Not for distribution to United States newswire services or for release publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States.

VANCOUVER, BC / ACCESS Newswire / July 11, 2025 / Prince Silver Corp. (formerly Hawthorn Resources Corp.) (CSE:PRNC)(OTC:HWTNF) ("Prince Silver" or the "Company") is pleased to announce that it has completed the acquisition (the "Acquisition") of all issued and outstanding shares of Stampede Metals Corporation, a private Nevada-based company, from Stampede Metals Limited, a private Australian company ("Stampede AU"), pursuant to the previously announced Share Exchange Agreement, as amended.

As part of the closing, the Company has also issued all securities related to the Acquisition, converted its subscription receipts into common shares and warrants, and filed a technical report prepared in accordance with 43-101 Standards of Disclosure for Mineral Projects.

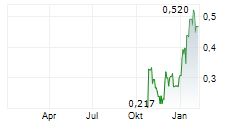

The Name Change and Consolidation are now effective, and the Company's common shares are trading on a consolidated basis under the name Prince Silver Corp. and the new symbol "PRNC." The new CUSIP for the Company's consolidated common shares is 74174A102.

"The completion of this transaction and our rebranding as Prince Silver Corp. mark a major milestone for the Company," stated Ralph Shearing, P.Geo., President of Prince Silver Corp. "We are now fully aligned with our flagship Prince Silver Project; a large-scale silver asset located in one of the world's premier mining jurisdictions. With silver prices reaching multi-year highs and a previously disclosed Exploration Target in place, we believe this is a timely opportunity to unlock significant value for our shareholders."

Highlights:

Closing of the Stampede Acquisition

Prince Silver has issued 15,000,000 units (the "Consideration Units") (each consisting of one common share and 0.566666667 of a Contingent Value Right) to Stampede AU. These Contingent Value Rights will convert into up to 8,500,000 Milestone Shares if defined resource milestones are met within four years. The Company retains the option to accelerate the milestone conversion and reduce the total number of Milestone Shares by 20% within the first year.Finder's Shares Issued

In connection with the Acquisition, the Company issued 350,000 common shares to an arm's length party as finder's consideration, at a deemed price of $0.27 per share.Subscription Receipt Conversion

The Company's Subscription Receipts have automatically converted into 14,807,315 common shares and 7,403,650share purchase warrants, each exercisable at $0.40 until December 23, 2026. Subscription Receipt proceeds have been released from trust to the Company resulting in gross proceeds of $3,997,975.05. Additionally, the Company issued 369,111 Finder's Warrants and paid aggregate finder fees of $101,549.98.Resulting Share Capital

Following the closing of the Acquisition and conversion of the Subscription Receipts, the Company now has 45,861,440 common shares issued and outstanding on a post-consolidation basis.New Control Person

With the issuance of the 15,000,000 Consideration Units, Stampede AU now holds approximately 32% of the Company's issued and outstanding shares, making it a new Control Person under applicable securities laws and Canadian Securities Exchange ("CSE") policies (a "Control Person"). It is the intent of Stampede Au to distribute the Consideration Units to its shareholders after preparing and filing necessary Australian corporate and regulatory documents to legally effect the transfer to its shareholders, after which, it is expected that Stampede Au would no longer be a Control Person.Voluntary Lock-Up & Support Agreement

Stampede AU has agreed to a voluntary lock-up of its Consideration Units for a period of one year, or until it ceases to be a Control Person, whichever is later. During this lock-up period, Stampede AU will abstain from voting its shares, except in the case of votes involving a change of control.

Appointment of Director

The Company is also pleased to announce that, in connection with the closing of the Acquisition, it has appointed Robert Wrixon, a Director of Stampede Metals Limited, as a member of the Company's board of directors. Mr. Wrixon is a Graduate of the Australian Institute of Company Directors, and has served as both Executive and non Executive Director of several ASX and London listed companies. He holds a Ph.D in mineral engineering from the University of California, Berkeley.

The Company also announced that Samantha Shorter has resigned from the Company's board of directors. "We would like to thank Samantha for her dedication to the Company since its initial public offering, and wish her well in her future endeavours." stated Ralph Shearing, P.Geol., President.

Filing of 43-101 Technical Report for the Prince Silver Project

The Company has filed an independent technical report for its 100%-owned Prince Silver Project, located in Lincoln County, Nevada (the "Prince Silver Project").

The report, titled "43-101 Technical Report on the Prince Silver Mine Project, Lincoln County, Nevada", is dated May 19, 2025, with an effective date of May 19, 2025 (the "Technical Report"). It was prepared in accordance with 43-101 Standards of Disclosure for Mineral Projects ("43-101") by John E. Hiner, SME Registered Member.

The report does not contain a current mineral resource estimate compliant with NI 43-101 standards. Historical estimates are included for context only, and the reader is cautioned not to treat them as current or reliable. The Company has initiated plans to confirm historical data through a proposed two-phase drill program designed to define a compliant resource.

The Technical Report is available under the Company's profile on SEDAR+ at www.sedarplus.ca.

About Prince Silver Corp.

Prince Silver is a silver exploration company focused on advancing the Prince Silver Project in Nevada, USA. Mineralization is open in all directions and is near surface. Prince Silver also holds option interest in Broken Handle Project, an early-stage mineral exploration project located southern British Columbia, Canada.

On Behalf of the Board of Directors

Ralph Shearing, Director, President

Tel: 604-764-0965

Email: rshearing@princesilvercorp.com

Website: www.princesilvercorp.com

Forward-Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. Some of the specific forward-looking information in this news release includes, but is not limited to, statements with respect to: completion of the Acquisition and related transactions, proposed drill programs, amendments to the Company's website, property option payments and regulatory and corporate approvals. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, dependence on key personnel, completion of satisfactory due diligence in respect of the Acquisition and related transactions, and compliance with property option agreements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, failure to obtain regulatory or corporate approvals, exploration results, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This news release does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

The CSE has neither approved nor disapproved the contents of this press release and the CSE does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: Prince Silver Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/prince-silver-corp.-announces-closing-of-stampede-acquisition-issuance-of-securit-1047820