New Assay Results from Jake Lee Claims Confirms Recent Discovery

MIRAMICHI, NB / ACCESS Newswire / July 9, 2025 / SLAM Exploration Ltd. (TSXV:SXL) ("SLAM" or the "Company") is pleased to report additional gold assay results from its wholly owned Jake Lee mineral claims, located in southwestern New Brunswick. The results were obtained from grab samples collected during the 2025 trenching program.

Eight grab samples were collected from a mineralized quartz vein exposed in bedrock within the first trench of the season (Trench JT25-01). These samples returned assay values from 7.42 grams per tonne ("g/t") to 94.80 g/t gold. The following table summarizes the assay results for all eight (8) samples:

| Sample |

| Location |

| Description |

| Au G/T |

| ||

|

| 458222 |

| JT25-01 |

| QV 15-20 cm wide. 2% Cp-Py-Gn-Bn. |

|

| 37.9 |

|

|

| 458223 |

| JT25-01 |

| QV 15-20 cm wide. 2% Cp-Py-Gn-Bn. |

|

| 26.4 |

|

|

| 458224 |

| JT25-01 |

| QV 3-5 cm wide. 2% Cp-Py-Gn-Bn. |

|

| 94.8 |

|

|

| 458225 |

| JT25-01 |

| QV 15-20 cm wide. 4% Cp-Py-Gn-Bn. |

|

| 12.7 |

|

|

| 458226 |

| JT25-01 |

| QV 5-10 cm wide. 2% Cp-Py-Gn-Bn. |

|

| 10.1 |

|

|

| 458227 |

| JT25-01 |

| QV 15-20 cm wide. 4% Cp-Py-Gn-Bn. |

|

| 92.7 |

|

|

| 458228 |

| JT25-01 |

| QV 15-20 cm wide. 4% Cp-Py-Gn-Bn. |

|

| 50.4 |

|

|

| 458229 |

| JT25-01 |

| QV 15-20 cm wide. 4% Cp-Py-Gn-Bn. |

|

| 7.42 |

|

*Abbreviations: Cp-Chalcopyrite, Py-Pyrite, Gn-Galena, Bn-Bornite.

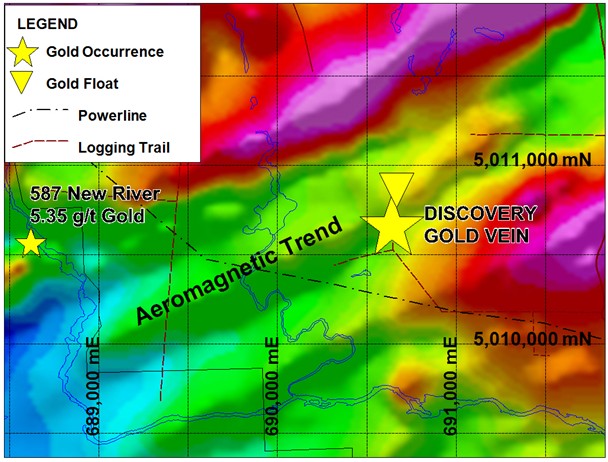

Eight grab samples were collected from the newly identified gold vein previously reported by Slam on May 20, 2025. These samples were taken taken from a bedrock vein in Trench JT25-01 and returned assay values ranging from 7.42 g/t to 94.80 g/t gold. The new gold discovery occurs on the flank of a 2,800 meter long aeromagnetic anomaly as shown on Figure 1.

According to the NBDNRE website, the New River Gold Occurrence 587 is a placer gold occurrence that dates back to the 1960's. In 1998, a bedrock discovery by prospectors produced grab samples grading up to 5.35 g/t gold. Slam's Discovery Gold Vein is located 2,000 meters east of the New River gold occurrence as shown on Figure 1.

Figure 1: Aeromagnetics - Gold Occurrences - Discovery Gold Vein Site

Additional samples collected during the 2025 prospecting and trenching program have been submitted to Activation Laboratories Ltd. ("Actlabs") in Fredericton, New Brunswick, for gold analysis. Assay results for these samples are pending.

Cautionary Statement: Grab and float samples are selective by nature and may not be representative of the overall mineralization on the property.

QA-QC Procedures: The eight reported grab samples were collected from exposed bedrock in trench JT25-01 and delivered directly to Actlabs in Fredericton, New Brunswick for analysis. All samples were processed using Procedure 1A2 (fire assay with atomic absorption finish). Samples exceeding detection limited were reanalyzed using Procedure 1A3 (gravimetric finish).

Figure 1 is derived from SLAM's internal technical files and illustrates both SLAM's results and historical data from previous operators.

