WASHINGTON (dpa-AFX) - Nektar Therapeutics (NKTR), a clinical-stage biotech firm specializing in immunotherapy, has priced its underwritten public offering of approximately $100 million in common stock.

The company will issue 4,255,320 shares at $23.50 per share, with gross proceeds expected to be around $100 million before underwriting discounts and offering expenses.

Additionally, underwriters have a 30-day option to purchase up to 638,298 more shares at the same price, excluding underwriting fees. The offering, which includes only Nektar-issued securities, is expected to close on July 2, 2025, subject to customary conditions.

Proceeds from the offering will be used for general corporate purposes, including R&D, clinical development, and manufacturing costs to advance the company's pipeline of drug candidates.

The securities are being offered under an effective shelf registration statement filed with the SEC in March 2025. The final prospectus supplement will be filed with the SEC and made available on www.sec.gov, as well as through Jefferies and Piper Sandler upon request.

Nektar noted the announcement does not constitute an offer or solicitation in any jurisdiction where such actions would be unlawful prior to appropriate registration or qualification.

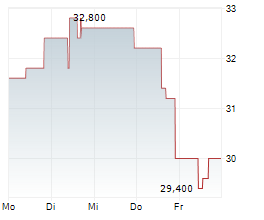

Wednesday, NKTR closed at $25.53, up 3.82%, and edged up to $25.62 after hours, gaining 0.35% on the NasdaqCM.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News