AKRON (dpa-AFX) - The Goodyear Tire & Rubber Company (GT), Thursday announced that it has initiated a public offering of $500 million in senior unsecured notes due in five years. The offering is part of Goodyear's broader plan to manage its debt obligations.

Proceeds from the offering, along with existing cash, will be used to fully redeem the company's outstanding $900 million in 5.000 percent senior notes due 2026. Of that amount, $400 million is scheduled for redemption on June 30, 2025, funded partly by cash received from the recent sale of the Dunlop brand.

A group of major financial institutions, including Deutsche Bank, BofA Securities, and Goldman Sachs, are leading the offering as joint book-running managers. The notes will be offered under a shelf registration statement.

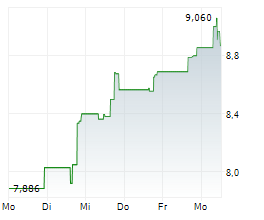

GT is currently trading at $11.44, down $0.11 or 0.91 percent on the Nasdaq.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News