Fingerprint Cards AB (publ) held its Annual General Meeting today on June 24, 2025 in Stockholm. A summary of the resolutions passed by the Meeting is set out below.

Dividend

The Meeting resolved that no dividend be paid.

Board of Directors and Auditors

The Meeting discharged the directors of the Board and the managing director from liability in relation to the company for the period 1 January - 31 December 2024.

The Meeting re-elected Christian Lagerling and Adam Philpott as Board Members, and elected John Lord and Carl Johan Grandinson as Board members. Christian Lagerling was re-elected as Chairman of the Board of Directors.

The Meeting resolved that Board remuneration shall be SEK 675,000 to the Chairman of the Board and SEK 295,000 to each other Member of the Board. No remuneration shall be paid to a Board member that is employed and paid by the Company. No fee for work on committees shall be paid. It is noted that the adjusted Board remuneration implies a significant cost saving for the Company.

The Meeting resolved to re-elect BDO Mälardalen AB, with Authorized Public Accountant Johan Pharmanson as Auditor-in-Charge, as auditor up until the end of the next Annual General Meeting.

The Meeting resolved that remuneration of auditors shall be paid in accordance with approved invoices.

Remuneration report

The Meeting resolved to approve the Board of Directors' report over remuneration regarding 2024 according to Chapter 8, Section 53 a of the Swedish Companies Act.

Authorization of the Board to decide on the repurchase and transfer of class B treasury shares

The Meeting resolved, in accordance with the proposal of the Board of Directors, to authorize the Board to repurchase, on one or several occasions up until the next Annual General Meeting, as many class B shares in the company as may be purchased without the company's holding at any time exceeding ten (10) per cent of the total number of outstanding shares in the company. The Board of Directors was also authorized to resolve, on one or several occasions up until the next Annual General Meeting, to transfer the company's class B shares, with deviation from the shareholders' preferential rights.

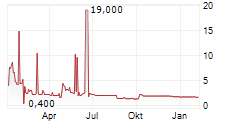

Amendment of articles of association, a reverse share split and transfer of Class B treasury shares

The Meeting resolved, in accordance with the Board of Directors' proposals, to amend the articles of association in order to enable a reverse share split. Furthermore, the Meeting resolved on a reverse share split of the Company's shares where 2,000 existing shares shall be consolidated to one share. After the reverse share split has been completed, the number of shares and votes in the Company, based on the current number of outstanding shares, will decrease from 15,175,375,766 shares (7,875,000 A-shares and 15,167,500,766 B-shares) and 15,246,250,766 votes to 7,587,687 shares (3,937 A-shares and 7,583,750 B-shares) and 7,623,120 votes. The Board of Directors were authorized to determine the record date for the reverse share split. The Meeting also resolved to authorize the Board to transfer, free of charge and deviating from the shareholders' preferential rights, a maximum of 520,000 Class B treasury shares to the shareholders whose holding of class B shares on the record date does not correspond to a full number of new class B shares, i.e. is not evenly divisible by 2,000. The reason for the deviation from the shareholders' preferential right is to be able to carry out the reverse share split.

A separate press release will be published once the Board of Directors has determined the record date for the reverse share split.

Authorization of the Board to resolve on the issue of new shares with or without preferential rights for the shareholders

The Meeting resolved to authorize the Board of Directors to resolve, on one or several occasions up until the next Annual General Meeting, with or without deviation from the shareholders' preferential rights, on new issues of class B shares, warrants and/or convertibles entitling to subscription of class B shares corresponding to no more than twenty (20) percent of the total number of outstanding shares in the company.

Establishment of long-term incentive programs

The Meeting resolved to approve the Board of Directors' proposal to implement an employee stock option program for employees within Fingerprint Cards ("Employee Stock Option Program 2025/2028") and on a directed issue of no more than 265,595 warrants (after the implementation of the reverse share split) and approval of transfer of warrants to participants in Employee Stock Option Program 2025/2028. The Employee Stock Option Program 2025/2028 comprises no more than 265,595 options with the right to subscribe for B-shares during 1 September 2028 to 1 November 2028 at a price corresponding to 150 percent of the volume-weighted average price according to Nasdaq Stockholm's official price list for Fingerprint Cards' Class B shares during the first ten (10) trading days immediately following the record date for the reverse share split.

The Meeting also resolved to approve a shareholders' proposal to implement an Employee Stock Option Program for the Board of Fingerprint Cards ("Employee Stock Option Program 2025/2029"). The Employee Stock Option Program 2025/2029 comprises no more than 113,815 options (after the implementation of the reverse share split) with the right to subscribe for B-shares during 1 September 2029 to 1 November 2029 at a price corresponding to 175 percent of the volume-weighted average price according to Nasdaq Stockholm's official price list for Fingerprint Cards' Class B shares during the first ten (10) trading days immediately following the record date for the reverse share split. The Meeting did not resolve in accordance with the proposal on a directed issue and transfer of warrants to the participants. The shareholders proposing the program and the nomination committee will evaluate alternatives in order to deliver shares under the program.

For further information, please contact:

Investor Relations:

+46(0)10-172 00 10

investrel@fingerprints.com

Press:

+46(0)10-172 00 20

press@fingerprints.com

| About FPC Fingerprint Cards AB (FPC) is a global biometrics leader, offering intelligent edge to cloud biometrics. We envision a secure, seamless world where you are the key to everything. Our solutions - trusted by enterprises, fintechs, and OEMs - power hundreds of millions of products, enabling billions of secure, convenient authentications daily across devices, cards, and digital platforms. From consumer electronics to cybersecurity and enterprise, our cloud-based identity management platforms support multiple biometric modalities, including fingerprints, iris, facial, and more. With improved security and user experience, we are driving the world to passwordless. Discover more at our website and follow us on LinkedIn and X for the latest updates. FPC is listed on Nasdaq Stockholm (FING B). |