First quarter 2025 (compared to first quarter 2024)

- Net sales for the quarter decreased to MSEK 6 (13)

- Gross margin for the quarter increased to 69% (67%)

- Operating loss amounted to MSEK -13 (-14)

- Net income for the period decreased to MSEK -37 (-2)

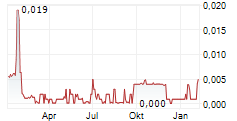

- Earnings per share before and after dilution decreased to SEK -0.02 (0.00)

Events after the reporting period

- On 29 April 2025, the company launched inq, a new consumer brand featuring redesigned smartpens, notebooks, accessories, and software. The product line integrates handwriting with digital technology using advanced AI recognition. Pre-orders began in the U.S. with fulfilment initially expected from early May. However, the fulfilment of pre- orders has been delayed until the start of June. The launch marks a strategic expansion in B2C sales and does not materially impact the financial statements for the reporting period.

- On 29 April 2025, the company announced that it has entered into a convertible loan agreement with two of its major shareholders. Under the terms of the agreement, the lenders will provide a secured loan of USD 750,000 with conversion rights. Proceeds from the loan will be used to accelerate the manufacture, launch, and marketing of Anoto's new digital pen and software platform, branded under the name "inq." The loan will be repaid in twelve (12) equal monthly instalments beginning on October 22, 2025, with a final maturity date of October 22, 2026. The outstanding principal will accrue interest at a rate of 10.00% per annum. Interest is payable on the final maturity date unless converted into ordinary shares of Anoto. Each lender has the right to request conversion of all or part of the outstanding loan amount, including accrued interest, into newly issued ordinary shares of the Company. The conversion price is fixed at SEK 0.15 per share, representing a 66.67% premium to quota value, with a fixed exchange rate of SEK 9.65/USD applied for conversion purposes. The loan is secured under a convertible investment agreement. The security package includes a first-ranking floating charge of SEK 20 million over the assets of Anoto AB, and a share pledge over Anoto AB's shares in KAIT Knowledge AI Holdings Pte. Ltd.

The report for January - March 2025 is available in its entirety on the following address: https://www.anoto.com/investors/reports/

For further information contact:

Kevin Adeson, Chairman of the Board of Directors

For more information about Anoto, visit www.anoto.com or email ir@anoto.com

Anoto Group AB (publ), Reg.No. 556532-3929, Flaggan 1165, 116 74 Stockholm

This information constitutes inside information as Anoto Group AB (publ) is obliged to disclose under the EU Market Abuse Regulation 596/2014. The information was provided by the contact person above for publication on 30 May 2025 at 20:00 CEST.

About Anoto Group

Anoto Group AB (Nasdaq Stockholm: ANOT) is a publicly held Swedish technology company and the original inventor of the digital pen and dot pattern technology. Anoto develops intelligent pens, paper and software that seamlessly bridge handwritten input and the digital world. Its core business lines include 'inq' and 'Livescribe' retail products as well as enterprise workflow solutions. Anoto's smartpens are used globally by students, professionals, and organizations to enhance productivity, creativity, and data capture. With a renewed focus on high-quality design, software innovation, and customer experience, Anoto is driving the next generation of digital writing.