, |

|

| For the Fiscal Year Ended March 31, |

| ||||||||||

|

| 2025 |

|

| 2024 |

|

| 2025 |

|

| 2024 |

| ||||

Operating Income |

| $ | 10,419 |

|

| $ | 8,764 |

|

| $ | 35,061 |

|

| $ | 24,576 |

|

Amortization and Depreciation Expense |

|

| 6,771 |

|

|

| 6,373 |

|

|

| 26,299 |

|

|

| 24,986 |

|

OIBDA |

| $ | 17,190 |

|

| $ | 15,137 |

|

| $ | 61,360 |

|

| $ | 49,562 |

|

Reservoir Media, Inc. and Subsidiaries

Reconciliation of Music Publishing Segment Reporting Operating Income to OIBDA

Three and Twelve Months Ended March 31, 2025 versus March 31, 2024

(Unaudited)

(Dollars in thousands)

|

| For the Three Months Ended March 31, |

|

| For the Fiscal Year Ended March 31, |

| ||||||||||

|

| 2025 |

|

| 2024 |

|

| 2025 |

|

| 2024 |

| ||||

Operating Income |

| $ | 5,670 |

|

| $ | 4,277 |

|

| $ | 18,654 |

|

| $ | 9,918 |

|

Amortization and Depreciation Expense |

|

| 4,782 |

|

|

| 4,946 |

|

|

| 18,691 |

|

|

| 18,966 |

|

OIBDA |

| $ | 10,452 |

|

| $ | 9,223 |

|

| $ | 37,345 |

|

| $ | 28,884 |

|

Reservoir Media, Inc. and Subsidiaries

Reconciliation of Recorded Music Segment Reporting Operating Income to OIBDA

Three and Twelve Months Ended March 31, 2025 versus March 31, 2024

(Unaudited)

(Dollars in thousands)

|

| For the Three Months Ended March 31, |

|

| For the Fiscal Year Ended March 31, |

| ||||||||||

|

| 2025 |

|

| 2024 |

|

| 2025 |

|

| 2024 |

| ||||

Operating Income |

| $ | 4,531 |

|

| $ | 4,063 |

|

| $ | 15,237 |

|

| $ | 13,216 |

|

Amortization and Depreciation Expense |

|

| 1,965 |

|

|

| 1,403 |

|

|

| 7,512 |

|

|

| 5,925 |

|

OIBDA |

| $ | 6,496 |

|

| $ | 5,466 |

|

| $ | 22,749 |

|

| $ | 19,141 |

|

Reservoir Media, Inc. and Subsidiaries

Reconciliation of Net Income to Adjusted EBITDA

Three and Twelve Months Ended March 31, 2025 versus March 31, 2024

(Unaudited)

(Dollars in thousands)

|

| For the Three Months Ended March 31, |

|

| For the Fiscal Year Ended March 31, |

| ||||||||||

|

| 2025 |

|

| 2024 |

|

| 2025 |

|

| 2024 |

| ||||

Net Income |

| $ | 2,721 |

|

| $ | 2,852 |

|

| $ | 7,731 |

|

| $ | 837 |

|

Income Tax Expense |

|

| 600 |

|

|

| 1,208 |

|

|

| 2,141 |

|

|

| 335 |

|

Interest Expense |

|

| 6,086 |

|

|

| 5,223 |

|

|

| 21,883 |

|

|

| 21,088 |

|

Amortization and Depreciation |

|

| 6,771 |

|

|

| 6,373 |

|

|

| 26,299 |

|

|

| 24,986 |

|

EBITDA |

|

| 16,178 |

|

|

| 15,656 |

|

|

| 58,054 |

|

|

| 47,246 |

|

(Gain) Loss on Foreign Exchange(a) |

|

| (750 | ) |

|

| 32 |

|

|

| (578 | ) |

|

| 102 |

|

Loss (Gain) on Fair Value of Swaps(b) |

|

| 1,682 |

|

|

| (649 | ) |

|

| 4,214 |

|

|

| 1,125 |

|

Non-cash Share-based Compensation(c) |

|

| 1,051 |

|

|

| 847 |

|

|

| 4,385 |

|

|

| 3,387 |

|

Recoupable Legal Fee Write-off(d) |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 2,695 |

|

Other (Income) Expense, Net(e) |

|

| 81 |

|

|

| 99 |

|

|

| (330 | ) |

|

| 1,089 |

|

Adjusted EBITDA |

| $ | 18,242 |

|

| $ | 15,985 |

|

| $ | 65,745 |

|

| $ | 55,644 |

|

(a) Reflects the (gain) loss on foreign exchange fluctuations.

(b) Reflects the non-cash loss or (gain) on the mark-to-market of interest rate swaps.

(c) Reflects non-cash share-based compensation expense related to the Reservoir Media, Inc. 2021 Omnibus Incentive Plan.

(d) Reflects the write-off of recoupable legal expenses and attorneys' fees. This non-recurring item relates to the resolution of a matter, which began in 2017, that was settled through mediation requiring Reservoir to expense legal fees from prior years that the Company had previously expected to recoup, resulting in a one-time write-off.

(e) Reflects the Company's share of proceeds related to underreported royalty usage for acquired Recorded Music catalogs that pertained to periods prior to the Company's acquisition of the catalogs ("Recovery Income") and a non-cash impairment expense to write-down an equity investment to its estimated fair value ("2025 Investment Write-down") during the three months ended March 31, 2025. Reflects Recovery Income, 2025 Investment Write-down and a gain recorded on the disposal of an equity investment, partially offset by the Company's share of losses recorded by an equity method investment during the twelve months ended March 31, 2025. Reflects non-cash impairment expense to write-down an equity investment to its estimated fair value during the twelve months ended March 31, 2024.

Media Contact

Reservoir Media, Inc.

Suzy Arrabito

Vice President, Marketing & Communications

sa@reservoir-media.com

www.reservoir-media.com

Investor Contact

Alpha IR Group

Jackie Marcus or Nathan Skown

RSVR@alpha-ir.com

SOURCE: Reservoir Media, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/publishing-and-media/reservoir-media-announces-fourth-quarter-and-fiscal-year-2025-results-1032315