Historical data is sourced from public disclosures, including news releases filed on SEDAR+ and Reports of Work published on the New Brunswick Department of Natural Resources and Energy Development (NBDNRE) website. SLAM's exploration data referenced herein has also been disclosed in prior news releases available on SEDAR+ and at www.slamexploration.com.

Corporate Update - Resignation of Director/CFO

The Company announces that Mr. Eugene Beukman has resigned as a Director and as Chief Financial Officer, effective June 30, 2025. The Board of Directors extends its sincere gratitude to Mr. Beukman for his many years of dedicated service to SLAM. Mike Taylor, President and CEO, stated, "I personally want to thank Eugene for his long standing commitment to the Company and wish him continued success in all his future endeavours". A search process is underway to identify a successor CFO, and further updates will be provided as appropriate.

Exploration Update - Goodwin IP Survey

The Company is conducting an Induced Polarization ("IP") geophysical survey over the Granges, Farquharson and Logan zones located on SLAM's wholly owned Goodwin copper- nickel-cobalt claims in the Bathurst Mining Camp ("BMC") of New Brunswick.

This program follows encouraging results from the 2024 diamond drilling campaign, in which 15 drill holes intercepted significant copper, nickel, and cobalt mineralization. Highlights include:

Granges Zone: Drill hole GW2402 returned a core interval of 64.90 metres grading 1.49% copper equivalent ("CuEq")

Farquharson Zone: Drill hole GW2403 intersected 60.60 metres grading 0.84% CuEq.

These CuEq values incorporate an 85% recovery rate, as disclosed in the Company news release date June 30, 2025.

About SLAM Exploration Ltd: SLAM Exploration Ltd. is a publicly listed resource company with a 40,000-hectare portfolio of mineral claim holdings in the mineral-rich province of New Brunswick. The 2025 exploration campaign is in progress on SLAM's contiguous Jake Lee, Roger Lake and Love Lake projects. As reported above, the Company has made a new gold discovery with grab samples grading 7.42 to 94.80 g/t gold.

SLAM drilled 2 holes and cut multiple gold-bearing veins were on its wholly owned Menneval gold project in 2024. The Company previously reported gold bearing core intervals including 162.5 g/t gold over 0.2 m and 56.90 g/t gold over 0.5 m in news releases on December 13, 2021 and November 22, 2022.

The Company is a project generator and expects to receive significant cash and share payments in 2025. SLAM received $9,000 cash and 1,200,000 shares from Nine Mile Metals Inc. (NINE) on February 28, 2025 pursuant to the Wedge project agreement. On March 29, 2025, the Company received a cash payment of $60,000 as well as 180,000 shares of a private company pursuant to the Ramsay gold agreement. The Company holds NSR royalties and expects to receive additional cash and share payments on the Wedge copper zinc project and on the Ramsay gold project.

To view SLAM's corporate presentation, click SXL-Presentation. Additional information is available on SLAM's website and on SEDAR+ at www.sedarplus.ca. Follow us on X @SLAMGold.

Qualifying Statements: Mike Taylor P.Geo, President and CEO of SLAM Exploration Ltd., is a qualified person as defined by National Instrument 43-101, and has approved the contents of this news release.

FORWARD LOOKING INFORMATION

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements regarding: the results and interpretation of exploration activities, including trenching and drilling; expectations regarding assay results from pending samples; the timing and scope of future exploration programs; the potential for new discoveries on the Jake Lee, Roger Lake, Love Lake and Menneval projects; the significance of gold values obtained from grab samples; the planned induced polarization surveys on the Goodwin property; the receipt of future cash and share payments under existing option or royalty agreements; and the potential future value of SLAM's NSR royalty interests.

Forward-looking information is based on assumptions that may prove to be incorrect, including assumptions regarding: the reliability of historical and current exploration data; that mineralization encountered in grab samples and drill core is indicative of potential economic quantities; that planned exploration activities will be completed as scheduled; that the Company will continue to have access to capital and to skilled personnel; and that partner companies will meet their obligations under property agreements.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied in such information. These risks include, but are not limited to: the inherent risks of mineral exploration and development; fluctuations in commodity prices; risks related to title, permits and access; environmental risks; operating risks; delays in obtaining or failure to obtain required approvals; and risks related to joint venture and option counterparties failing to meet obligations.

Readers are cautioned not to place undue reliance on forward-looking information. SLAM disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

CONTACT INFORMATION:

Mike Taylor, President & CEO

Contact: 506-623-8960 mike@slamexploration.com

SEDAR+: 00012459E

SOURCE: SLAM Exploration Ltd.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/slam-reports-gold-assays-from-7.42-to-94.80-g%2ft-gold-and-announces-resignation-of-1047088