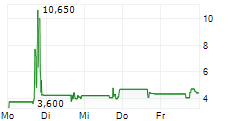

BEIJING, June 27, 2025 (GLOBE NEWSWIRE) -- Julong Holding Limited ("Julong" or the "Company") (Nasdaq: JLHL), a growth-oriented provider of intelligent integrated solutions, today announced the closing of its initial public offering (the "Offering") of 1,250,000 Class A ordinary shares, at a public offering price of US$4.00 per share (the "Offering Price"). The Company's Class A ordinary shares began trading on the Nasdaq Capital Market on June 26, 2025, under the ticker symbol "JLHL."

The aggregate gross proceeds from the Offering were US$5.0 million, before deducting underwriting discounts and other related expenses. The Company intends to use the net proceeds for (i) pursuing strategic acquisitions and investment opportunities to strengthen its market position and further enhancing its competitiveness in the intelligent integrated solutions industry, (ii) expanding into a wider customer base and more geographical markets in mainland China and internationally, (iii) investment in research and development to expand the capabilities of its technology in both hardware and software domains, and (iv) general corporate purposes.

In addition, the Company has granted the underwriter an option, exercisable within 45 days from the date of the Offering, to purchase up to an aggregate of 187,500 additional Class A ordinary shares at the Offering Price, less underwriting discounts and commissions.

US Tiger Securities, Inc. acted as the sole book-runner for the Offering.

A registration statement related to these securities has been filed with, and declared effective by, the United States Securities and Exchange Commission. This press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

This offering is being made only by means of a prospectus forming part of the effective registration statement. The final prospectus relating to the Offering was filed with the SEC and is available on the SEC's website at www.sec.gov. Copies of the final prospectus relating to the Offering may be obtained, when available, by contacting US Tiger Securities, Inc. at 437 Madison Avenue, 27th Floor, New York, NY 10022, United States, or by telephone at +1-646-978-5188, or by email at ECM@ustigersecurities.com.

About Julong

Founded in 1997, Julong is a growth-oriented professional provider of intelligent integrated solutions to public utilities, commercial properties, and multifamily residential properties operating at scale in China. The Company's comprehensive suite of intelligent integrated solutions includes systems for intelligent security, fire protection, parking, toll collection, broadcasting, identification, data room, emergency command, and city management. Since its inception, Julong has focused on the successful and on-time execution of complex projects, through its "deliveries before deadline" and "customers first" initiatives. As Julong continues to cross-sell its service and solution offerings and advance its purpose-built technologies, the Company is well-positioned to achieve economies of scale and capture future opportunities.

For more information, please visit: ir.julongzx.com.

Forward-Looking Statements

This press release contains statements that may constitute "forward-looking" statements which are made pursuant to the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements relating to the anticipated size of the initial public offering and the expected trading commencement and closing dates. These forward-looking statements can be identified by terminology such as "will," "would," "may," "expects," "anticipates," "aims," "future," "continues," "could," "should," "target," "intends," "plans," "believes," "estimates," "likely to," and similar expressions. Statements that are not historical facts, including statements about the Company's beliefs, plans, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: uncertainties related to market conditions, the satisfaction of customary closing conditions related to the initial public offering, the completion of the initial public offering on the anticipated terms, or at all, and other factors discussed in the "Risk Factors" section of the preliminary and final prospectus that forms a part of the effective registration statement filed with the Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Investor Relations:

Email: ir@julongzx.com

The Piacente Group, Inc.

Jenny Cai

Tel: +86 (10) 6508-0677

Email: julong@thepiacentegroup.com

In the United States:

The Piacente Group, Inc.

Brandi Piacente

Tel: +1-212-481-2050

Email: julong@thepiacentegroup.com