NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

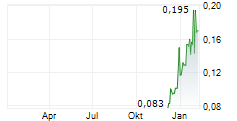

CALGARY, AB / ACCESS Newswire / June 26, 2025 / CANEX Metals Inc. ("CANEX" or the "Company") (TSX.V:CANX) is pleased to announce that it has closed its previously announced non-brokered private placement (the "Private Placement") of 23,636,380 common shares ("Common Shares") for gross proceeds of $1,300,000.90. The Common Shares were issued at a price of $0.055 per Common Share and are subject to a hold period of four months plus one day from the date of closing.

The Common Shares were offered on a non-brokered basis by way of private placement to accredited investors and no commissions were paid to investment dealers in connection with the Private Placement. The Private Placement is subject to final acceptance of the TSX Venture Exchange.

Certain insiders purchased a total of 1,139,054 Common Shares in connection with the Private Placement. The Company has relied on exemptions from the formal valuation and minority shareholder approval requirements contained in Sections 5.5(a) and 5.7(1)(a) of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101") as the participation in the Private Placement by the insiders does not exceed 25% of the fair market value of the market capitalization of the Company as determined in accordance with MI 61-101.

Proceeds of the Private Placement will be used to advance the district consolidation opportunity as announced by the Company on June 9, 2025, for exploration at the Company's Gold Range and Louise projects, and for general working capital.

About CANEX Metals

CANEX Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing its 100% owned Gold Range Project in Northern Arizona. With several near surface bulk tonnage gold discoveries made to date across a 4 km gold mineralized trend, the Gold Range Project is a compelling early-stage opportunity for investors. CANEX is also advancing the Louise Copper-Gold Porphyry deposit in British Columbia. The Louise Copper-Gold Porphyry contains a large historic copper-gold resource that has seen very little deep or lateral exploration, offering investors copper and gold discovery potential. CANEX is led by an experienced management team which has made three notable porphyry and bulk tonnage discoveries in North America and is sponsored by Altius Minerals (TSX: ALS), a large shareholder of the Company.

Dr. Shane Ebert P.Geo., is the Qualified Person for CANEX Metals and has approved the technical disclosure contained in this news release.

"Shane Ebert"

Shane Ebert

President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: http://www.canexmetals.ca

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "intends", "would", "believes", "will", "may", "expects" and similar expressions, constitute forward-looking information within the meaning of applicable Canadian securities laws and represent management's internal projections, expectations or beliefs concerning, among other things, the use of proceeds and the final acceptance of the TSX Venture Exchange with respect to the Private Placement. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, the ability to obtain regulatory approvals (including approval of the TSX-V and the securities commissions); the changes in general economic conditions in Canada, the United States and elsewhere, and those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: CANEX Metals Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/canex-closes-equity-financing-1043431