Interim Report January - June 2025

Second Quarter 2025 (compared to second quarter 2024)

- Net sales for the quarter amounted to MSEK 4 (6)

- Gross margin for the quarter increased to 53% (38%)

- Operating loss amounted to MSEK -21 (-16)

- Earnings per share before and after dilution increased to SEK -0.02 (-0.04)

- On April 29, lenders issued a USD 750,000 secured loan with conversion rights to fund the launch of Anoto's "inq" pen and software. Repayable in 12 monthly installments from October 22, 2025, to October 22, 2026, it accrues 10% annual interest, payable at maturity unless converted into shares at SEK 0.15 (SEK 9.65/USD). Security includes a SEK 20 million floating charge on Anoto AB assets and a share pledge in KAIT Knowledge AI Holdings Pte. Ltd. On 20 June, a further USD 250,000 was raised under the same terms.

- On 27 June 2025 the AGM was held for Anoto Group. The AGM approved the 2024 financial statements, resolved not to distribute a dividend, and discharged the Board and CEO from liability. Kevin Adeson was re-elected as Chair alongside returning members Alexander Fällström, Gary Stolkin, and Adrian Weller, with Matthew Doerner elected as a new member; BDO was reappointed as auditor. Shareholders also approved updated executive remuneration guidelines, the 2024 remuneration report, and a new long-term incentive program (LTIP 2025). The Board was granted authorisations to issue shares and other instruments, including those required to fulfil LTIP 2025 and other incentive programs.

Events after the reporting period:

- The Green Mango dispute has now been finalized: Against Anoto Korea's provision of USD 150,000 (1,447 KSEK) plus a further provision of USD 50,000 (482 KSEK) of legal costs. The court ordered Anoto Korea to pay the plaintiff (Green Mango Corp.) 924 KSEK (?133,905,000), plus interest calculated at 6% per annum from 3 March 2022 to 11 November 2022, and then 12% per annum thereafter until the date of full payment. Litigation costs are apportioned between the parties, with the plaintiff bearing 3/5 and the defendant the remainder. Final legal costs have not yet been received.

- After the end of the reporting period, Anoto Group AB entered into a promissory note agreement with Achilles Capital AB for a loan of USD 400,000. This loan provided support for working capital while pursuing additional financing for the global expansion of the inq brand. When USD 600,000 of additional financing is obtained by 14 September 2025, this note will change into a Convertible Loan, on substantially the same terms as the Company's existing convertible financing, as set out in the press release dated June 20, 2025; otherwise, the loan, including accrued interest at an annual rate of 8%, will become due and payable.

January - June 2025 (compared to Jan-Jun 2024)

- Net sales for the period amounted to MSEK 10 (19)

- Gross margin for the period increased to 63% (58%)

- Operating loss increased to MSEK -34 (-30)

- Earnings per share before and after dilution remained SEK -0.04 (-0.04)

The report for January - June 2025 is available in its entirety on the following address: https://www.anoto.com/investors/reports/

For further information contact:

Mats Karlsson, CEO of Anoto Group AB (publ)

E-mail: mats.karlsson@anoto.com

For more information about Anoto, please visit www.anoto.com or email ir@anoto.com

Anoto Group AB (publ), Reg.No. 556532-3929, Flaggan 1165, 116 74 Stockholm

This information constitutes inside information as Anoto Group AB (publ) is obliged to disclose under the EU Market Abuse Regulation 596/2014. The information was provided by the contact person above for publication on 29 August 2025 at 23:00 CEST.

About Anoto Group

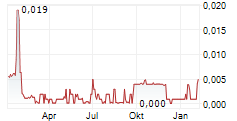

Anoto Group AB (Nasdaq Stockholm: ANOT) is a publicly held Swedish technology company and the original inventor of the digital pen and dot pattern technology. Anoto develops intelligent pens, paper and software that seamlessly bridge handwritten input and the digital world. Its core business lines include inq and Livescribe retail products as well as enterprise workflow solutions. Anoto's smartpens are used globally by students, professionals, and organizations to enhance productivity, creativity, and data capture. With a renewed focus on high-quality design, software innovation, and customer experience, Anoto is driving the next generation of digital writing.