- H1 2025 revenue of €7.5 million (compared to €10.6 million in H1 2024), reflecting the impact of the divestiture of the "Data Acceleration Platform" Enterprise business unit;

- Strategic refocus on the "semiconductor" business, which posted strong growth in H1 2025;

- Significant improvement in profitability expected in 2025, with positive EBITDA as early as the first half;

- Signing of the second phase of the industrial cooperation agreement with Openchip, focused on key European sovereignty issues in the field of Artificial Intelligence (AI);

- Extension of liquidity horizon to June 30th, 2026;

- Publication of the 2024 Annual Financial Report and request for trading resumption.

Grenoble, July 10th, 2025 - Kalray (Euronext Growth Paris: ALKAL) a leader in hardware and software technologies dedicated to the management and intensive processing of data from the Cloud to the Edge, provides an update on its first-half 2025 revenue and outlook. The 2024 Annual Financial Report has been filed and enables the company to request the resumption of trading.

Éric Baissus, Chairman of the Executive Board of Kalray, stated:

" The first half of 2025 has been a pivotal period for Kalray, marked by the divestment of our software services division to DataCore Software, a major player in storage technologies, and the signing of our strategic industrial cooperation agreement with Openchip in the semiconductor business. These two key milestones reflect our strategy to focus on our DPU development activity, where we bring high added value and anticipate growing demand as AI moves into large-scale production. They also demonstrate the strength of our technology and our ability to bounce back after a particularly challenging year in 2024. Kalray now benefits from an extended liquidity horizon, enabling us to fully concentrate on our roadmap - particularly our collaboration with Openchip on the development of a new generation of Kalray's DPU to address major technological sovereignty challenges in the AI market."

H1 2025 Revenue - Positive EBITDA Expected

At the end of the first half of 2025, Kalray posted revenue of €7,533K[1], compared to €10,791K in the same period last year. This figure includes one month of revenue from its Enterprise business unit called "Data Acceleration Platform," which was sold on February 5th, 2025[2] and the contribution from the intellectual property licensing agreement with Openchip2.

Kalray recalls that it sold its "Data Acceleration Platform" business unit - including all assets related to its Ngenea offering and approximately 80 employees - to U.S.-based company DataCore Software, a major player in data storage and protection technologies. As of June 30th, 2025, the company has 128 employees, compared to 230 a year earlier.

It is worth noting that the semiconductor business - which is now the Group's core business - showed strong growth during the period, reaching €5,366K in H1 2025, up from €1,143K in H1 2024.

For FY2025, Kalray expects annual revenue to decline by approximately 35%, reflecting the divestiture of its Enterprise business, which accounted for more than 80% of revenue in 2024. However, this shift is expected to drive a significant improvement in profitability, due to the strategic refocus on the semiconductor segment. EBITDA is expected to be positive as early as the first half and should continue to improve in the second half, supported in particular by contributions from the Openchip agreement and reduced operating expenses.

Signing of the Second Phase of the Industrial Cooperation Agreement with Openchip Focused on Key AI Challenges

Kalray announced today, via press release[3], that it has signed the second phase of its industrial cooperation agreement with Openchip. The agreement covers a service agreement with a total value of €10 million, aimed at developing a new version of Kalray's DPU specifically designed for next-generation high-performance computing systems and AI Gigafactories.

For further details, please refer to the press release issued today.

Extension of Liquidity Horizon

Considering the signing of the second phase of the strategic agreement with Openchip, as well as the renegotiation of debt with suppliers and strategic partners - and subject to the fulfillment of the company's cash flow forecast (including expected third-party payments) - the Company now estimates that its financing horizon has been extended to June 30th, 2026.

It is also worth noting that Kalray secured a €2.8 million R&D tax credit pre-financing (CIR) in the first half of 2025.

