Original-Research: Vossloh AG - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Vossloh AG

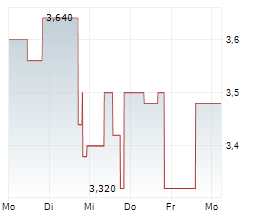

Driving Infrastructure Growth Following a change of analyst, we are raising our price target to EUR 102, applied by our ROE/COE valuation approach, and reiterate our Buy rating. The management has clearly defined the targets for the current financial year (based on the current group structure, Sales revenues of between EUR 1,250-1,325m; EBIT of between EUR 110-120m) and the consolidation of the Sateba acquisition is only a matter of time. The last time the company surpassed the EUR 100m EBIT/Operating result mark, the stock followed with a strong upward trend, climbing over EUR 90. This price movement highlighted the close correlation between operating profitability and market valuation. Investors rewarded the company's sustained earnings momentum and strong order intake with a significant re-rating of the stock. If Vossloh manages to cross this milestone again on a sustainable basis - as it forecasts for FY 2025 in EBIT - it could send a similar signal to the market and unlock further upside potential. Amid growing public focus on planned infrastructure investments in Germany, Vossloh shares have seen a significant uptick in trading volume. This has led to improved liquidity - despite the continued influence of a major shareholder. A potential technical catalyst: if the share price exceeds EUR 103.70, Vossloh's free float market capitalization would surpass EUR 1bn. This could trigger additional momentum, potentially through heightened interest from institutional investors. The company benefits from global infrastructure investment tailwinds and increased rail spending driven by sustainability goals. With robust fundamentals, technological edge, and shareholder returns, Vossloh offers an attractive mid-cap industrial growth story. We recommend to Buy. You can download the research here: VOSSLOH_AG_202507071 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2166374 07.07.2025 CET/CEST

© 2025 EQS Group