Net Asset Value Anticipated to be $9.00 to $9.50 Per Share

Board of Directors Declares $0.25 Per Share Cash Dividend

NEW YORK, July 08, 2025 (GLOBE NEWSWIRE) -- SuRo Capital Corp. ("SuRo Capital", the "Company", "we", "us", and "our") (Nasdaq: SSSS) today provided the following preliminary update on its investment portfolio for the second quarter ended June 30, 2025.

"The second quarter was SuRo Capital's best quarter since inception, as measured by the appreciation in NAV per share," said Mark Klein, Chairman and Chief Executive Officer of SuRo Capital. "Our performance was largely driven by the public and private markets recognizing the value proposition of AI infrastructure companies. CoreWeave's IPO, coupled with its post-IPO performance, led the way. Additionally, OpenAI announced a landmark $40.0 billion financing round at a $300.0 billion post-money valuation, the largest private capital raise ever by a technology company. It has been reported that Canva is preparing for a secondary tender at a $37.0 billion valuation and Colombier Acquisition Corp. II is nearing completion of a proposed merger with GrabAGun, further building on SuRo Capital's SPAC sponsor strategy success. These developments resulted in an NAV per share uplift of over 35% for the quarter," Klein added.

Mr. Klein further emphasized, "Beyond these high-profile capital raises, we remain committed to backing some of the world's most innovative and sought-after private companies ahead of their public market debuts. In April, we completed a new $5.0 million investment in Plaid (through a wholly owned SPV), a market-leading fintech platform that enables secure, seamless connectivity between financial applications and consumers, with an estimated reach of 1 in every 2 adults in the U.S."

"As a result of this strong performance and momentum across our portfolio, we are pleased to announce that our Board of Directors has declared an initial dividend of $0.25 per share. This dividend is driven by successful monetizations of SuRo Capital's public securities. Based on ongoing portfolio activity, we anticipate declaring additional dividends throughout the year. As always, we will keep you informed about our dividend strategy as we gain more clarity on the timing and magnitude," Mr. Klein concluded.

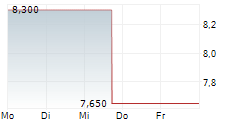

As previously reported, SuRo Capital's net assets totaled approximately $156.8 million, or $6.66 per share, at March 31, 2025, and approximately $162.3 million, or $6.94 per share at June 30, 2024. As of June 30, 2025, SuRo Capital's net asset value is estimated to be between $9.00 and $9.50 per share.

Investment Portfolio Update

As of June 30, 2025, SuRo Capital held positions in 36 portfolio companies - 33 privately held and 3 publicly held.

During the three months ended June 30, 2025, SuRo Capital made the following investment:

| Portfolio Company | Investment | Transaction Date | Amount(1) |

| Plaid Inc.(2) | Class A Common Shares | 4/4/2025 | $5.0 million |

___________________

(1) Amount invested does not include capitalized costs, origination fees, or prepaid expenses.

(2) SuRo Capital's investment in the Class A Common Shares of Plaid Inc. was made through 1789 Capital Nirvana II LP, an SPV in which SuRo Capital is the Sole Limited Partner. SuRo Capital paid a 7% origination fee at the time of investment.

During the three months ended June 30, 2025, SuRo Capital exited and received proceeds from the following investments:

| Portfolio Company | Transaction Date | Quantity | Average Net Share Price(1) | Net Proceeds | Realized Gain | |

| CoreWeave, Inc.(2) | Various | 222,240 | $113.99 | $25.3 million | $15.3 million | |

| ServiceTitan, Inc.(3) | Various | 151,515 | $105.07 | $15.9 million | $5.9 million | |

__________________

(1) The average net share price is the net share price realized after deducting all commissions and fees on the sale(s), if applicable.

(2) As of June 20, 2025, SuRo Capital had sold the entirety of its directly held CoreWeave, Inc. public common shares. As of June 30, 2025 SuRo Capital continues to hold the entirety of its interest in CW Opportunity 2 LP.

(3) As of June 27, 2025, SuRo Capital had sold its entire position in ServiceTitan, Inc. public common shares.

SuRo Capital's liquid assets were approximately $52.4 million as of June 30, 2025, consisting of cash and directly-held securities of publicly traded portfolio companies.

As of June 30, 2025, there were 23,888,107 shares of the Company's common stock outstanding.

Recent Dividend Declarations and Certain Information Regarding the Dividends

On July 3, 2025, SuRo Capital's Board of Directors declared a dividend of $0.25 per share payable on July 31, 2025 to the Company's common stockholders of record as of the close of business on July 21, 2025. The dividend will be paid in cash.

The date of declaration and amount of any dividends, including any future dividends, are subject to the sole discretion of SuRo Capital's Board of Directors.

The aggregate amount of the dividends declared and paid by SuRo Capital will be fully taxable to stockholders. The tax character of SuRo Capital's dividends cannot be finally determined until the close of SuRo Capital's taxable year (December 31). SuRo Capital will report the actual tax characteristics of each year's dividends annually to stockholders and the IRS on Form 1099-DIV subsequent to year-end.

Registered stockholders with questions regarding declared dividends may call Equiniti Trust Company, LLC at 800-937-5449.

Preliminary Estimates and Guidance

The preliminary financial estimates provided herein are unaudited and have been prepared by, and are the responsibility of, the management of SuRo Capital. Neither our independent registered public accounting firm, nor any other independent accountants, have audited, reviewed, compiled, or performed any procedures with respect to the preliminary financial data included herein. Actual results may differ materially.

The Company expects to announce its second quarter ended June 30, 2025 results in August 2025.

Forward-Looking Statements

Statements included herein, including statements regarding SuRo Capital's beliefs, expectations, intentions, or strategies for the future, may constitute "forward-looking statements". SuRo Capital cautions you that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected or implied in these statements. All forward-looking statements involve a number of risks and uncertainties, including the impact of any market volatility that may be detrimental to our business, our portfolio companies, our industry, and the global economy, that could cause actual results to differ materially from the plans, intentions, and expectations reflected in or suggested by the forward-looking statements. Risk factors, cautionary statements, and other conditions which could cause SuRo Capital's actual results to differ from management's current expectations are contained in SuRo Capital's filings with the Securities and Exchange Commission. SuRo Capital undertakes no obligation to update any forward-looking statement to reflect events or circumstances that may arise after the date of this press release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly traded investment fund that seeks to invest in high-growth, venture-backed private companies. The fund seeks to create a portfolio of high-growth emerging private companies via a repeatable and disciplined investment approach, as well as to provide investors with access to such companies through its publicly traded common stock. Since inception, SuRo Capital has served as the public's gateway to venture capital, offering unique access to some of the world's most innovative and sought-after private companies before they become publicly traded. SuRo Capital's diverse portfolio encompasses high-growth sectors including AI infrastructure, emerging consumer brands, and cutting-edge software solutions for both consumer and enterprise markets, among others. SuRo Capital is headquartered in New York, NY and has an office in San Francisco, CA. Connect with the company on X, LinkedIn, and at www.surocap.com.

Contact

SuRo Capital Corp.

(212) 931-6331

IR@surocap.com

Media Contact

Deborah Kostroun

Zito Partners

SuRoCapitalPR@zitopartners.com