Suresnes (France), 10 July 2025

BOOSTHEAT (FR001400OS22 / ALBOO) announces the expansion of its strategy with the launch of a Bitcoin Treasury Company business aimed at creating value for its shareholders.

Stéphane Lederman, CEO of BOOSTHEAT, said: "Since taking up my position, I have become convinced that BOOSTHEAT can be a major asset in meeting the energy transition challenge. But I also understand that this is necessarily a long-term endeavour. That is why, starting today, we are giving ourselves the means to find a way to build financial assets and grow them so that we can ultimately create value for our shareholders.

Based on this analysis, the Board of Directors has decided to approve a Bitcoin Treasury Company policy and allocate a significant portion of the funds raised through the OCEANE programme to this policy".

I A NEW LEVER FOR VALUE CREATION

As announced, BOOSTHEAT demonstrated in 2024 that the patent for its hybrid compressor (thermal + volumetric) delivers on all its promises. The three possible operating modes (Stirling heat pump, micro-cogeneration and hybrid heat pump) were successfully tested. At the same time, the Company underwent a major restructuring to significantly reduce its cash requirements.

The Company has also identified significant potential for leveraging its unique and patented expertise in three strategic areas (high-power compressors, data centre cooling and, above all, methanisation). In this strategic field of renewable energies, BOOSTEHAT's technology offers the promise of optimising plant profitability by reducing gas consumption. Nevertheless, short-term uncertainties regarding the strategy and speed of implementation of the energy transition, particularly in France, require patience and adaptation to longer timelines on the part of contractors.

In this context, BOOSTHEAT has decided to build up a cash reserve in order to support its current operations and have the financial resources necessary when the market recovers. To this end, the Company has decided to launch a Bitcoin acquisition and accumulation activity (Bitcoin Treasury Company) within its subsidiary BoostHeat France, renamed Bitcoin Hold France for the occasion, which is wholly owned by BOOSTHEAT.

I THE CHOICE OF THE NEW MONETARY REFERENCE ASSET

As a driver of technological innovation in the service of the green transition since its creation in 2011, BOOSTHEAT has naturally chosen Bitcoin, a store of value recognised by a growing number of financial institutions and companies, as the underlying asset for its cash accumulation and valuation policy.

Under the impetus of public authorities, particularly in the United States, Bitcoin has been granted monetary status and major financial institutions have now created divisions dedicated to cryptocurrencies. The number of publicly traded companies that have invested all or part of their financial assets in Bitcoin continues to grow. According to a report published by Bitwise[1], the number of Bitcoins held by listed companies increased by 16% in the first quarter of 2025 to reach 688,000 Bitcoins, with a value of $57 billion. There are now 79 listed companies worldwide applying this policy, including US giants Strategy and Tesla, as well as French companies The Blockchain Group and TME Pharma.

To implement this policy, Bitcoin Hold France relies on the services of a digital asset service provider (PSAN) registered with the French Financial Markets Authority (AMF), which is responsible for services related to the acquisition and storage of Bitcoin.

I AN INITIAL FUND RAISING CAMPAIGN OF €250,000

In order to launch its Bitcoin Treasury Company policy, BOOSTHEAT announces that it has raised €250,000 through the issuance of one tranche of 50 OCEANE bonds, with a nominal value of €250,000, subscribed by Impact Tech Turnaround Opportunities (ITTO) under the agreement signed on 6 November 2024.

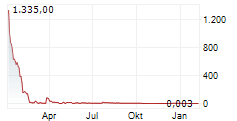

The net proceeds from this fundraising (€250,000) will be allocated in full to the Bitcoin Treasury Company policy. This OCEANE issue could result in the creation of 344,298,246 new shares based on the last quoted price. The stake of a shareholder holding 1% of the capital prior to this drawdown would be reduced to 0.77%.

The characteristics of the OCEANE bonds and the dilutive impact of the transaction are detailed in the press release dated 2 December 2024. These issues do not require the preparation of a prospectus for approval by the AMF. The role of the initial subscriber is to ensure that the Company gradually raises funds. It does not intend to retain the securities and remain a long-term shareholder of the Company, but to sell them gradually on the market. The table showing the OCEANE bonds and shares outstanding is available on the Company's website.

Prior to the draw announced today, (i) the issue of ORA arising from the agreement, the characteristics and dilutive impact of which are detailed in the press release dated 21 May 2021, (ii) and the issue of OCEANE bonds under the agreement, the characteristics and dilutive impact of which are detailed in the press release dated 2 December 2024, raised €9,070,000, resulted in the creation of 2,446,936,714 new shares and could still result in the creation of 1,524,676,348 new shares based on the last quoted price. The shareholding of a shareholder holding 1% of the capital prior to these drawings is now 0.379%.

The public's attention is drawn to the risk factors relating to the Company and its business, as described in the 2024 Annual Financial Report available on the Company's website. The occurrence of all or part of these risks is likely to have an adverse effect on the Company's business, financial position, results, development or prospects. As of the date of the last Financial Report, the Company conducted a specific review of its liquidity risk and estimated that it would be able to meet its upcoming maturities over the next 12 months, in particular through the use of this financing facility.

* * *

Find all the information about BOOSTHEAT at

www.boostheat-group.com

ABOUT BOOSTHEAT AND BITCOIN HOLD FRANCE

Founded in 2011, BOOSTHEAT is a player in the energy efficiency sector. The Company's mission is to accelerate the ecological transition by integrating its technology into energy-intensive applications. BOOSTHEAT has designed and developed a patented thermal compressor that significantly optimises energy consumption, thereby promoting the rational and appropriate use of resources.

The Company has also created a Bitcoin Treasury Company business within its subsidiary Bitcoin Hold France for the purpose of acquiring and accumulating Bitcoin.

BOOSTHEAT is listed on Euronext Growth in Paris (ISIN: FR001400OS22).

I CONTACTS

ACTUS finance & communication - Jérôme FABREGUETTES LEIB

Investor Relations

Tel.: 01 53 67 36 78 /boostheat@actus.fr

ACTUS finance & communication - Anne-Charlotte DUDICOURT

Press Relations

Tel.: 06 24 03 26 52 /acdudicourt@actus.fr

Warning:

BOOSTHEAT has set up financing in the form of OCEANE-BSA bonds with Impact Tech Turnaround Opportunities (ITTO), which, after receiving the shares resulting from the repayment or exercise of these instruments, does not intend to remain a shareholder of the Company.

The shares resulting from the redemption or exercise of the aforementioned securities will generally be sold on the market within a very short period of time, which may create significant downward pressure on the share price.

Shareholders may suffer a loss of their invested capital due to a significant decrease in the value of the Company's shares, as well as significant dilution due to the large number of securities issued to Impact Tech Turnaround Opportunities (ITTO).

Investors are advised to exercise caution before deciding to invest in the securities of the Company admitted to trading that carries out such dilutive financing transactions, particularly when they are carried out on a successive basis. The Company notes that this dilutive financing transaction is not the first it has carried out.

[1] (15) Bitwise sur X: "Companies are buying bitcoin, Q1 2025 edition. https://t.co/qZc62N8vu5" / X

- SECURITY MASTER Key: nZxylspqYprKmZpvYcqYZ5aZaGqWmWmbmmeelZSbl5fFbZqSmppmZ8maZnJjnm1m

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-92980-20250710-alboo_cp_bitcoinholdfrance_vdef-eng.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free