Asset Value Investors ("AVI") has sent an open letter to the Supervisory Board of Gerresheimer AG ("Gerresheimer") calling for it to make changes to its financial leadership. You can find the published letter here

AVI invested in Gerresheimer in 2024 and manages a 3.5% stake on behalf of institutional clients.

Gerresheimer holds a valuable position in the Containment Solutions Delivery Systems industry, with high barriers to entry and attractive long-term growth prospects. These have been reaffirmed in 2025 with reports of private equity interest in Gerresheimer.

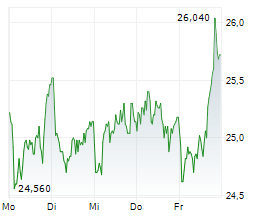

This value is not currently reflected in its shares, which trade at a substantial discount to their sum-of-the-parts. The shares now sit some -56% below their 52-week high. Shareholder value is at risk.

AVI believes that:

- New financial leadership is required to repair the relationship with the market and restore credibility.

- Gerresheimer should establish a capital allocation committee to oversee and review the Company's capital allocation and capital structure.

- Gerresheimer should look to exit Moulded Glass.

Time is of the essence and a new and improved plan for Gerresheimer should be presented at a capital markets day later this year.

Joe Bauernfreund, CEO and CIO of AVI, commented:

"Gerresheimer is a leading player in the Containment Solutions and Delivery Systems industry, which offers attractive growth. We believe that Gerresheimer should benefit from this.

"We understand the market's scepticism surrounding Gerresheimer and we believe that these steps are the key to unlocking value and repairing its relationship with the market."

Wilfrid Craigie, Senior Investment Analyst at AVI, added:

"Despite the strategic transformation to move Gerresheimer higher up the value chain, we believe that the market is assigning Gerresheimer a large discount, leading to its current valuation.

"We believe that Gerresheimer's current valuation is being dragged down by Moulded Glass, and the best way to improve its financial profile and valuation is to perform a swift strategic review to exit it."

About Asset Value Investors:

AVI is an investment management company established in London, United Kingdom, in 1985. AVI has invested in Global and Japanese equities for nearly 40 years. AVI manages AVI Global Trust plc ("AGT"), AVI Japan Opportunity Trust plc ("AJOT"), and MIGO Opportunities Trust ("MIGO"). AGT, AJOT, MIGO are public companies whose shares are listed and traded on the main market of the London Stock Exchange.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250606959093/en/

Contacts:

Quill PR AVI@quillpr.com