DJ Coinsilium Group Limited: Forza! Bitcoin Treasury Update

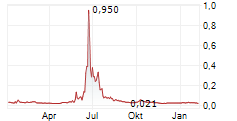

Coinsilium Group Limited (COIN)

Coinsilium Group Limited: Forza! Bitcoin Treasury Update

16-Jun-2025 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Coinsilium Group Limited

("Coinsilium" or the "Company")

Forza! Bitcoin Treasury Update

Gibraltar, 16 June 2025 - Coinsilium Group Limited (AQSE: COIN | OTCQB: CINGF), is pleased to provide an update on its

Bitcoin treasury activity and that of its wholly owned Gibraltar subsidiary, Forza Gibraltar Limited ("Forza!"),

established to implement the Company's dedicated Bitcoin-focused treasury operations.

Details of the latest Bitcoin acquisition are as follows:

-- Number of Bitcoin Purchased: 6.5577

-- Average Purchase Price: GBP77,770.36 per Bitcoin (USD105,572.30 per Bitcoin)

-- Total Purchase Amount: GBP510,000

As of the date of this announcement, Forza!'s total Bitcoin holdings stand at 25.2392 Bitcoin.

Summary of Forza!'s Bitcoin Holdings to Date:

-- Total Bitcoin Holdings: 25.2392 Bitcoin

-- Aggregate Average Purchase Price: GBP79,701.69 per Bitcoin (USD107,622.48 per Bitcoin)

-- Total Value of Holdings: GBP1,962,695.09 (USD2,662,609.40)

All Bitcoin purchases are being conducted in accordance with the Company's Bitcoin Treasury Policy.

The Directors of Coinsilium Group Limited take responsibility for this announcement.

Coinsilium Group Limited +350 2000 8223

Malcolm Palle, Executive Chairman +44 (0)7785 381 089

Eddy Travia, Chief Executive www.coinsilium.com

Peterhouse Capital Limited

+44 (0)20 7469 0930

(AQUIS Growth Market Corporate Adviser and Corporate Broker)

SI Capital Limited (Joint Broker) +44 (0)1483 413 500

Nick Emerson

Oberon Capital (Joint Broker)

+44 (0)20 3179 5300

Nick Lovering, Adam Pollock

OAK Securities (Joint Broker)

Tel. +44 (0)20 3973 3678

Damion Carruel, Calvin Man

Notes to Editors

About Coinsilium

Coinsilium is an investor, advisor and venture builder at the forefront of Web3 convergence. The Company invests in and accelerates Web3 and AI-powered technology start-ups whilst supporting their development and commercialisation.

Coinsilium also provides strategic advisory services to start-ups looking to issue tokens through token generation events. Coinsilium's wholly owned subsidiary, Coinsilium (Gibraltar) Limited, serves as the Company's operational hub in Gibraltar.

In 2025, the Company launched Forza Gibraltar Limited, its wholly owned Gibraltar-based subsidiary focused on accumulating and holding Bitcoin.

In 2015, Coinsilium became the first blockchain company to IPO. Coinsilium shares are traded on the AQSE Growth Market in London, under the ticker symbol "COIN", and on the OTCQB Venture Market in the United States under the ticker symbol "CINGF".

Important Notice

Coinsilium Group Limited ("Coinsilium" or "the Company") holds part of its reserves in Bitcoin through its wholly owned Gibraltar-based subsidiary, Forza (Gibraltar) Limited ("Forza"), which is responsible for managing the Company's Bitcoin treasury.

The Financial Conduct Authority ("FCA") regards digital assets such as Bitcoin as high-risk and speculative, with potential for extreme price volatility. An investment in Coinsilium Group Limited is not an investment in Bitcoin, either directly or by proxy. Coinsilium holds a range of assets, including equity interests in companies operating within and beyond the blockchain sector, and maintains a diversified portfolio of strategic investments across the digital asset space. This structure provides broader exposure beyond Bitcoin. The Company's exposure to Bitcoin forms part of its broader capital allocation strategy.

Coinsilium is not authorised or regulated by the FCA. While the Board of Directors considers Bitcoin to be an appropriate long-term reserve asset, prospective and existing investors should be aware of the associated risks. There is no certainty that the Company will be able to realise its Bitcoin holdings at expected valuations, and the financial performance of the Company may be affected by movements in the price of Bitcoin. As a result of the Company's exposure to Bitcoin, the market value of Coinsilium shares may also experience significant fluctuations, and the value of investments can go down as well as up.

The decision to allocate capital into Bitcoin, facilitated through the Company's dedicated treasury management structure, Forza, reflects a strategic view of Bitcoin as a long-term reserve asset. This approach is underpinned by over a decade of experience operating in the digital asset sector. The Company is aware of the particular risks Bitcoin presents to its financial position, which include but are not limited to:

(i) Volatility: Bitcoin is subject to significant price fluctuations, and its value can decline sharply over short periods, just as it can appreciate. Investors should be aware of the potential for substantial losses.

(ii) Lack of Regulation: The Bitcoin market operates with minimal regulatory supervision in many jurisdictions. This increases the risk of financial loss arising from events such as cyber breaches, illicit activity, or the failure of counterparties.

(iii) Liquidity Risk: The Company's ability to liquidate its Bitcoin holdings is not guaranteed and may be subject to constraints. Factors that could affect this include market conditions at the time of sale, availability of counterparties, and unforeseen disruptions such as liquidity shortfalls, system outages, or cybersecurity incidents.

(iv) Reputational and Security Concerns: The cryptoasset sector continues to face reputational challenges, including associations with fraud, money laundering, and cyber-related threats. These concerns are not unfounded, particularly in certain areas of the market. However, based on over a decade of operational experience in the virtual assets industry, the Company has developed a deep understanding of the real-world risks and has established practices to navigate them responsibly-particularly in relation to Bitcoin.

Prospective investors are strongly encouraged to conduct their own research and carefully consider these risks before making any investment decision.

Nothing herein amounts to a recommendation to invest in the Company or to investment, taxation or legal advice. For further detail, please refer to the Company's Bitcoin Treasury Policy and Strategic Plan.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse Regulation (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: VGG225641015 Category Code: MSCM TIDM: COIN Sequence No.: 392677 EQS News ID: 2155202 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2155202&application_name=news&site_id=dow_jones%7e%7e%7ebed8b539-0373-42bd-8d0e-f3efeec9bbed

(END) Dow Jones Newswires

June 16, 2025 02:00 ET (06:00 GMT)