Publication of the 2024 Annual Financial Report and Resumption of Trading

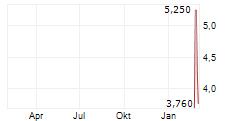

Kalray announces that the audit of its 2024 annual accounts has been completed, and the report of statutory auditors is being issued. The 2024 Annual Financial Report is filed on the Euronext website and Kalray's corporate website, in accordance with applicable regulations. The Company has made a request to Euronext for the resumption of trading of its shares (FR0010722819 - ALKAL) that should occur on July 11th,2025.

Update on the Equity Line signed with IRIS

As part of the equity line signed with IRIS on July 11th, 2024, the Company has decided to increase the maximum theoretical number of new ordinary shares that may be issued for this bond financing to 9 million shares[4].

To date, the Company has raised €6 million under this equity line and has issued 2,400 Bonds, of which 1,503 Bonds have been redeemed by the issue of 3,193,005 new ordinary shares.

For illustrative purposes, if all Bonds were to be redeemed based on Kalray's closing share price on July 8th, 2025[5], a shareholder holding 1% of the Company's share capital would see their stake reduced to 0.76% on a non-diluted basis and 0.67% on a fully diluted basis[6].

The other terms of the bond financing, as described in the Company's press release dated July 11th, 2024, remain unchanged (see press release as of July 11th, 2024). At this stage, the Company has no plans to draw down the two additional tranches of €2 million each.

ABOUT KALRAY

Kalray is a leading provider of hardware and software technologies and solutions for high-performance, data-centric computing markets, from cloud to edge.

Kalray provides a full range of products to enable smarter, more efficient, and energy-wise data-intensive applications and infrastructures. Its offers include its unique patented DPU (Data Processing Unit) processors and acceleration cards as well as its leading-edge software-defined storage and data management offers. Separated or in combination, Kalray's high-performance solutions allow its customers to improve the efficiency of data centers or design the best solutions in fast-growing sectors such as AI, Media & Entertainment, Life Sciences, Scientific Research, Edge Computing, Automotive and others.

Founded in 2008 as a spin-off of the well-known French CEA research lab, with corporate and financial investors such as Alliance Venture (Renault-Nissan-Mitsubishi), NXP Semiconductors or Bpifrance, Kalray is dedicated through technology, expertise, and passion to offer more: more for a smart world, more for the planet, more for customers and developers. www.kalrayinc.com

Disclaimer

This press release may contain forward-looking statements regarding the Company's objectives and outlook. These forward-looking statements are based on the current estimates and expectations of the Company's management and are subject to risks and uncertainties, including those described in Appendix 1 of the Management Board's report dated April 30th, 2024, available on the Company's website.

Readers' attention is particularly highlighted in the fact that the Company's current funding horizon is extended to June 30th, 2026 at the present date of the press release. The forward-looking statements mentioned in this press release may not be achieved due to these factors or other unknown risks and uncertainties, or those not currently deemed significant by the Company.

| INVESTOR RELATION CONTACTS Eric BAISSUS contactinvestisseurs@kalrayinc.com Phone +33 4 76 18 90 71 ACTUS Finance & Communication Anne-Pauline PETUREAUX kalray@actus.fr Phone + 33 1 53 67 36 72 | MEDIA CONTACTS ELLYN KALIFA communication@kalrayinc.com Phone. +33 4 76 18 90 71 ACTUS Finance & Communication Serena BONI sboni@actus.fr Phone +33 4 72 18 04 92 |

[1] EUR/GBP exchange rate: 0.84. Unaudited data

[2] See press release February 5th, 2025

[3] See press release July 9th,2025

[4] The Executive Board, exercising the delegation granted to it under the 9th resolution of the General Meeting held on December 20th, 2024

[5] At €0.48 - based on this price, the issuance of 4,917,763 additional shares would be required to redeem the remaining Bonds

[6] Based on the number of shares comprising the Company's share capital, namely 12,026,309 shares.

- SECURITY MASTER Key: x2udYZdtlGabnHFrlZdmmmNoaGaVl2PIl2OVm2ZxZMyZbZxklG1kbcbGZnJjnmtm

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-92960-pr_kalray_hy2025_revenue_en_final-version.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free